Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1-5 The vehicle and equipment that Fido's Food Mart purchased both require annual depreciation. It is determined that the vehicle has a 5-year useful life

1-5

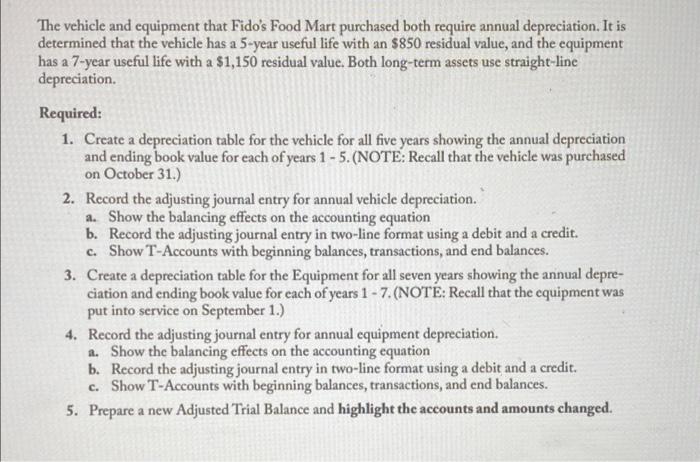

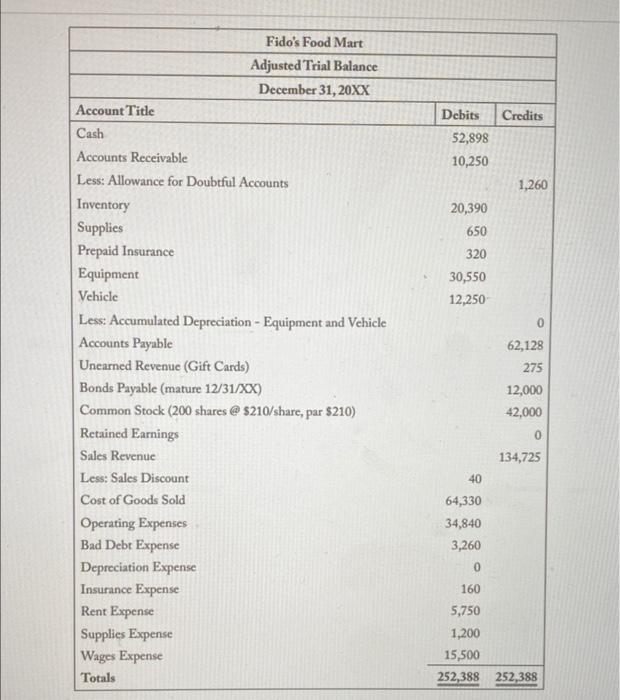

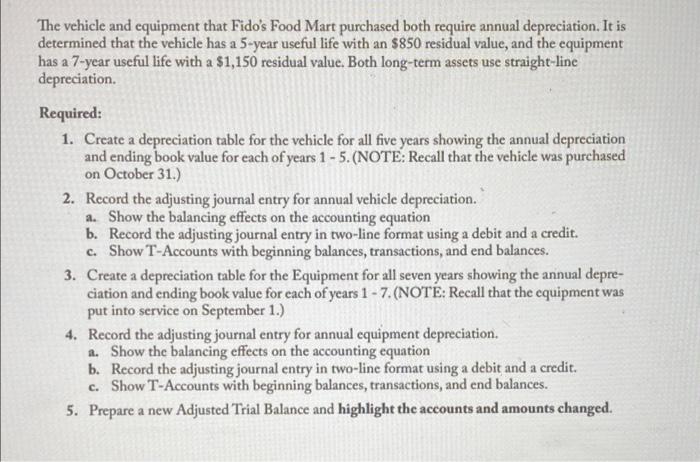

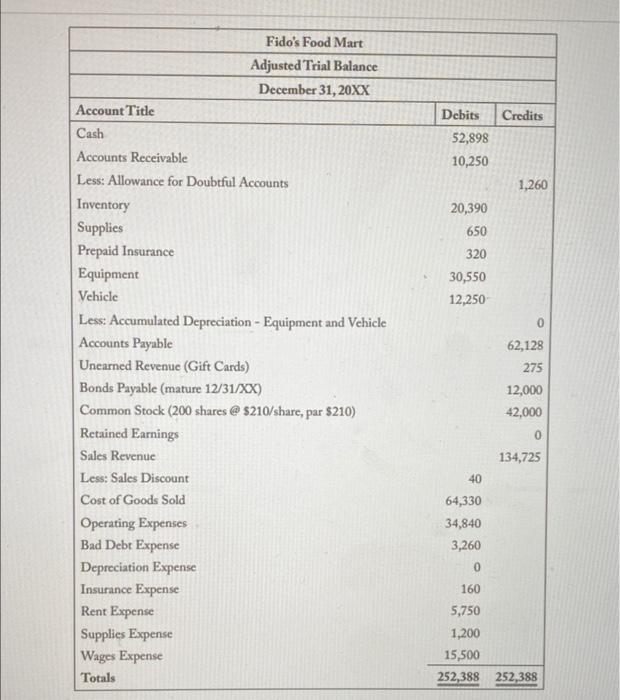

The vehicle and equipment that Fido's Food Mart purchased both require annual depreciation. It is determined that the vehicle has a 5-year useful life with an $850 residual value, and the equipment has a 7-year useful life with a $1,150 residual value. Both long-term assets use straight-line depreciation. Required: 1. Create a depreciation table for the vehicle for all five years showing the annual depreciation and ending book value for each of years 1 - 5. (NOTE: Recall that the vehicle was purchased on October 31.) 2. Record the adjusting journal entry for annual vehicle depreciation. a. Show the balancing effects on the accounting equation b. Record the adjusting journal entry in two-line format using a debit and a credit. c. Show T-Accounts with beginning balances, transactions, and end balances. 3. Create a depreciation table for the Equipment for all seven years showing the annual depre- ciation and ending book value for each of years 1 - 7. (NOTE: Recall that the equipment was put into service on September 1.) 4. Record the adjusting journal entry for annual equipment depreciation. a. Show the balancing effects on the accounting equation b. Record the adjusting journal entry in two-line format using a debit and a credit. c. Show T-Accounts with beginning balances, transactions, and end balances. 5. Prepare a new Adjusted Trial Balance and highlight the accounts and amounts changed. Debits Credits 52,898 10,250 1,260 20,390 650 320 30,550 12,250 0 Fido's Food Mart Adjusted Trial Balance December 31, 20XX Account Title Cash Accounts Receivable Less: Allowance for Doubtful Accounts Inventory Supplies Prepaid Insurance Equipment Vehicle Less: Accumulated Depreciation - Equipment and Vehicle Accounts Payable Unearned Revenue (Gift Cards) Bonds Payable (mature 12/31/XX) Common Stock (200 shares @ $210/share, par $210) Retained Earnings Sales Revenue Less: Sales Discount Cost of Goods Sold Operating Expenses Bad Debt Expense Depreciation Expense Insurance Expense Rent Expense Supplies Expense Wages Expense Totals 62,128 275 12,000 42,000 0 134,725 40 64,330 34,840 3,260 0 160 5,750 1,200 15,500 252,388 252,388

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started