Answered step by step

Verified Expert Solution

Question

1 Approved Answer

16. In 2019, Madison is considering making a proportionate non-liquidating distribution of shares of stock that it owns in CDE Corporation to its partners.

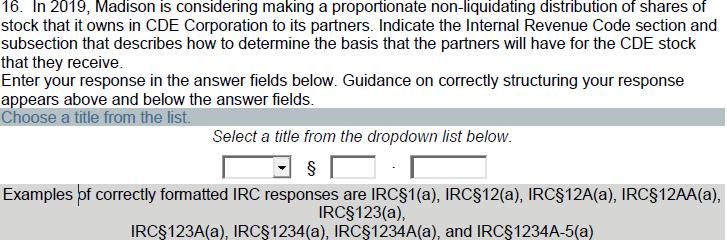

16. In 2019, Madison is considering making a proportionate non-liquidating distribution of shares of stock that it owns in CDE Corporation to its partners. Indicate the Internal Revenue Code section and subsection that describes how to determine the basis that the partners will have for the CDE stock that they receive. Enter your response in the answer fields below. Guidance on correctly structuring your response appears above and below the answer fields. Choose a title from the list. Select a title from the dropdown list below. Examples of correctly formatted IRC responses are IRC1(a), IRC12(a), IRC12A(a), IRC12AA(a), IRC123(a), IRC123A(a), IRC1234(a), IRC1234A(a), and IRC1234A-5(a)

Step by Step Solution

★★★★★

3.63 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

The basis that the partners will have for the CD E stock that they receive ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started