Answered step by step

Verified Expert Solution

Question

1 Approved Answer

15./ You are the Finance Director of the German company BMW. BMW has sold cars to Denmark (currency is Danish Krona, DKK) and has received

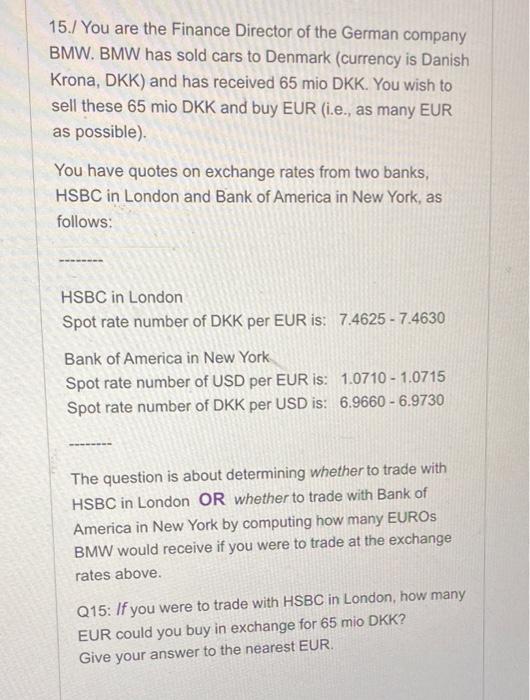

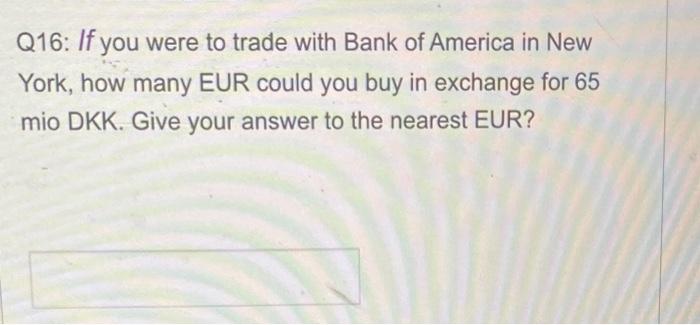

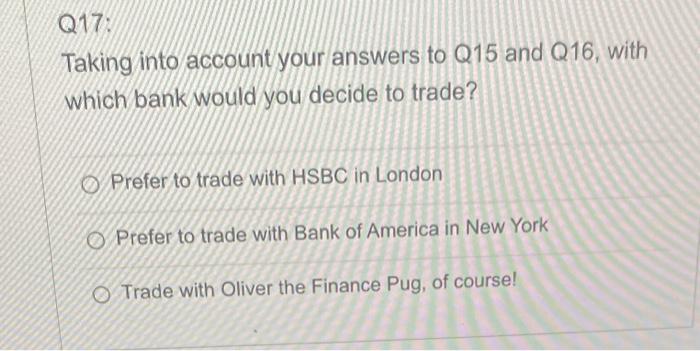

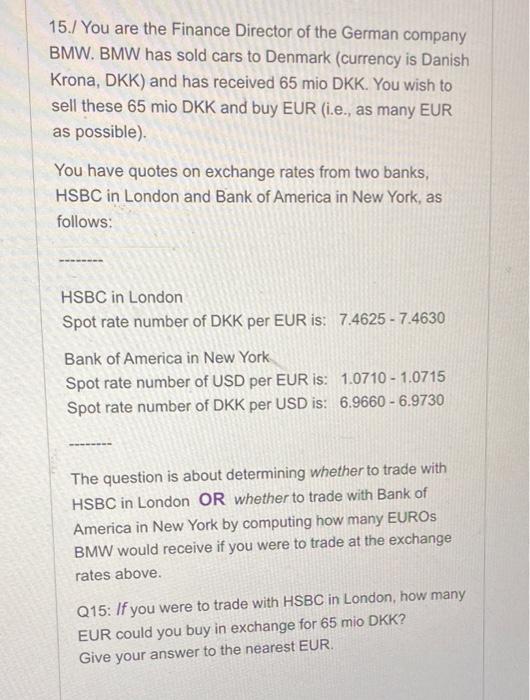

15./ You are the Finance Director of the German company BMW. BMW has sold cars to Denmark (currency is Danish Krona, DKK) and has received 65 mio DKK. You wish to sell these 65 mio DKK and buy EUR (i.e., as many EUR as possible). You have quotes on exchange rates from two banks, HSBC in London and Bank of America in New York, as follows: HSBC in London Spot rate number of DKK per EUR is: 7.4625 - 7.4630 Bank of America in New York Spot rate number of USD per EUR is: 1.07101.0715 Spot rate number of DKK per USD is: 6.96606.9730 The question is about determining whether to trade with HSBC in London OR whether to trade with Bank of America in New York by computing how many EUROs BMW would receive if you were to trade at the exchange rates above. Q15: If you were to trade with HSBC in London, how many EUR could you buy in exchange for 65 mio DKK? Give your answer to the nearest EUR. Q16: If you were to trade with Bank of America in New York, how many EUR could you buy in exchange for 65 mio DKK. Give your answer to the nearest EUR? Taking into account your answers to Q15 and Q16, with which bank would you decide to trade? Prefer to trade with HSBC in London Prefer to trade with Bank of America in New York Trade with Oliver the Finance Pug, of course

15./ You are the Finance Director of the German company BMW. BMW has sold cars to Denmark (currency is Danish Krona, DKK) and has received 65 mio DKK. You wish to sell these 65 mio DKK and buy EUR (i.e., as many EUR as possible). You have quotes on exchange rates from two banks, HSBC in London and Bank of America in New York, as follows: HSBC in London Spot rate number of DKK per EUR is: 7.4625 - 7.4630 Bank of America in New York Spot rate number of USD per EUR is: 1.07101.0715 Spot rate number of DKK per USD is: 6.96606.9730 The question is about determining whether to trade with HSBC in London OR whether to trade with Bank of America in New York by computing how many EUROs BMW would receive if you were to trade at the exchange rates above. Q15: If you were to trade with HSBC in London, how many EUR could you buy in exchange for 65 mio DKK? Give your answer to the nearest EUR. Q16: If you were to trade with Bank of America in New York, how many EUR could you buy in exchange for 65 mio DKK. Give your answer to the nearest EUR? Taking into account your answers to Q15 and Q16, with which bank would you decide to trade? Prefer to trade with HSBC in London Prefer to trade with Bank of America in New York Trade with Oliver the Finance Pug, of course

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started