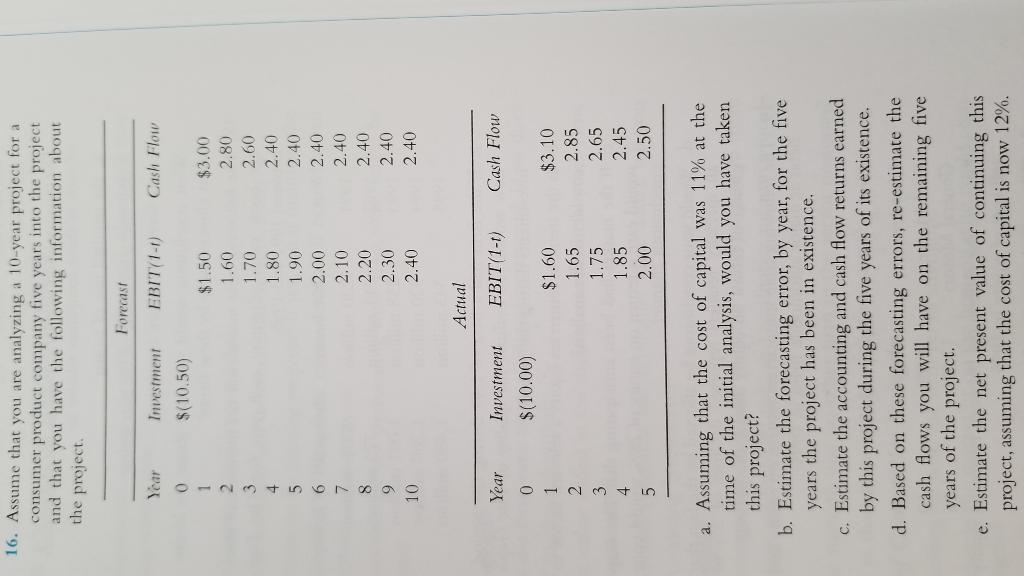

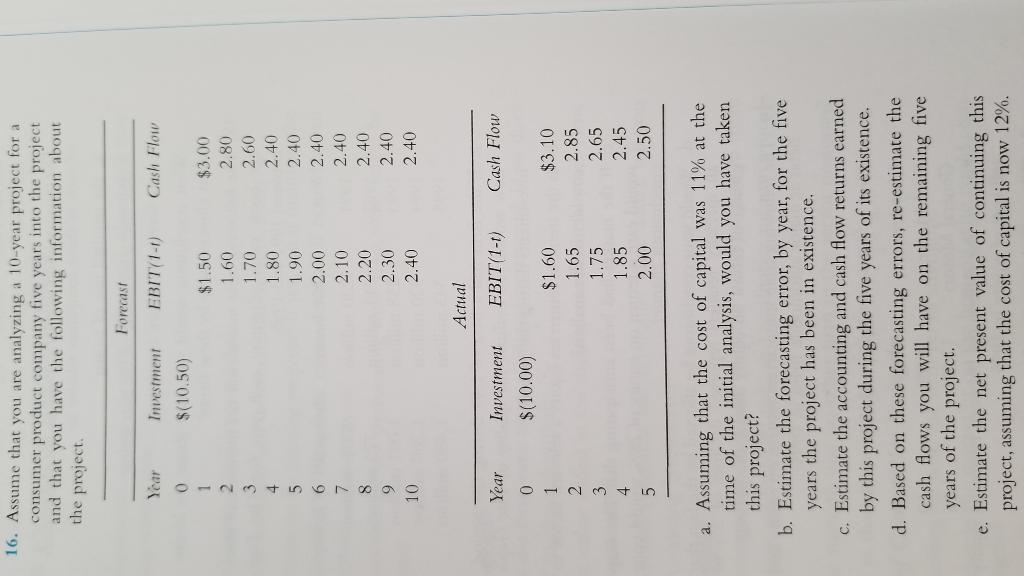

16. Assume that you are analyzing a 10-year project for a consumer product company five years into the project and that you have the following information about the project Forecast Year EBIT(1-1) Cash Flow Investment $(10.50) 0 1 2 3 4 5 6 7 $1.50 1.60 1.70 1.80 1.90 2.00 2.10 2.20 2.30 2.40 $3.00 2.80 2.60 2.40 2.40 2.40 2.40 2.40 2.40 2.40 8 9 10 Actual Year Investment EBIT(1-1) Cash Flow 0 $(10.00) $1.60 1.65 1 2 3 4 5 1.75 1.85 $3.10 2.85 2.65 2.45 2.50 2.00 a. Assuming that the cost of capital was 11% at the time of the initial analysis, would you have taken this project? b. Estimate the forecasting error, by year, for the five years the project has been in existence. c. Estimate the accounting and cash flow returns earned by this project during the five years of its existence. d. Based on these forecasting errors, re-estimate the cash flows you will have on the remaining five years of the project. e. Estimate the net present value of continuing this project, assuming that the cost of capital is now 12%. Question 3 (1 point) Refer to Chapter 15, Problem 16. Calculate the forecasting error (%) each year for the first five years of the project. The forecasting error (%) in Year 3 is 1.92%. This statement is: True False 16. Assume that you are analyzing a 10-year project for a consumer product company five years into the project and that you have the following information about the project Forecast Year EBIT(1-1) Cash Flow Investment $(10.50) 0 1 2 3 4 5 6 7 $1.50 1.60 1.70 1.80 1.90 2.00 2.10 2.20 2.30 2.40 $3.00 2.80 2.60 2.40 2.40 2.40 2.40 2.40 2.40 2.40 8 9 10 Actual Year Investment EBIT(1-1) Cash Flow 0 $(10.00) $1.60 1.65 1 2 3 4 5 1.75 1.85 $3.10 2.85 2.65 2.45 2.50 2.00 a. Assuming that the cost of capital was 11% at the time of the initial analysis, would you have taken this project? b. Estimate the forecasting error, by year, for the five years the project has been in existence. c. Estimate the accounting and cash flow returns earned by this project during the five years of its existence. d. Based on these forecasting errors, re-estimate the cash flows you will have on the remaining five years of the project. e. Estimate the net present value of continuing this project, assuming that the cost of capital is now 12%. Question 3 (1 point) Refer to Chapter 15, Problem 16. Calculate the forecasting error (%) each year for the first five years of the project. The forecasting error (%) in Year 3 is 1.92%. This statement is: True False