Answered step by step

Verified Expert Solution

Question

1 Approved Answer

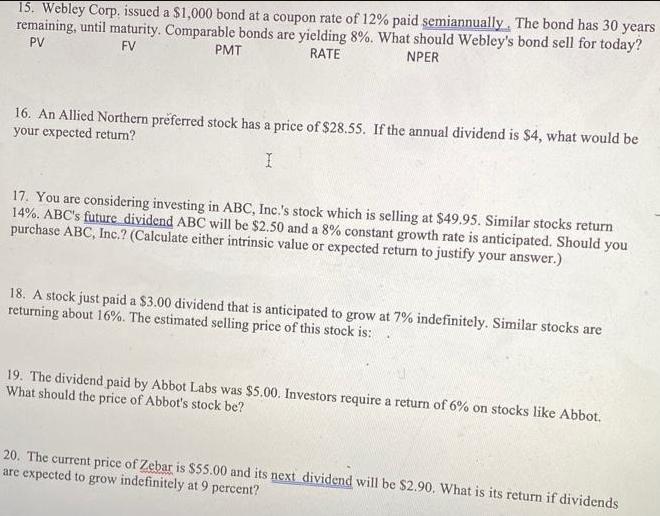

15. Webley Corp. issued a $1,000 bond at a coupon rate of 12% paid semiannually, The bond has 30 years remaining, until maturity. Comparable

15. Webley Corp. issued a $1,000 bond at a coupon rate of 12% paid semiannually, The bond has 30 years remaining, until maturity. Comparable bonds are yielding 8%. What should Webley's bond sell for today? RATE PV FV PMT NPER 16. An Allied Northern preferred stock has a price of $28.55. If the annual dividend is $4, what would be your expected retun? 17. You are considering investing in ABC, Inc.'s stock which is selling at $49.95. Similar stocks return 14%. ABC's future dividend ABC will be $2.50 and a 8% constant growth rate is anticipated. Should you purchase ABC, Inc.? (Calculate either intrinsic value or expected return to justify your answer.) 18. A stock just paid a $3.00 dividend that is anticipated to grow at 7% indefinitely. Similar stocks are returning about 16%. The estimated selling price of this stock is: 19. The dividend paid by Abbot Labs was $5.00. Investors require a return of 6% on stocks like Abbot. What should the price of Abbot's stock be? 20. The current price of Zebar is $55.00 and its next dividend will be $2.90, What is its return if dividends are expected to grow indefinitely at 9 percent?

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

15 selling price Fv 1000 coupon rate 12 paid semiannual...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started