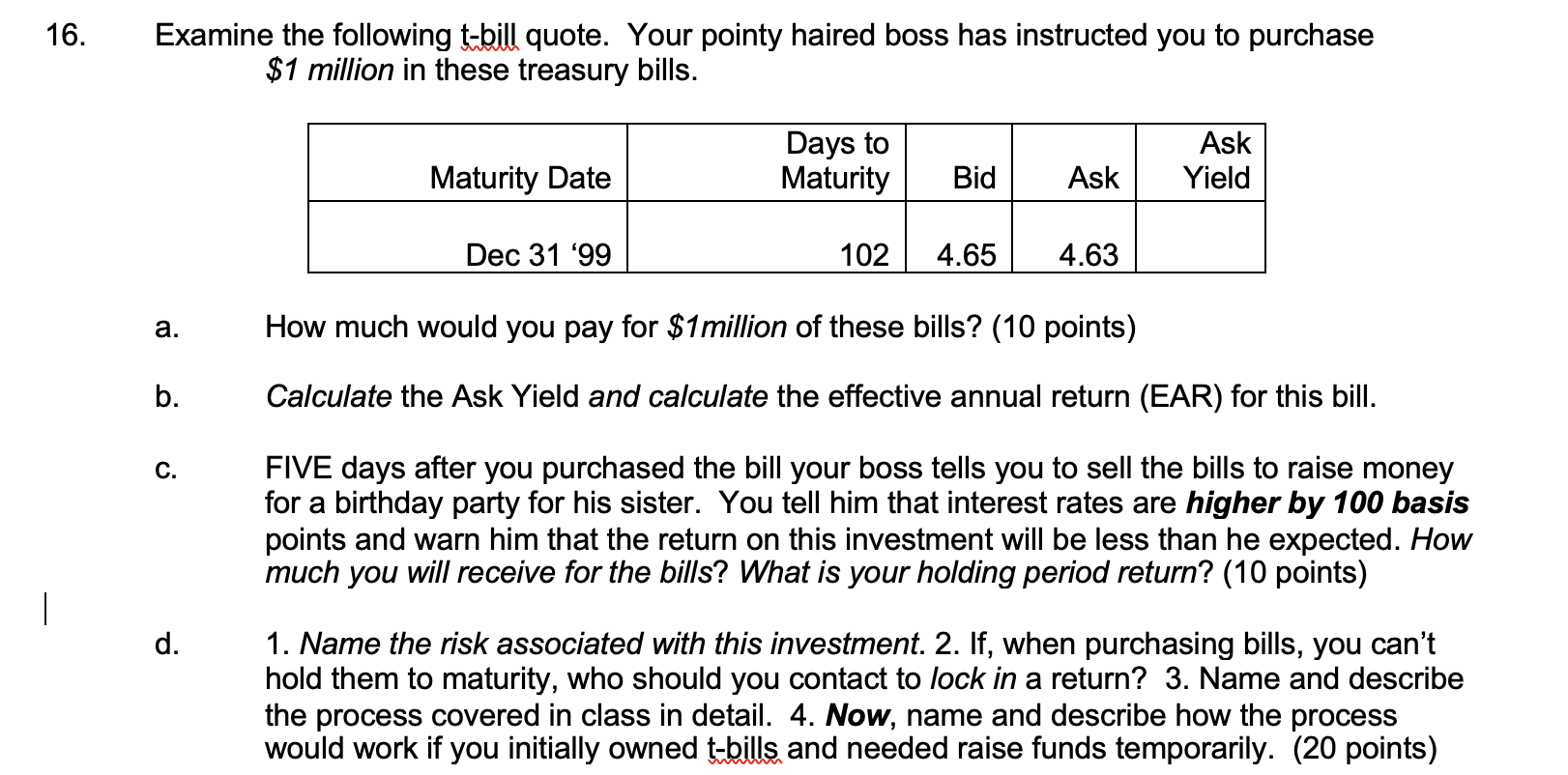

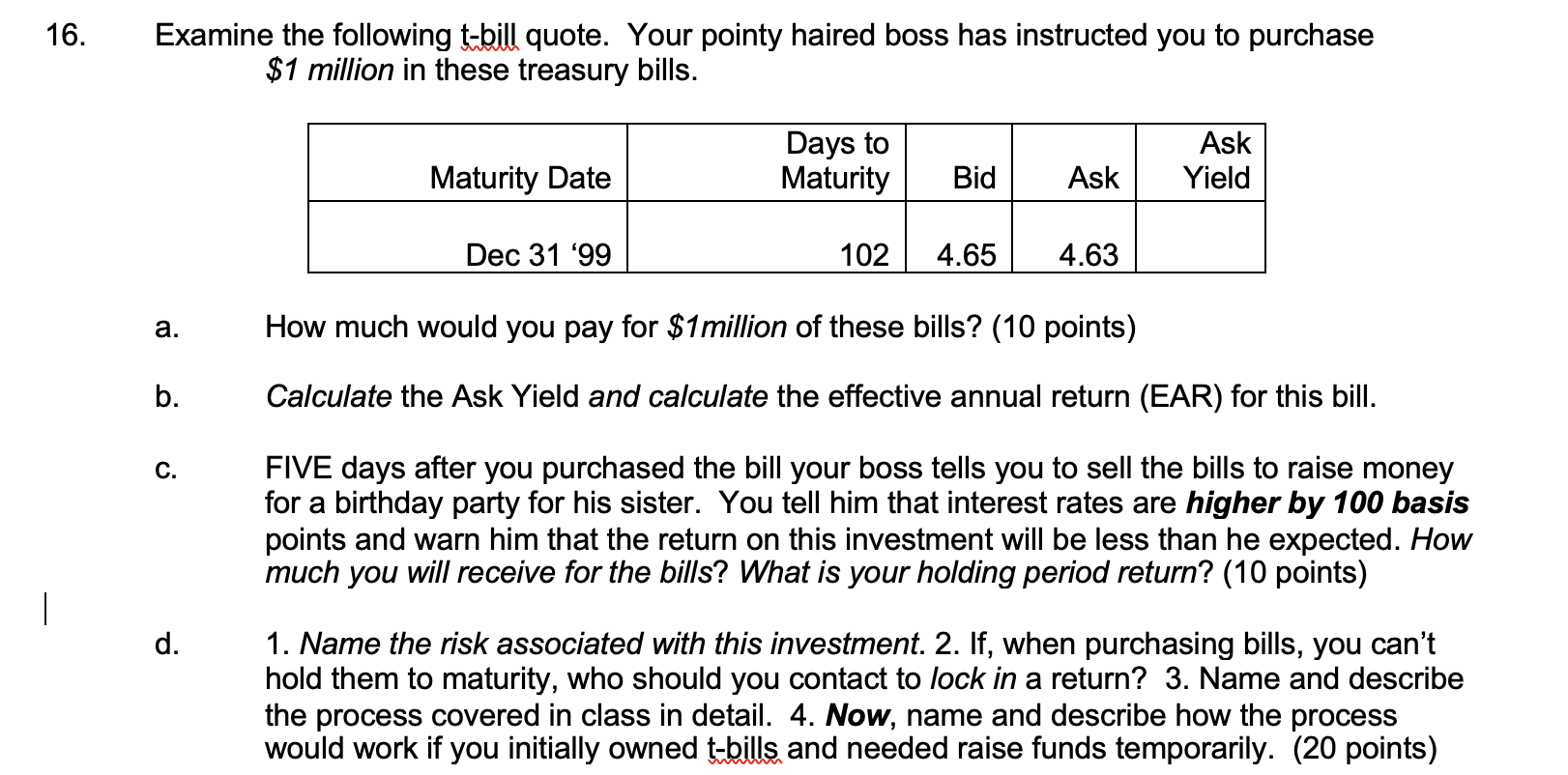

16. Examine the following t-bill quote. Your pointy haired boss has instructed you to purchase $1 million in these treasury bills. Days to Maturity Ask Yield Maturity Date Bid Ask Dec 31 '99 102 4.65 4.63 a. How much would you pay for $1million of these bills? (10 points) b. Calculate the Ask Yield and calculate the effective annual return (EAR) for this bill. C. FIVE days after you purchased the bill your boss tells you to sell the bills to raise money for a birthday party for his sister. You tell him that interest rates are higher by 100 basis points and warn him that the return on this investment will be less than he expected. How much you will receive for the bills? What is your holding period return? (10 points) | d. 1. Name the risk associated with this investment. 2. If, when purchasing bills, you can't hold them to maturity, who should you contact to lock in a return? 3. Name and describe the process covered in class in detail. 4. Now, name and describe how the process would work if you initially owned t-bills and needed raise funds temporarily. (20 points) 16. Examine the following t-bill quote. Your pointy haired boss has instructed you to purchase $1 million in these treasury bills. Days to Maturity Ask Yield Maturity Date Bid Ask Dec 31 '99 102 4.65 4.63 a. How much would you pay for $1million of these bills? (10 points) b. Calculate the Ask Yield and calculate the effective annual return (EAR) for this bill. C. FIVE days after you purchased the bill your boss tells you to sell the bills to raise money for a birthday party for his sister. You tell him that interest rates are higher by 100 basis points and warn him that the return on this investment will be less than he expected. How much you will receive for the bills? What is your holding period return? (10 points) | d. 1. Name the risk associated with this investment. 2. If, when purchasing bills, you can't hold them to maturity, who should you contact to lock in a return? 3. Name and describe the process covered in class in detail. 4. Now, name and describe how the process would work if you initially owned t-bills and needed raise funds temporarily. (20 points)