Answered step by step

Verified Expert Solution

Question

1 Approved Answer

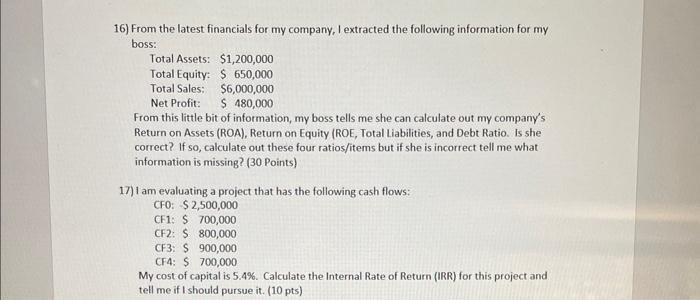

16) From the latest financials for my company, I extracted the following information for my boss: Total Assets: $1,200,000 Total Equity: $ 650,000 Total

16) From the latest financials for my company, I extracted the following information for my boss: Total Assets: $1,200,000 Total Equity: $ 650,000 Total Sales: $6,000,000 Net Profit: $ 480,000 From this little bit of information, my boss tells me she can calculate out my company's Return on Assets (ROA), Return on Equity (ROE, Total Liabilities, and Debt Ratio. Is she correct? If so, calculate out these four ratios/items but if she is incorrect tell me what information is missing? (30 Points) 17) I am evaluating a project that has the following cash flows: CFO: $2,500,000 CF1: $ 700,000 CF2: $ 800,000 CF3: $ CF4: $ 900,000 700,000 My cost of capital is 5.4%. Calculate the Internal Rate of Return (IRR) for this project and tell me if I should pursue it. (10 pts)

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

16 Yes your boss is correct We can calculate the Return on Assets ROA Return on Equity ROE Total Lia...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started