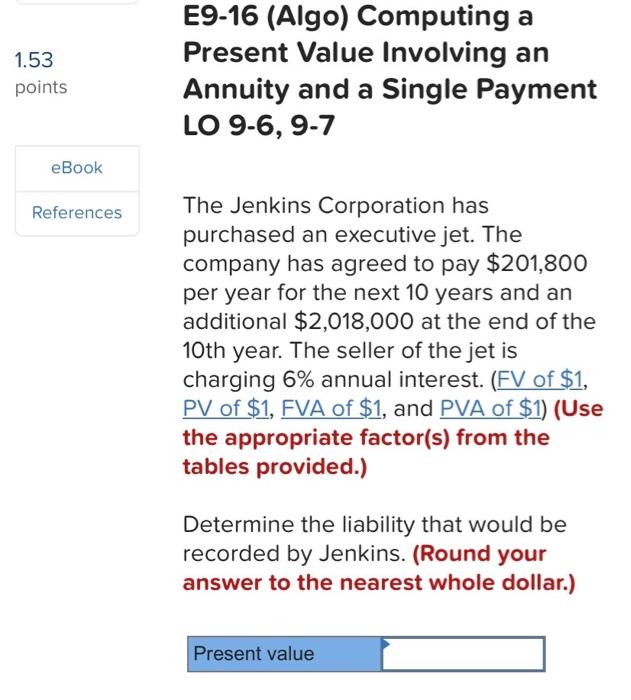

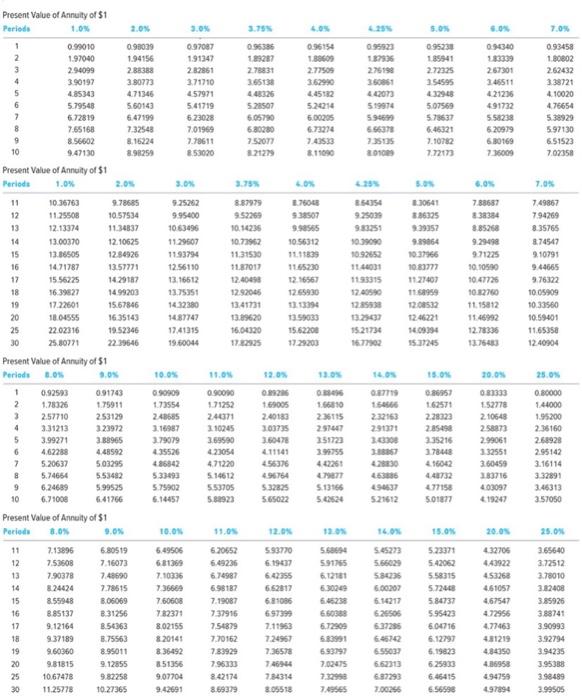

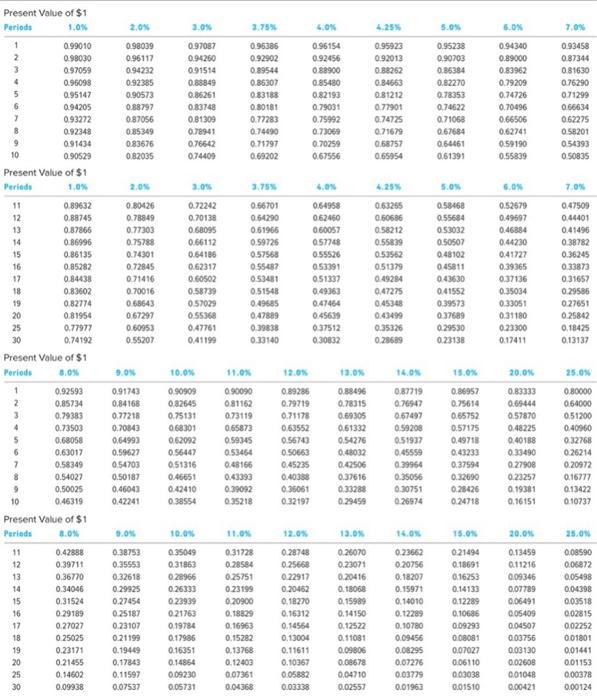

1.53 points E9-16 (Algo) Computing a Present Value Involving an Annuity and a Single Payment LO 9-6, 9-7 eBook References The Jenkins Corporation has purchased an executive jet. The company has agreed to pay $201,800 per year for the next 10 years and an additional $2,018,000 at the end of the 10th year. The seller of the jet is charging 6% annual interest. (FV of $1, PV of $1, FVA of $1, and PVA of $1) (Use the appropriate factor(s) from the tables provided.) Determine the liability that would be recorded by Jenkins. (Round your answer to the nearest whole dollar.) Present value SON 7.0% 0.95230 185941 2.72725 354595 0.94340 183339 267301 346511 421236 491732 5.58238 6.20979 630169 735000 093458 1.80802 262432 338721 4.10020 476654 5.38929 5.97130 6,51523 7.02358 5.07569 5.78637 6.46321 7.10782 7.72173 6.0 7.0% 7.88687 838384 3.30641 3.86325 9.39352 9.9064 10.80777 1127407 11.8959 1200532 12.46221 16.09394 15.3245 9.29498 9.71225 10.10500 10.47725 1082750 11.15812 11.46992 12.78336 12.7543 7.49867 7.94269 8.35765 8.74547 9.10791 9.44665 9.76322 1005909 10.33560 10:59401 11.65358 1240904 Present Value of Annuity of 51 Periode 30% 3.751 1 0.99010 0.93039 097087 0.96386 0.96154 2 1.97040 1.94156 1.91347 1927 1.88609 3 2.94099 2388 282851 278831 2.77509 2.76198 4 3.90197 3.80773 3.71710 365138 3.62990 350861 5 485343 471346 457971 448326 445132 442073 6 5.79548 5.60143 5.41719 528507 524214 519974 6.72819 6.47199 6 23028 6.05790 6.00205 594699 7.65168 7.32543 7.01969 6.80280 6.73274 656378 8.56602 8.16224 7.78611 752077 7.43533 10 9.47130 3.98259 8.53020 121279 8.11090 201009 Present Value of Annuity of $1 Periods 1.0% 3.0% 40% 10.36763 9.78685 9.25202 8.87979 7604 12 11.25508 10.57534 995400 9.52269 938507 13 12.13374 11.34837 1063496 10.14235 9.98565 14 13.00370 12.10625 1129607 10.73962 10 56312 10.99090 15 13.88505 12.34926 1193794 11.31530 11.11839 16 1471787 13.57771 12.56110 11.87017 1165230 114031 17 1556225 14.29187 13.16612 12.40490 12.16567 1193395 18 16.39827 1499203 13.75351 12.92045 12.65930 19 17.22601 15.67846 1432380 13.4171 1313394 20 18.04555 16.35143 1487747 13.29620 1359033 13.20 25 22.02316 19.52346 17.41015 16.04320 15.62200 1521734 30 25.80271 2239646 19.60044 17.22925 17.29200 Present Value of Annuity of 51 Periods 1.05 100% 11.09 $2.05 13.0 1 6.92593 0.91743 0.90909 0.90090 02920 0.87719 2 1.78326 1.75911 173554 171252 169005 1.66810 154666 3 2.57710 2.53129 248685 246001 2.40130 25115 232163 4 3.31213 323972 1.16987 210245 303735 25147 2.9071 5 3.99271 338965 2.79079 3.69590 3.60478 331723 3.000 6 462288 4.48592 435526 4.23054 411141 7 5.20637 501295 4.86842 4.71220 456376 442261 8 5.74654 553482 533093 514612 4.96764 47977 5.75902 553705 532825 5.13166 10 6.7100 6.41766 6.14457 5.82923 5.65022 5.62524 521612 Present Value of Annuity of 51 Paris 9.08 12.03 120 16.0% 11 7.13896 6.80519 6.49506 6.20652 593770 5.686 S45273 12 7.53608 7.16073 681369 6.49236 6.19637 591765 5.66029 13 7.90378 7.48690 7.10336 6.42355 6.12161 5.30236 14 8.24424 7.78615 736660 6.98187 6.62817 6.00207 15 8.55948 8.06069 7.60608 7.19087 681086 6.14217 16 8.85137 831256 7.82371 7.37915 697399 650388 17 9.12164 8.56363 8.02155 7.54879 7.11953 6.72005 6.37255 18 9.37189 8.75563 8 20141 7.70162 7.24967 6.83991 64672 19 9.60360 8.95011 8.36492 7.83929 7.36578 693792 655031 20 9.81815 9.12855 851356 796333 7464 7.02475 6.62313 25 1067478 9.82258 9.07704 8.42174 7.34314 697293 30 11.25778 10.27365 8.69379 8.05518 7.4956 7.00256 15.0 20.05 25.05 0.86957 162571 2.28323 2.85490 2.35216 3.78443 4.16042 441732 477158 501877 1.52778 2.10548 258873 2.99061 332551 360459 183716 403097 19247 0.80000 144000 195.200 2.35160 2.68928 2.95142 3.16114 3.32891 3.46313 3.57050 599525 15.0% 25.0% 5.23371 5.42062 558315 5.72468 5.84737 595423 6.04716 6.12297 6.19823 6.25933 646415 656598 432706 443922 453262 4.61057 4.67547 4.72956 4.77463 481219 4.84350 4.86958 3.65640 3.72512 3.78010 382408 3.85925 388741 3.90993 3.92794 394235 395338 398489 399505 497894 Present Value of $1 Periods 1.0% 2.0% 2.05 4.0 5.0% 50 7.09 4.25 0.95923 0.92013 0.98039 0.96117 0.94232 0:92385 0.90573 0.88797 0.87056 0.85349 083676 082035 0.97087 0.94260 0.91514 0.88849 0.86261 0.83748 0.81309 0.78941 0.76642 0.74409 2.75% 0.96385 0.92902 0.89544 0.86307 0.83188 0.80181 0.77283 0.7490 0.71797 0.69202 0.96154 0.92456 0.88900 0.85480 0.82193 0.79031 0.75992 0.73068 0.70259 0.67556 0.84663 0.81212 0.77901 0.74725 071679 068757 0.65954 0.95238 0.90703 0.85384 0.82270 0.78353 0.74622 0.71068 0.67684 0.64461 0.61391 0.94340 0.89000 0.83962 0.79209 0.74726 0.70496 0.66506 093458 0.87344 0.81630 0.76290 0.71299 0.66634 0.62275 058201 054393 0.50835 0.59190 0.55839 3.09 3.75% 4.0% S.O 6.0 7.0 1 0.99010 2 0.98030 3 097059 4 0.95099 5 0.95147 6 0.94205 7 0.93272 0.92348 9 091434 10 0.90529 Present Value of $1 Periods 1,0% 11 0.89632 12 0.88745 13 0.87866 0.86996 15 0.86135 16 0.85282 17 0.84438 18 0.83602 19 0.82774 20 0.81954 25 0.77977 30 0.74192 Present Value of $1 Periods 8.0 1 0.92593 2 0.85734 3 0.79383 4 0.73503 5 0.68058 6 0.63017 7 0.58349 0.54027 9 0.50025 10 0.46319 Present Value of $1 Periods 8.09 0.80426 0.78849 0.77303 0.75788 0.74301 0.72845 0.71416 0.70016 0.68643 067297 060953 0.55207 0.72242 0.70138 0.68095 0.66112 0.54106 0.62317 0.60502 0.58739 0.57029 055360 0.47761 0.41199 0.66701 0.64290 0.61966 0.59726 0.57568 0.55487 053481 0.51548 0.49685 0.47889 0.39838 0.33140 0.64958 062450 060057 057745 0.55526 053391 051337 0.53255 0.60686 0.58212 0.55839 0.53562 051379 0.49294 047275 0.45348 0.43499 0.35326 0.28689 0.58462 0.55684 0.53032 0.50507 0.48102 045811 043630 0.41552 0.39573 0.37589 0.29530 0.23138 0.52579 0.49597 0.46884 0.44230 0.41727 0.39365 0.37136 0.35034 0.33051 0.31180 0.23300 0.17411 0.47509 0.44401 0.41496 0.38782 0.36245 0.33873 0.31652 0.29586 0.27651 0.25842 0.18425 0.13137 0.47464 0.45699 0.37512 0.30832 9.0 10.0 12.05 13.0 14.ON 20.0% 25.05 0.91743 0.84168 0.77218 0.70843 0.64993 0.59627 0.54703 0.50187 0.4604) 0.42241 090909 0.82645 0.75131 068301 0.62092 0.56447 051316 0.46651 0.42410 0.38554 11.0% O90090 081162 0.73119 0.65873 0.59345 0.53454 0.48166 0.43390 0.39092 0.35218 0.89286 0.79719 0.71178 0.63552 0.5670 0.50663 0.45235 0.40338 0.36061 0.32197 0.89496 0.78315 0.69305 0.61332 0.54276 0.48032 0.42506 0.37616 0.33288 0.29459 0.87719 0.76947 0.67497 0.59208 0.51937 0.45559 0.39964 0.35056 0.30751 0.26974 0.86957 0.75614 0.65752 0.57175 0.49718 0.43233 0.37594 0.32690 0.28426 0.24718 0.83333 0.69444 0.57870 0.48225 0.40188 0.33490 0.27900 0.23257 0.19381 0.16151 0.80000 064000 0.51200 0.40960 0.32768 0.26214 0.20972 0.16777 0.13422 0.10737 9.0 20.0% 12 13 14 15 16 17 18 19 20 25 30 0.42888 0.39711 0.36770 0.34046 0.31524 0.29189 0.27027 0.25025 0.23171 0.21455 0.14602 0.09938 0.38750 0.35553 0.32618 0.29925 0.27454 0.25187 0.23107 0.21199 0.19449 0.17843 0.11597 0.07537 10.0 0.35049 0.31863 0.28966 0.26333 0.23939 0.21763 0.19784 0.17986 0.16351 0.14854 0.09230 0.05731 11.08 0.31728 0.28584 0.25751 0.23199 0.20900 0.18829 0.16963 0.15282 0.13768 0.12409 0.07361 0.04368 0.28748 0.25668 0.22917 0.20462 0.18270 0.16312 0.14564 0.13004 0.11611 0.10367 0.05882 0.03338 13.0 0.26070 0.23071 0.20416 0.18068 0.15989 0.14150 0.12522 0.11081 0.09806 0.08678 0.04710 0.02557 0.23662 0.20756 0.18207 0.15971 0.14010 0.12289 0.10780 0.09456 0.08295 0.07276 0.03779 0.01963 15.05 0.21494 0.18691 0.16253 0.14133 0.12289 0.10686 0.09293 0.08081 0.07027 0.06110 0.03038 0.01510 0.13459 011216 0.09346 0.07789 0.06491 0.05409 0.04507 0.03756 0.03130 0.02608 0.01048 0.00421 25.09 0.08590 0.06872 0.05498 0.04398 0.03518 0.02815 0.02252 0.01801 0.01441 0.01153 0.00378 0.00124