Answered step by step

Verified Expert Solution

Question

1 Approved Answer

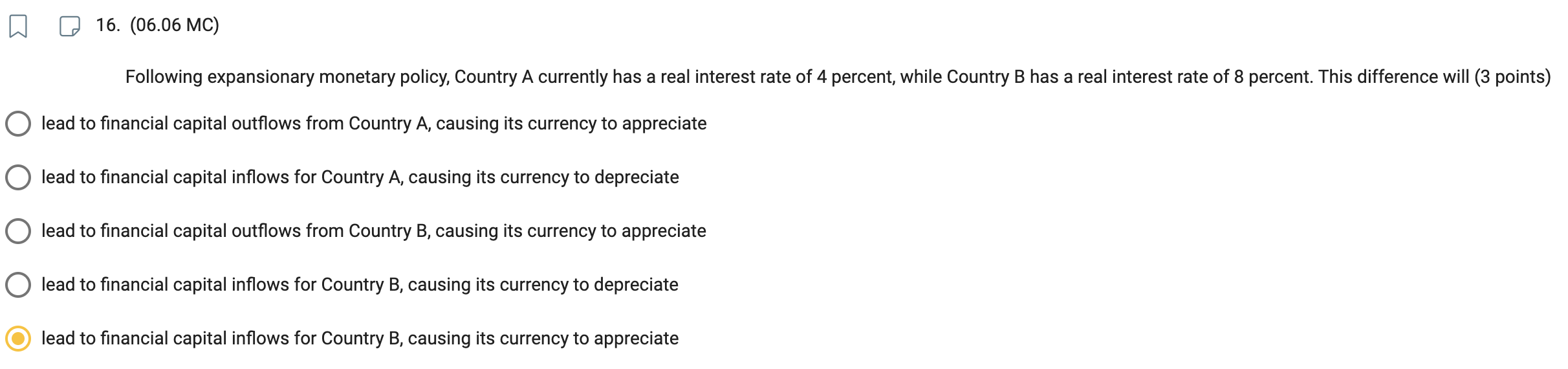

16. (06.06 MC) Following expansionary monetary policy, Country A currently has a real interest rate of 4 percent, while Country B has a real

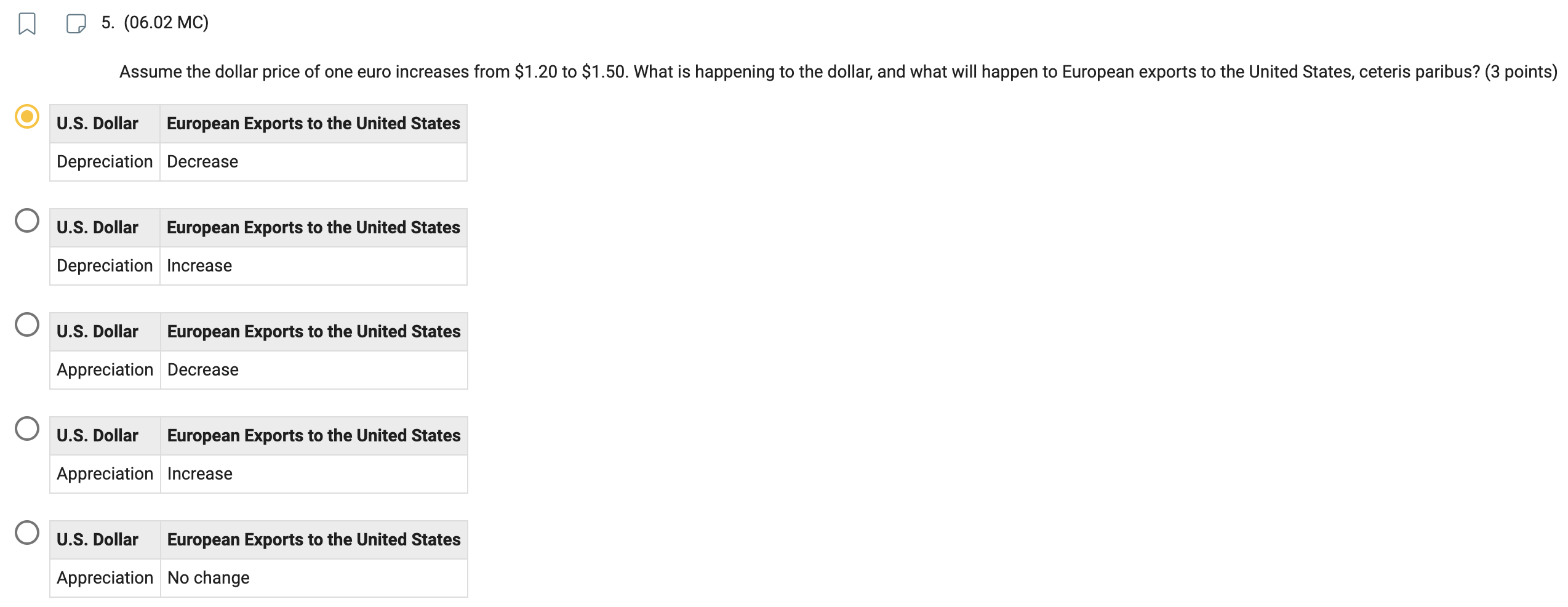

16. (06.06 MC) Following expansionary monetary policy, Country A currently has a real interest rate of 4 percent, while Country B has a real interest rate of 8 percent. This difference will (3 points) lead to financial capital outflows from Country A, causing its currency to appreciate lead to financial capital inflows for Country A, causing its currency to depreciate lead to financial capital outflows from Country B, causing its currency to appreciate lead to financial capital inflows for Country B, causing its currency to depreciate lead to financial capital inflows for Country B, causing its currency to appreciate O 5. (06.02 MC) Assume the dollar price of one euro increases from $1.20 to $1.50. What is happening to the dollar, and what will happen to European exports to the United States, ceteris paribus? (3 points) U.S. Dollar European Exports to the United States Depreciation Decrease O U.S. Dollar European Exports to the United States Depreciation Increase OU.S. Dollar Appreciation OU.S. Dollar European Exports to the United States Decrease European Exports to the United States Appreciation Increase U.S. Dollar European Exports to the United States Appreciation No change

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below The correct answer is b lead to financi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started