Answered step by step

Verified Expert Solution

Question

1 Approved Answer

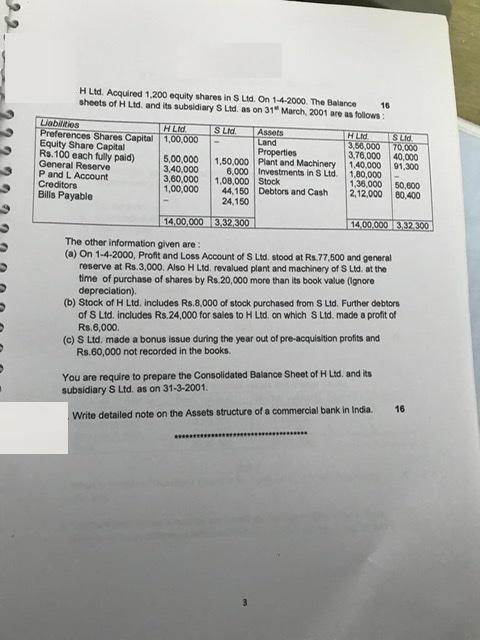

16 H Ltd. Acquired 1,200 equity shares in S Ltd. On 1-4-2000. The Balance sheets of H Ltd. and its subsidiary S Ltd. as

16 H Ltd. Acquired 1,200 equity shares in S Ltd. On 1-4-2000. The Balance sheets of H Ltd. and its subsidiary S Ltd. as on 31 March, 2001 are as follows: S Ltd. Liabilities Preferences Shares Capital Equity Share Capital Rs.100 each fully paid) General Reserve P and L Account Creditors Bills Payable H Ltd 1,00,000 1,50,000 Assets Land Properties Plant and Machinery 6,000 Investments in S Ltd. 5,00,000 3,40,000 3,60,000 1,08,000 Stock 1,00,000 44,150 24,150 3,32,300 ************** Debtors and Cash H Ltd 3,56,000 3,76.000 1,40,000 1,80,000 14,00,000 The other information given are: (a) On 1-4-2000, Profit and Loss Account of S Ltd. stood at Rs.77,500 and general reserve at Rs.3,000. Also H Ltd. revalued plant and machinery of S Ltd. at the time of purchase of shares by Rs.20,000 more than its book value (Ignore depreciation). (b) Stock of H Ltd. includes Rs.8,000 of stock purchased from S Ltd. Further debtors of S Ltd. includes Rs.24,000 for sales to H Ltd. on which S Ltd. made a profit of Rs.6,000. (c) S Ltd. made a bonus issue during the year out of pre-acquisition profits and Rs.60,000 not recorded in the books. ************* S Ltd. 70,000 40,000 91,300 1,36,000 50,600 2,12,000 80,400 You are require to prepare the Consolidated Balance Sheet of H Ltd. and its subsidiary S Ltd. as on 31-3-2001. Write detailed note on the Assets structure of a commercial bank in India. 14,00,000 3,32,300 16

Step by Step Solution

★★★★★

3.33 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER Consolidated Balance Sheet of H Ltd and its Subsidiary S Ltd as on 31st March 2001 Liabilities Preference Share Capital HLtd Rs100000 S Ltd Rs1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started