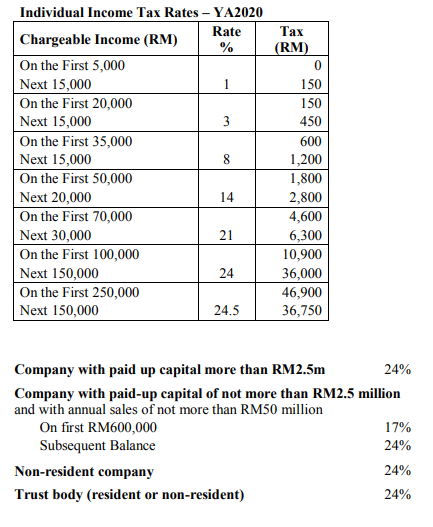

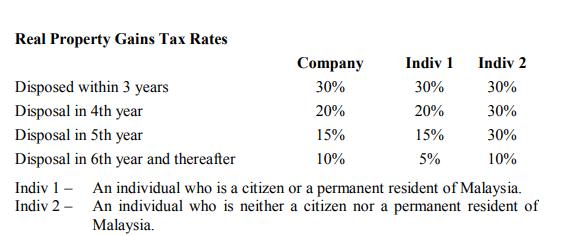

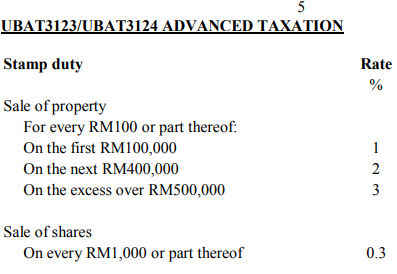

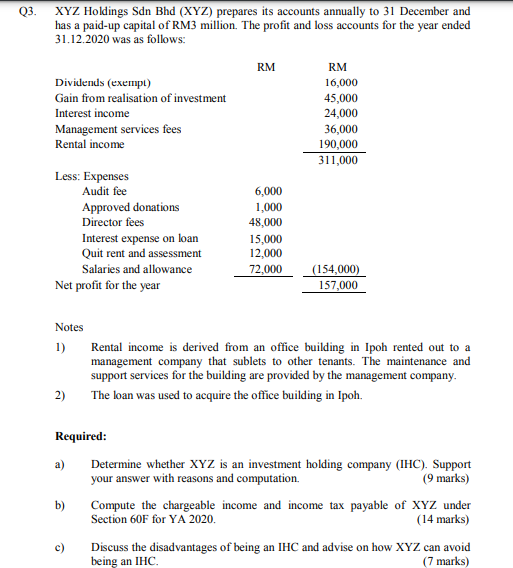

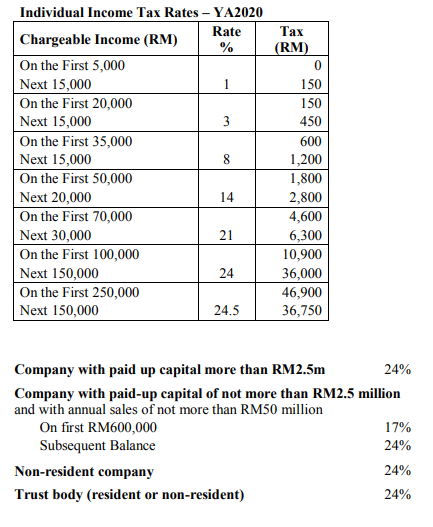

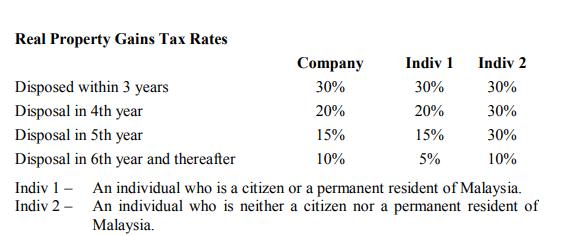

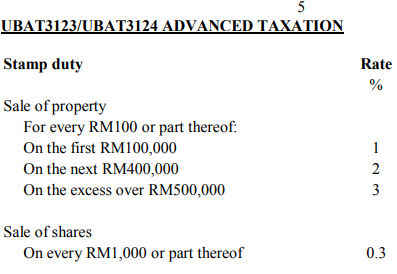

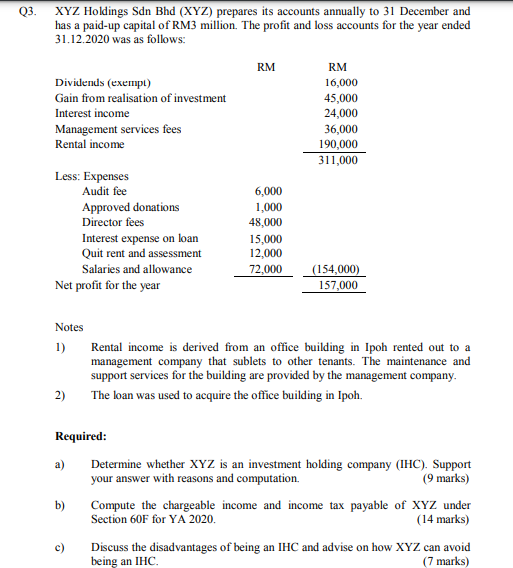

150 Individual Income Tax Rates - YA2020 Rate Tax Chargeable Income (RM) % (RM) On the First 5,000 0 Next 15,000 On the First 20,000 150 Next 15,000 3 450 On the First 35,000 600 Next 15,000 8 1,200 On the First 50,000 1,800 Next 20,000 14 2,800 On the First 70,000 4,600 Next 30,000 21 6,300 On the First 100,000 10,900 Next 150,000 24 36,000 On the First 250,000 46,900 Next 150,000 24.5 36,750 Company with paid up capital more than RM2.5m 24% Company with paid-up capital of not more than RM2.5 million and with annual sales of not more than RM50 million On first RM600,000 17% Subsequent Balance 24% Non-resident company 24% Trust body (resident or non-resident) 24% Real Property Gains Tax Rates Company Indiv 1 Indiv 2 Disposed within 3 years 30% 30% 30% Disposal in 4th year 20% 20% 30% Disposal in 5th year 15% 15% 30% Disposal in 6th year and thereafter 10% 5% 10% Indiv 1 - An individual who is a citizen or a permanent resident of Malaysia. Indiv 2 - An individual who is neither a citizen nor a permanent resident of Malaysia. 5 UBAT3123/UBAT3124 ADVANCED TAXATION Stamp duty Rate % Sale of property For every RM100 or part thereof. On the first RM100,000 On the next RM400,000 On the excess over RM500,000 1 2 3 Sale of shares On every RM1,000 or part thereof 0.3 Q3. XYZ Holdings Sdn Bhd (XYZ) prepares its accounts annually to 31 December and has a paid-up capital of RM3 million. The profit and loss accounts for the year ended 31.12.2020 was as follows: RM RM Dividends (exempl) 16,000 Gain from realisation of investment 45,000 Interest income 24,000 Management services fees 36,000 Rental income 190,000 311,000 Less: Expenses Audit fee 6,000 Approved donations 1,000 Director fees 48,000 Interest expense on loan 15,000 Quit rent and assessment 12,000 Salaries and allowance 72,000 (154,000) Net profit for the year 157,000 Notes 1) Rental income is derived from an office building in Ipoh rented out to a management company that sublets to other tenants. The maintenance and support services for the building are provided by the management company. The loan was used to acquire the office building in Ipoh. 2) Required: Determine whether XYZ is an investment holding company (IHC). Support your answer with reasons and computation. (9 marks) b) Compute the chargeable income and income tax payable of XYZ under Section 60F for YA 2020. (14 marks) c) Discuss the disadvantages of being an IHC and advise on how XYZ can avoid being an IHC (7 marks) 150 Individual Income Tax Rates - YA2020 Rate Tax Chargeable Income (RM) % (RM) On the First 5,000 0 Next 15,000 On the First 20,000 150 Next 15,000 3 450 On the First 35,000 600 Next 15,000 8 1,200 On the First 50,000 1,800 Next 20,000 14 2,800 On the First 70,000 4,600 Next 30,000 21 6,300 On the First 100,000 10,900 Next 150,000 24 36,000 On the First 250,000 46,900 Next 150,000 24.5 36,750 Company with paid up capital more than RM2.5m 24% Company with paid-up capital of not more than RM2.5 million and with annual sales of not more than RM50 million On first RM600,000 17% Subsequent Balance 24% Non-resident company 24% Trust body (resident or non-resident) 24% Real Property Gains Tax Rates Company Indiv 1 Indiv 2 Disposed within 3 years 30% 30% 30% Disposal in 4th year 20% 20% 30% Disposal in 5th year 15% 15% 30% Disposal in 6th year and thereafter 10% 5% 10% Indiv 1 - An individual who is a citizen or a permanent resident of Malaysia. Indiv 2 - An individual who is neither a citizen nor a permanent resident of Malaysia. 5 UBAT3123/UBAT3124 ADVANCED TAXATION Stamp duty Rate % Sale of property For every RM100 or part thereof. On the first RM100,000 On the next RM400,000 On the excess over RM500,000 1 2 3 Sale of shares On every RM1,000 or part thereof 0.3 Q3. XYZ Holdings Sdn Bhd (XYZ) prepares its accounts annually to 31 December and has a paid-up capital of RM3 million. The profit and loss accounts for the year ended 31.12.2020 was as follows: RM RM Dividends (exempl) 16,000 Gain from realisation of investment 45,000 Interest income 24,000 Management services fees 36,000 Rental income 190,000 311,000 Less: Expenses Audit fee 6,000 Approved donations 1,000 Director fees 48,000 Interest expense on loan 15,000 Quit rent and assessment 12,000 Salaries and allowance 72,000 (154,000) Net profit for the year 157,000 Notes 1) Rental income is derived from an office building in Ipoh rented out to a management company that sublets to other tenants. The maintenance and support services for the building are provided by the management company. The loan was used to acquire the office building in Ipoh. 2) Required: Determine whether XYZ is an investment holding company (IHC). Support your answer with reasons and computation. (9 marks) b) Compute the chargeable income and income tax payable of XYZ under Section 60F for YA 2020. (14 marks) c) Discuss the disadvantages of being an IHC and advise on how XYZ can avoid being an IHC (7 marks)