Question

16?? I need the full answers and help please! Cinqua Terra Incorporated issued 10 -year bonds three years ago with a coupon rate of 8.50%

16?? I need the full answers and help please!

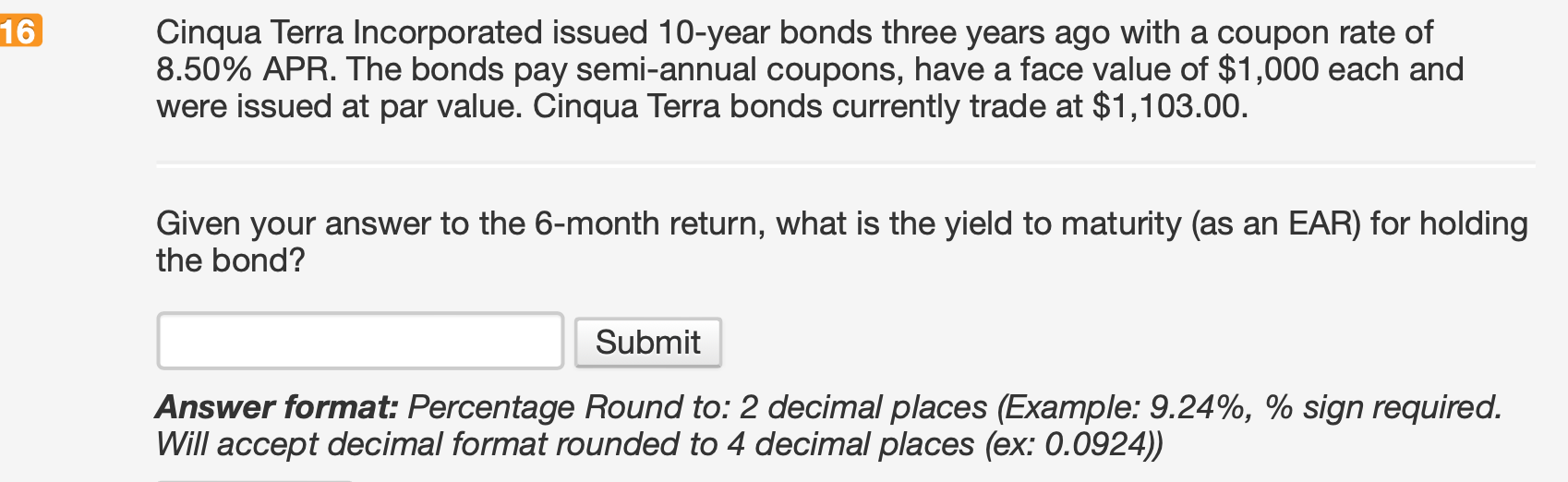

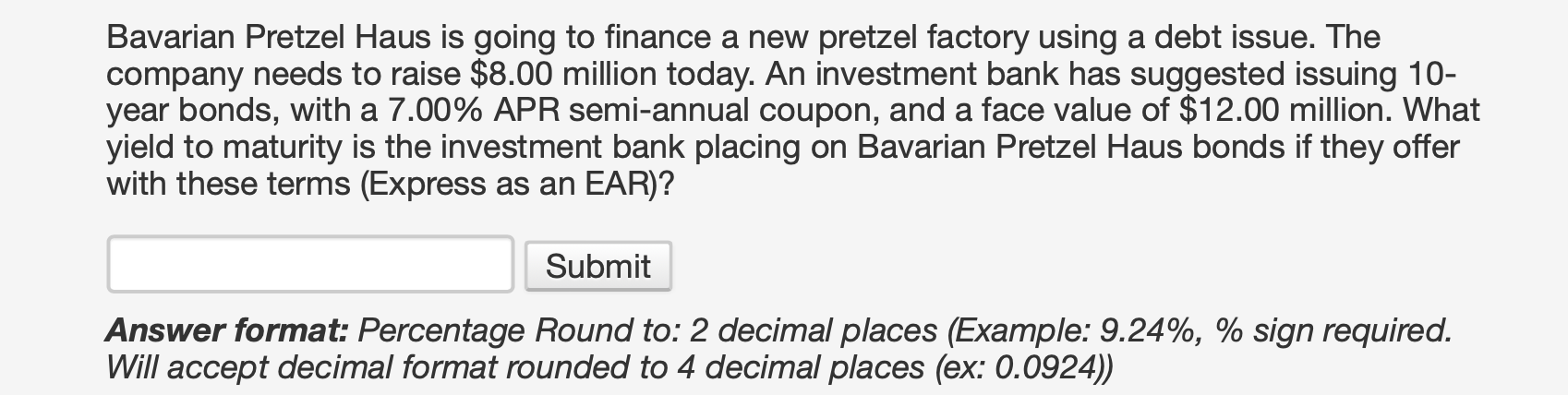

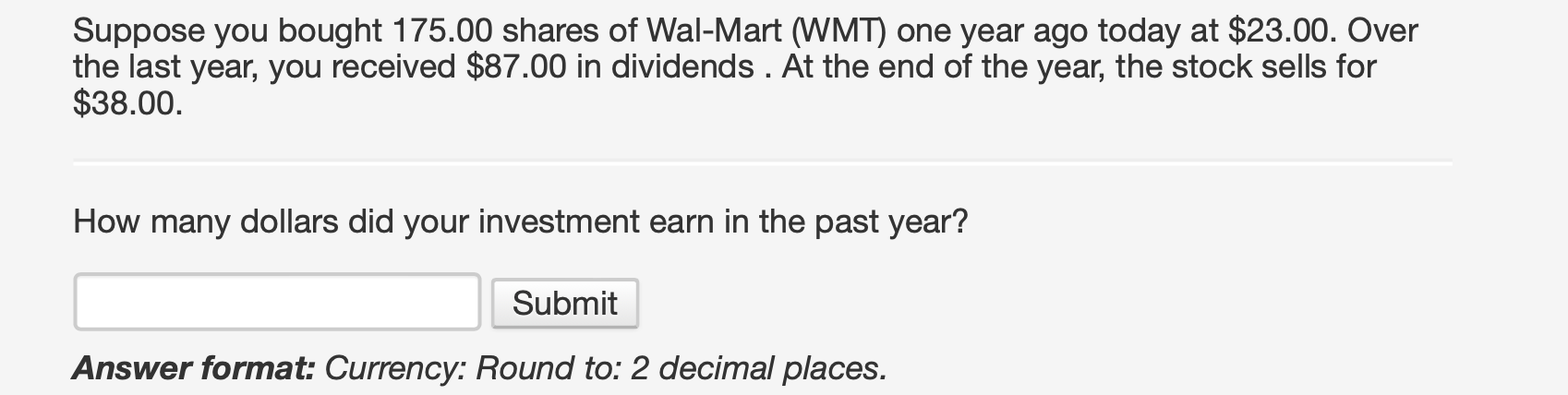

Cinqua Terra Incorporated issued 10 -year bonds three years ago with a coupon rate of 8.50% APR. The bonds pay semi-annual coupons, have a face value of $1,000 each and were issued at par value. Cinqua Terra bonds currently trade at $1,103.00. Given your answer to the 6-month return, what is the yield to maturity (as an EAR) for holding the bond? Answer format: Percentage Round to: 2 decimal places (Example: 9.24\%, \% sign required. Will accept decimal format rounded to 4 decimal places (ex: 0.0924)) Bavarian Pretzel Haus is going to finance a new pretzel factory using a debt issue. The company needs to raise $8.00 million today. An investment bank has suggested issuing 10year bonds, with a 7.00% APR semi-annual coupon, and a face value of $12.00 million. What yield to maturity is the investment bank placing on Bavarian Pretzel Haus bonds if they offer with these terms (Express as an EAR)? Answer format: Percentage Round to: 2 decimal places (Example: 9.24\%, \% sign required. Will accept decimal format rounded to 4 decimal places (ex: 0.0924)) Suppose you bought 175.00 shares of Wal-Mart (WMT) one year ago today at $23.00. Over the last year, you received $87.00 in dividends. At the end of the year, the stock sells for $38.00. How many dollars did your investment earn in the past year? Answer format: Currency: Round to: 2 decimal places. Cinqua Terra Incorporated issued 10 -year bonds three years ago with a coupon rate of 8.50% APR. The bonds pay semi-annual coupons, have a face value of $1,000 each and were issued at par value. Cinqua Terra bonds currently trade at $1,103.00. Given your answer to the 6-month return, what is the yield to maturity (as an EAR) for holding the bond? Answer format: Percentage Round to: 2 decimal places (Example: 9.24\%, \% sign required. Will accept decimal format rounded to 4 decimal places (ex: 0.0924)) Bavarian Pretzel Haus is going to finance a new pretzel factory using a debt issue. The company needs to raise $8.00 million today. An investment bank has suggested issuing 10year bonds, with a 7.00% APR semi-annual coupon, and a face value of $12.00 million. What yield to maturity is the investment bank placing on Bavarian Pretzel Haus bonds if they offer with these terms (Express as an EAR)? Answer format: Percentage Round to: 2 decimal places (Example: 9.24\%, \% sign required. Will accept decimal format rounded to 4 decimal places (ex: 0.0924)) Suppose you bought 175.00 shares of Wal-Mart (WMT) one year ago today at $23.00. Over the last year, you received $87.00 in dividends. At the end of the year, the stock sells for $38.00. How many dollars did your investment earn in the past year? Answer format: Currency: Round to: 2 decimal places

Cinqua Terra Incorporated issued 10 -year bonds three years ago with a coupon rate of 8.50% APR. The bonds pay semi-annual coupons, have a face value of $1,000 each and were issued at par value. Cinqua Terra bonds currently trade at $1,103.00. Given your answer to the 6-month return, what is the yield to maturity (as an EAR) for holding the bond? Answer format: Percentage Round to: 2 decimal places (Example: 9.24\%, \% sign required. Will accept decimal format rounded to 4 decimal places (ex: 0.0924)) Bavarian Pretzel Haus is going to finance a new pretzel factory using a debt issue. The company needs to raise $8.00 million today. An investment bank has suggested issuing 10year bonds, with a 7.00% APR semi-annual coupon, and a face value of $12.00 million. What yield to maturity is the investment bank placing on Bavarian Pretzel Haus bonds if they offer with these terms (Express as an EAR)? Answer format: Percentage Round to: 2 decimal places (Example: 9.24\%, \% sign required. Will accept decimal format rounded to 4 decimal places (ex: 0.0924)) Suppose you bought 175.00 shares of Wal-Mart (WMT) one year ago today at $23.00. Over the last year, you received $87.00 in dividends. At the end of the year, the stock sells for $38.00. How many dollars did your investment earn in the past year? Answer format: Currency: Round to: 2 decimal places. Cinqua Terra Incorporated issued 10 -year bonds three years ago with a coupon rate of 8.50% APR. The bonds pay semi-annual coupons, have a face value of $1,000 each and were issued at par value. Cinqua Terra bonds currently trade at $1,103.00. Given your answer to the 6-month return, what is the yield to maturity (as an EAR) for holding the bond? Answer format: Percentage Round to: 2 decimal places (Example: 9.24\%, \% sign required. Will accept decimal format rounded to 4 decimal places (ex: 0.0924)) Bavarian Pretzel Haus is going to finance a new pretzel factory using a debt issue. The company needs to raise $8.00 million today. An investment bank has suggested issuing 10year bonds, with a 7.00% APR semi-annual coupon, and a face value of $12.00 million. What yield to maturity is the investment bank placing on Bavarian Pretzel Haus bonds if they offer with these terms (Express as an EAR)? Answer format: Percentage Round to: 2 decimal places (Example: 9.24\%, \% sign required. Will accept decimal format rounded to 4 decimal places (ex: 0.0924)) Suppose you bought 175.00 shares of Wal-Mart (WMT) one year ago today at $23.00. Over the last year, you received $87.00 in dividends. At the end of the year, the stock sells for $38.00. How many dollars did your investment earn in the past year? Answer format: Currency: Round to: 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started