Answered step by step

Verified Expert Solution

Question

1 Approved Answer

16. Because the WACC varies with the use of funds rather than the source of funds, some firms evaluate new projects based on the WACC

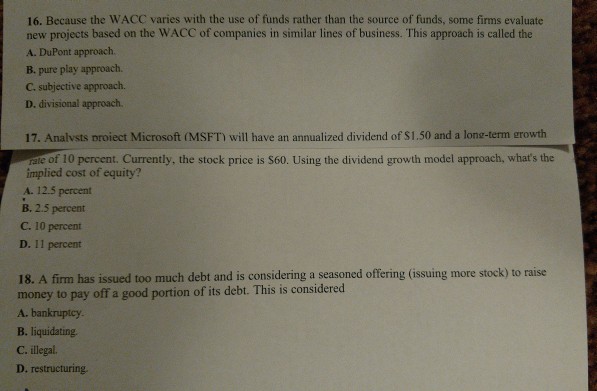

16. Because the WACC varies with the use of funds rather than the source of funds, some firms evaluate new projects based on the WACC of companies in similar lines of business. This approach is called the A. DuPont approach. B. pure play approach. C. subjective approach. D. divisional approach. 17. Analvsts proiect Microsoft (MSFT) will have an annualized dividend of S1.50 and a lona-term erowth rate of 10 percent. Currently, the stock price is S60. Using the dividend growth model approach, what's the implied cost of equity? A. 12.5 percent B. 2.5 percent C. 10 percent D. 11 percent money to pay off a good portion of its debt. This is considered A. bankruptcy B. liquidating C. illegal. D. restructuring

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started