Question

16 Eight years ago Winnie realized a net capital loss in the amount of $75,000 when the value of her shares in a technology

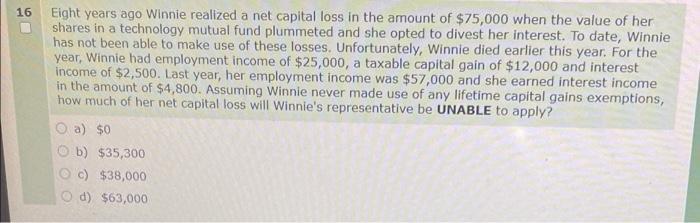

16 Eight years ago Winnie realized a net capital loss in the amount of $75,000 when the value of her shares in a technology mutual fund plummeted and she opted to divest her interest. To date, Winnie has not been able to make use of these losses. Unfortunately, Winnie died earlier this year. For the year, Winnie had employment income of $25,000, a taxable capital gain of $12,000 and interest income of $2,500. Last year, her employment income was $57,000 and she earned interest income in the amount of $4,800. Assuming Winnie never made use of any lifetime capital gains exemptions, how much of her net capital loss will Winnie's representative be UNABLE to apply? a) $0 b) $35,300 c) $38,000 d) $63,000

Step by Step Solution

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Winnie realized a net capital loss of 75000 Last year Winnie had emplo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

South Western Federal Taxation 2017 Essentials Of Taxation Individuals And Business Entities

Authors: William A. Raabe, David M. Maloney, James C. Young, Annette Nellen

20th Edition

978-0357109144, 978-0357686652, 978-1305874824

Students also viewed these General Management questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App