Answered step by step

Verified Expert Solution

Question

1 Approved Answer

15-29 Fixed-cost allocation. Baker University completed construction of its newest administrative building at the end of 2013. The University's first employees moved into the

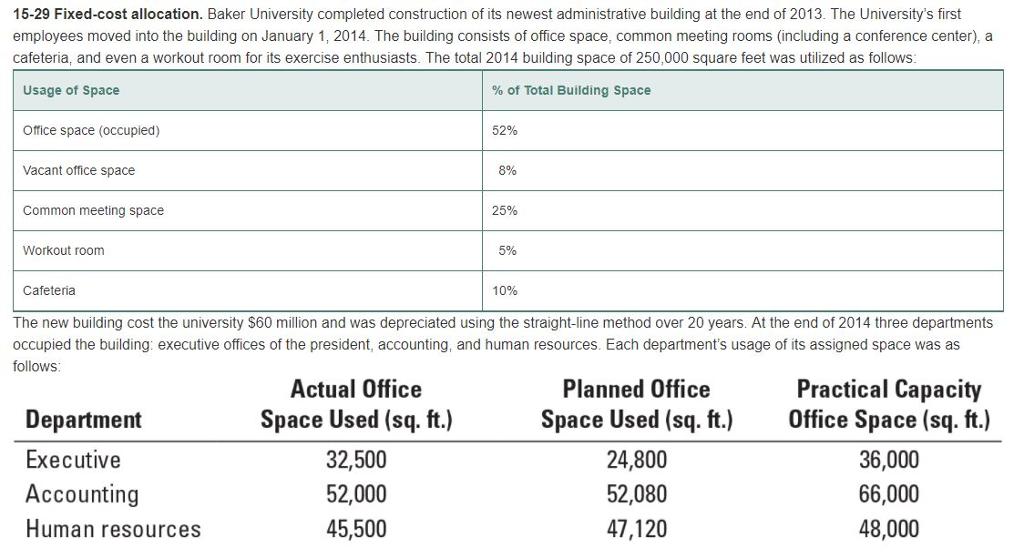

15-29 Fixed-cost allocation. Baker University completed construction of its newest administrative building at the end of 2013. The University's first employees moved into the building on January 1, 2014. The building consists of office space, common meeting rooms (including a conference center), a cafeteria, and even a workout room for its exercise enthusiasts. The total 2014 building space of 250,000 square feet was utilized as follows: Usage of Space % of Total Building Space Office space (occupied) 52% Vacant office space 8% Common meeting space 25% Workout room 5% Cafeteria 10% The new building cost the university $60 million and was depreciated using the straight-line method over 20 years. At the end of 2014 three departments occupied the building: executive offices of the president, accounting, and human resources. Each department's usage of its assigned space was as follows: Actual Office Space Used (sq. ft.) Planned Office Space Used (sq. ft.) Practical Capacity Office Space (sq. ft.) Department Executive 32,500 24,800 36,000 Accounting 52,000 52,080 66,000 Human resources 45,500 47,120 48,000 1. How much of the total building cost will be allocated in 2014 to each of the departments, if the total cost is allocated to each department on the basis of the following? Required a. Actual usage of the three departments b. Planned usage of the three departments c. Practical capacity of the three departments 2. Assume that Baker University allocates the total annual building cost in the following manner: a. All vacant office space is absorbed by the university and is not allocated to the departments. b. All occupied office space costs are allocated on the basis of actual square footage used. c. All common area costs are allocated on the basis of a department's practical capacity. 3. Calculate the cost allocated to each department in 2014 under this plan. Do you think the allocation method used here is appropriate? Explain.

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

1 Total building cost to be allocated for the Year 2014 60 mln20 yrs 3 mln a Actual usage Dept Sq ft to total Allocation3 mln Executive 32500 25 075 A...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started