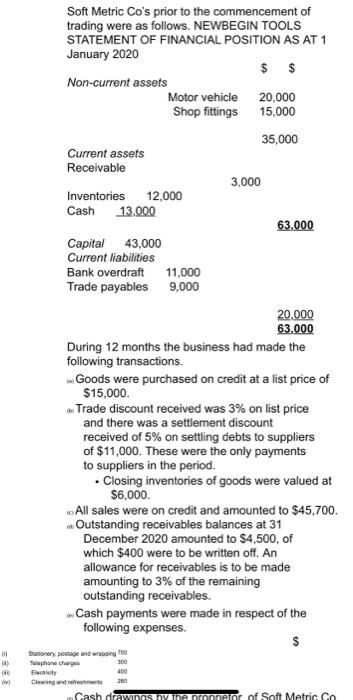

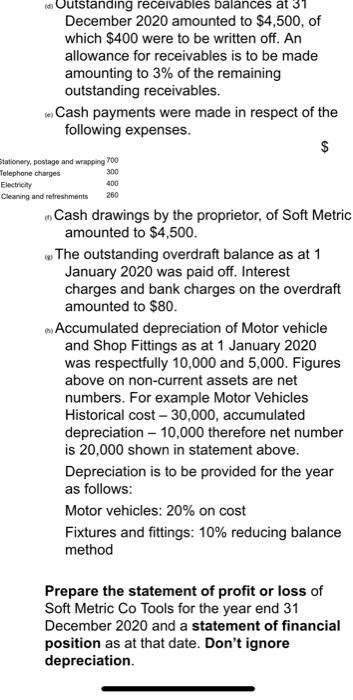

15,000 Soft Metric Co's prior to the commencement of trading were as follows. NEWBEGIN TOOLS STATEMENT OF FINANCIAL POSITION AS AT 1 January 2020 $ $ Non-current assets Motor vehicle 20,000 Shop fittings 35,000 Current assets Receivable 3,000 Inventories 12,000 Cash 13.000 63.000 Capital 43,000 Current liabilities Bank overdraft 11,000 Trade payables 9,000 20.000 63.000 During 12 months the business had made the following transactions Goods were purchased on credit at a list price of $15,000 Trade discount received was 3% on list price and there was a settlement discount received of 5% on settling debts to suppliers of $11,000. These were the only payments to suppliers in the period. Closing inventories of goods were valued at $6,000. All sales were on credit and amounted to $45.700. Outstanding receivables balances at 31 December 2020 amounted to $4,500, of which $400 were to be written off. An allowance for receivables is to be made amounting to 3% of the remaining outstanding receivables. Cash payments were made in respect of the following expenses. $ Stationery postage at ang TOO SI Telephone charge Electric 300 400 Cash drawings ny ine pronelor of Soft Metric Co Telephone charges 400 260 Outstanding receivables balances at 31 December 2020 amounted to $4,500, of which $400 were to be written off. An allowance for receivables is to be made amounting to 3% of the remaining outstanding receivables. - Cash payments were made in respect of the following expenses. $ Stationery, postage and wrapping 700 300 Electric Cleaning and refreshments Cash drawings by the proprietor, of Soft Metric amounted to $4,500. w The outstanding overdraft balance as at 1 January 2020 was paid off. Interest charges and bank charges on the overdraft amounted to $80. Accumulated depreciation of Motor vehicle and Shop Fittings as at 1 January 2020 was respectfully 10,000 and 5,000. Figures above on non-current assets are net numbers. For example Motor Vehicles Historical cost - 30,000, accumulated depreciation - 10,000 therefore net number is 20,000 shown in statement above. Depreciation is to be provided for the year as follows: Motor vehicles: 20% on cost Fixtures and fittings: 10% reducing balance method Prepare the statement of profit or loss of Soft Metric Co Tools for the year end 31 December 2020 and a statement of financial position as at that date. Don't ignore depreciation