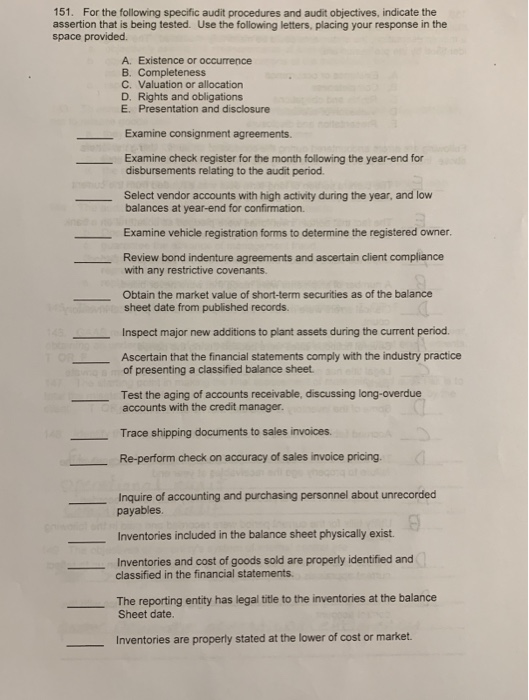

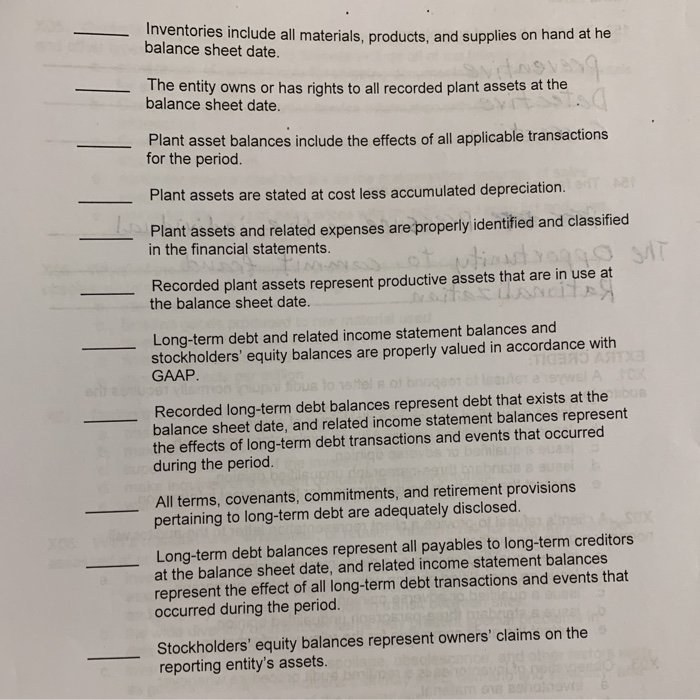

151. For the following specific audit procedures and audit objectives, indicate the assertion that is being tested. Use the following letters, placing your response in the space provided. A. Existence or occurrence B. Completeness C. Valuation or allocation D. Rights and obligations E. Presentation and disclosure Examine consignment agreements. Examine check register for the month following the year-end for disbursements relating to the audit period. Select vendor accounts with high activity during the year, and low balances at year-end for confirmation. Examine vehicle registration forms to determine the registered owner Review bond indenture agreements and ascertain client compliance with any restrictive covenants. Obtain the market value of short-term securities as of the balance sheet date from published records. Inspect major new additions to plant assets during the current period. Ascertain that the financial statements comply with the industry practice of presenting a classified balance sheet Test the aging of accounts receivable, discussing long-overdue accounts with the credit manager. Trace shipping documents to sales invoices. Re-perform check on accuracy of sales invoice pricing Inquire of accounting and purchasing personnel about unrecorded payables Inventories included in the balance sheet physically exist. Inventories and cost of goods sold are properly identified and classified in the financial statements The reporting entity has legal title to the inventories at the balance Sheet date. Inventories are properly stated at the lower of cost or market Inventories include all materials, products, and supplies on hand at he balance sheet date. The entity owns or has rights to all recorded plant assets at the balance sheet date. Plant asset balances include the effects of all applicable transactions for the period. Plant assets are stated at cost less accumulated depreciation Plant assets and related expenses are properly identified and classified in the financial statements Recorded plant assets represent productive assets that are in use at the balance sheet date Long-term debt and related income statement balances and stockholders' equity balances are properly valued in accordance with GAAP. Recorded long-term debt balances represent debt that exists at the balance sheet date, and related income statement balances represent the effects of long-term debt transactions and events that occurred during the period. All terms, covenants, commitments, and retirement provisions pertaining to long-term debt are adequately disclosed. Long-term debt balances represent all payables to long-term creditors at the balance sheet date, and related income statement balances represent the effect of all long-term debt transactions and events that occurred during the period. Stockholders' equity balances represent owners' claims on the reporting entity's assets