Answered step by step

Verified Expert Solution

Question

1 Approved Answer

16. Mixed costs contain both fixed and variable components a) True b) False 17. At the end of the year, overhead applied was $42,000,000. Actual

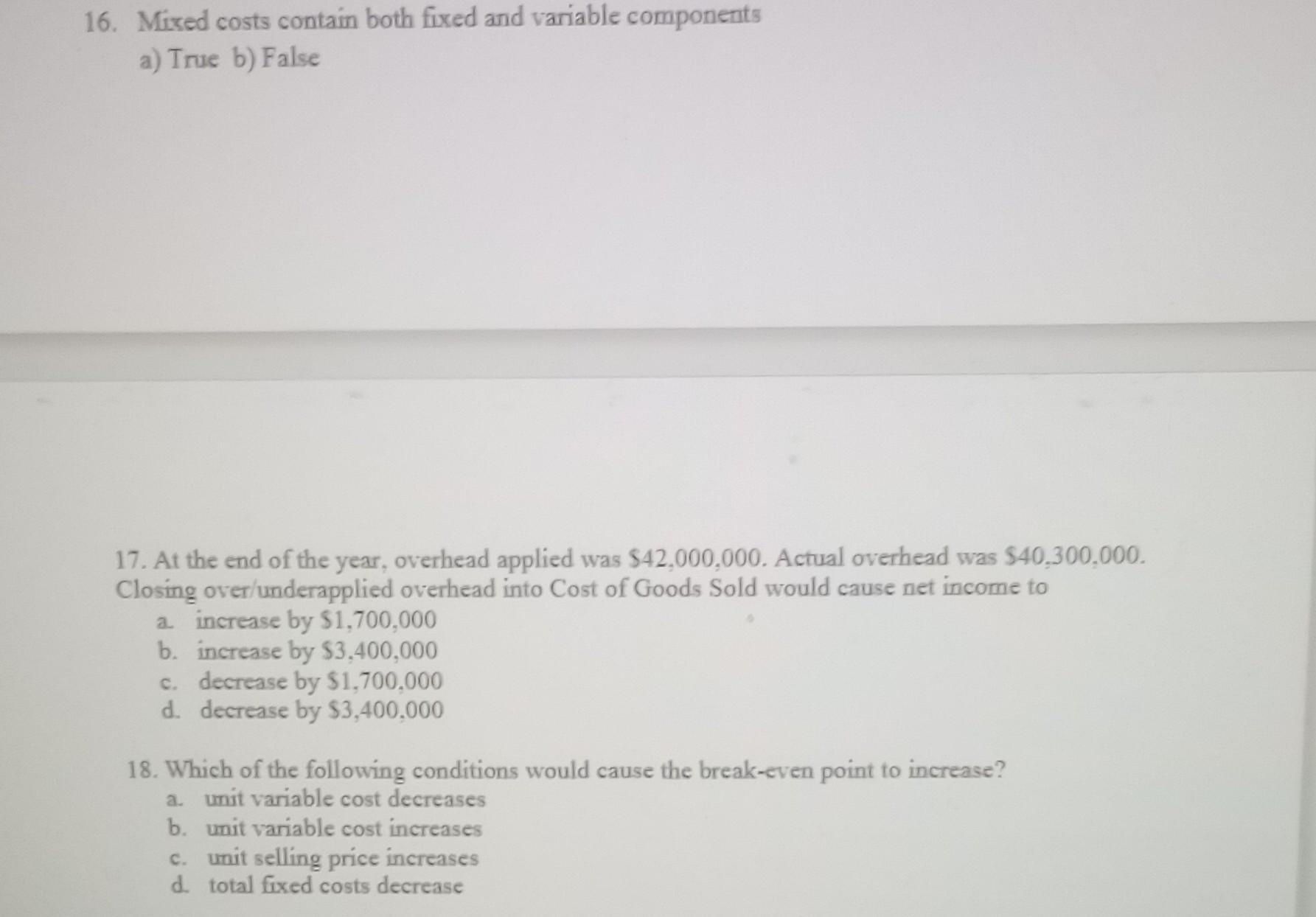

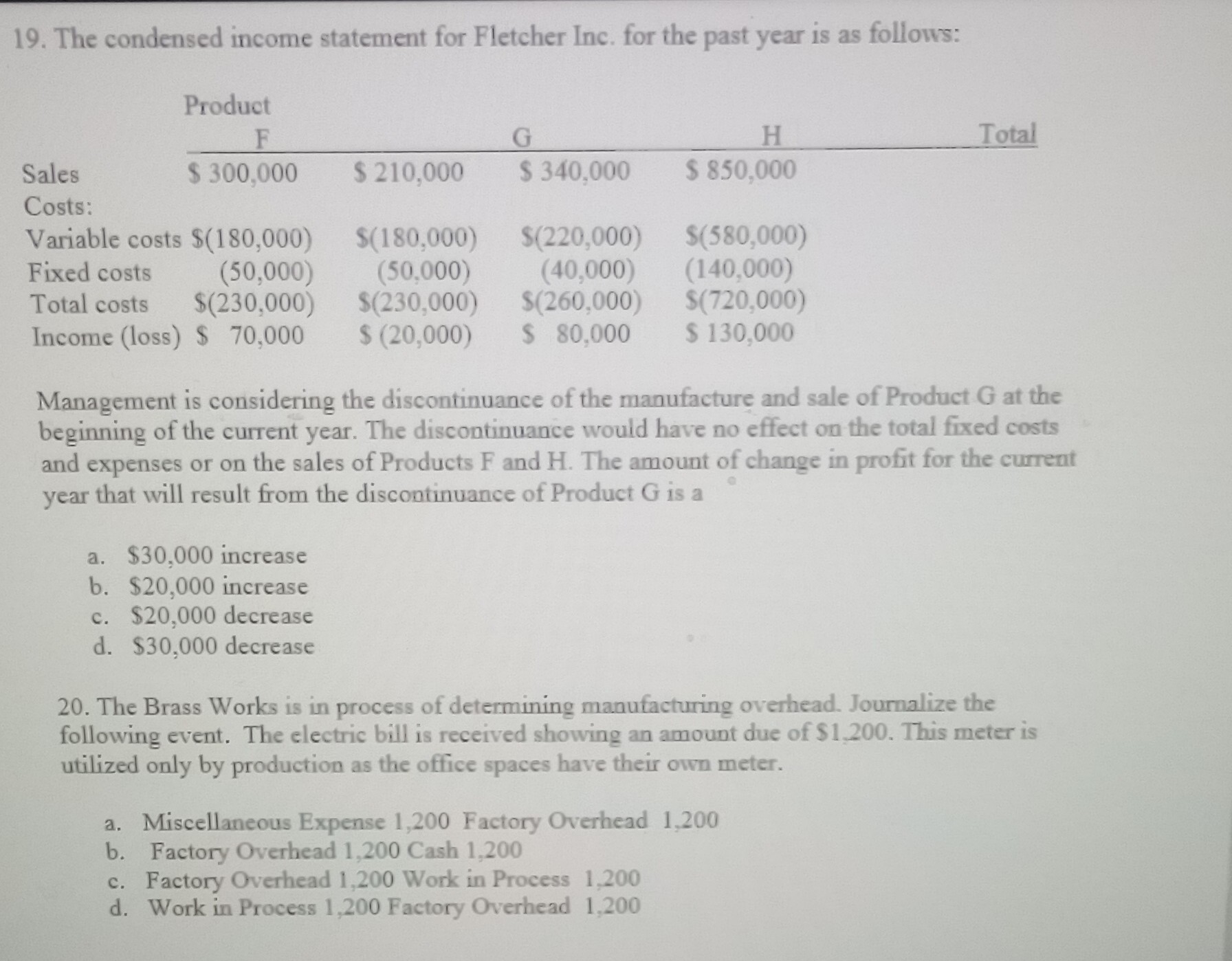

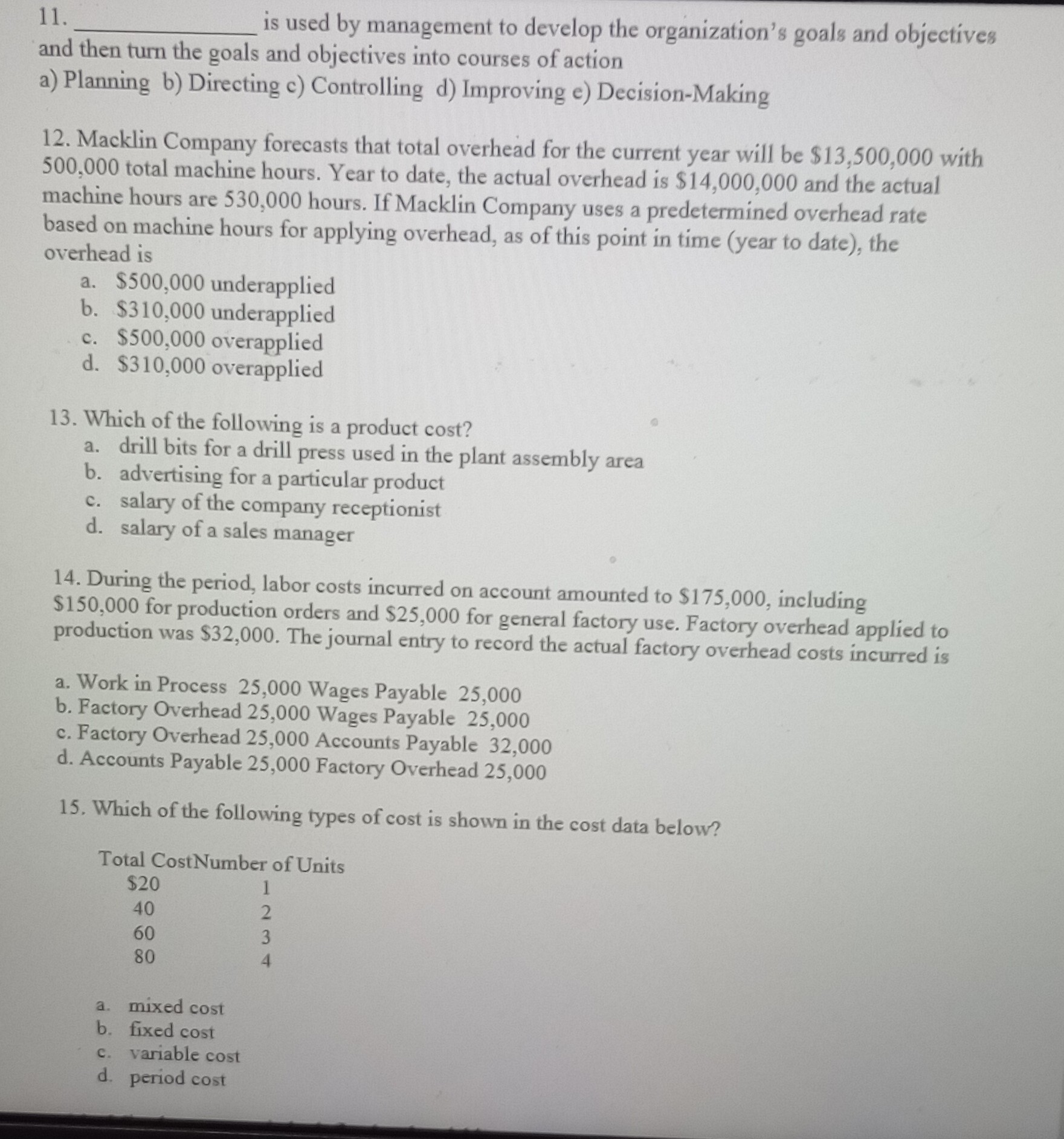

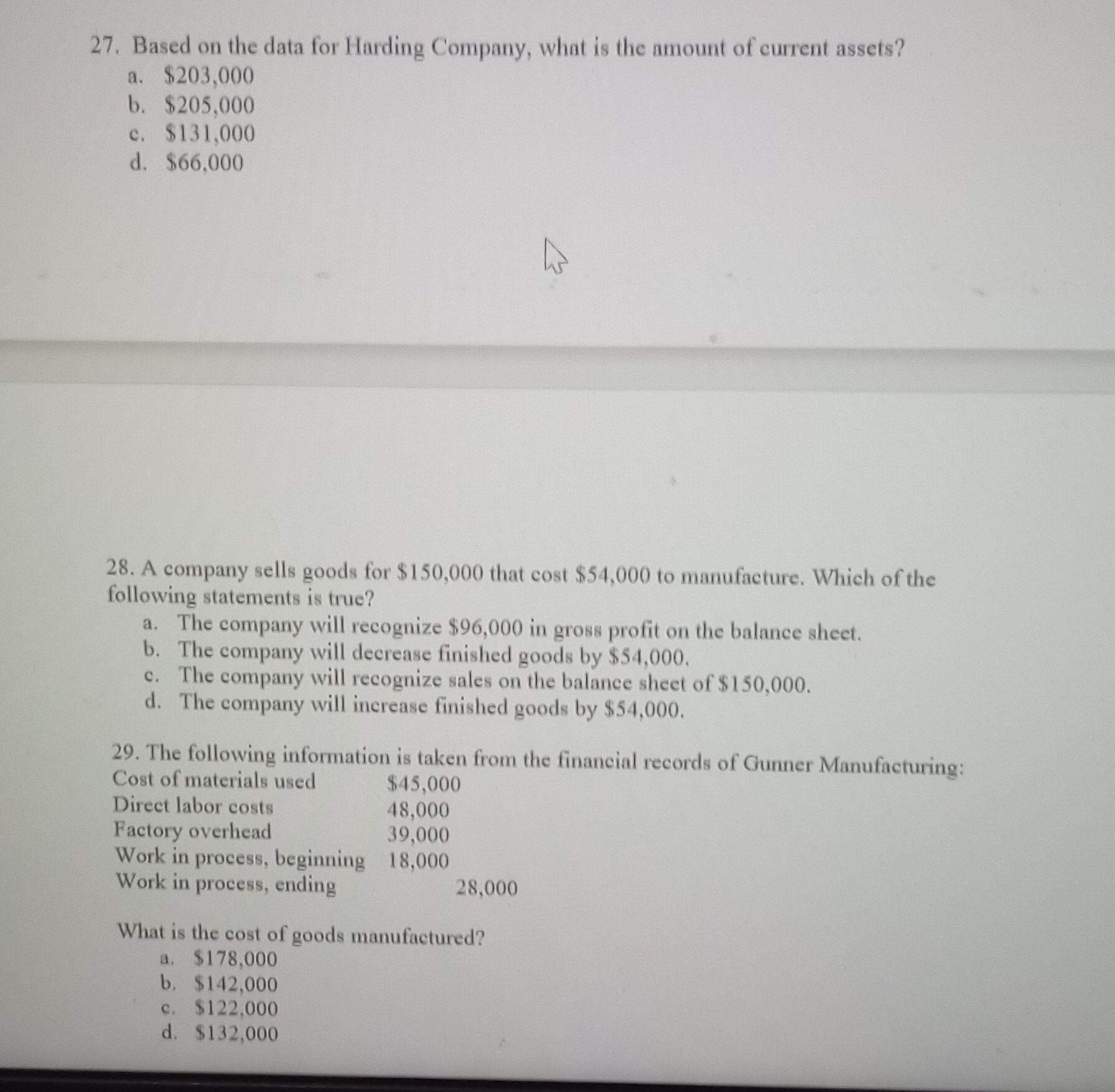

16. Mixed costs contain both fixed and variable components a) True b) False 17. At the end of the year, overhead applied was $42,000,000. Actual overhead was $40,300,000. Closing over/underapplied overhead into Cost of Goods Sold would cause net income to a. increase by $1,700,000 b. increase by $3,400,000 c. decrease by $1,700,000 d. decrease by $3,400,000 18. Which of the following conditions would cause the break-even point to increase? a. unit variable cost decreases b. unit variable cost increases c. unit selling price increases d. total fixed costs decrease 19. The condensed income statement for Fletcher Inc. for the past year is as follows: Management is considering the discontinuance of the manufacture and sale of Product G at the beginning of the current year. The discontinuance would have no effect on the total fixed costs and expenses or on the sales of Products F and H. The amount of change in profit for the current year that will result from the discontinuance of Product G is a a. $30,000 increase b. $20,000 increase c. $20,000 decrease d. $30,000 decrease 20. The Brass Works is in process of determining manufacturing overhead. Journalize the following event. The electric bill is received showing an amount due of $1,200. This meter is utilized only by production as the office spaces have their own meter. a. Miscellaneous Expense 1,200 Factory Overhead 1,200 b. Factory Overhead 1,200 Cash 1,200 c. Factory Overhead 1,200 Work in Process 1,200 d. Work in Process 1,200 Factory Overhead 1,200 11. is used by management to develop the organization's goals and objectives and then turn the goals and objectives into courses of action a) Planning b) Directing c) Controlling d) Improving e) Decision-Making 12. Macklin Company forecasts that total overhead for the current year will be $13,500,000 with 500,000 total machine hours. Year to date, the actual overhead is $14,000,000 and the actual machine hours are 530,000 hours. If Macklin Company uses a predetermined overhead rate based on machine hours for applying overhead, as of this point in time (year to date), the overhead is a. $500,000 underapplied b. $310,000 underapplied c. $500,000 overapplied d. $310,000 overapplied 13. Which of the following is a product cost? a. drill bits for a drill press used in the plant assembly area b. advertising for a particular product c. salary of the company receptionist d. salary of a sales manager 14. During the period, labor costs incurred on account amounted to $175,000, including $150,000 for production orders and $25,000 for general factory use. Factory overhead applied to production was $32,000. The journal entry to record the actual factory overhead costs incurred is a. Work in Process 25,000 Wages Payable 25,000 b. Factory Overhead 25,000 Wages Payable 25,000 c. Factory Overhead 25,000 Accounts Payable 32,000 d. Accounts Payable 25,000 Factory Overhead 25,000 15. Which of the following types of cost is shown in the cost data below? a. mixed cost b. fixed cost c. variable cost d. period cost 27. Based on the data for Harding Company, what is the amount of current assets? a. $203,000 b. $205,000 c. $131,000 d. $66,000 28. A company sells goods for $150,000 that cost $54,000 to manufacture. Which of the following statements is true? a. The company will recognize $96,000 in gross profit on the balance sheet. b. The company will decrease finished goods by $54,000. c. The company will recognize sales on the balance sheet of $150,000. d. The company will increase finished goods by $54,000. 29. The following information is taken from the financial records of Gunner Manufacturing What is the cost of goods manufactured? a. $178,000 b. $142,000 c. $122,000 d. $132,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started