Answered step by step

Verified Expert Solution

Question

1 Approved Answer

16. Oliver entered into a 40-year lease contract with Bernas. Per agreement, Olive will construct a building on Bernas lot and operate the same

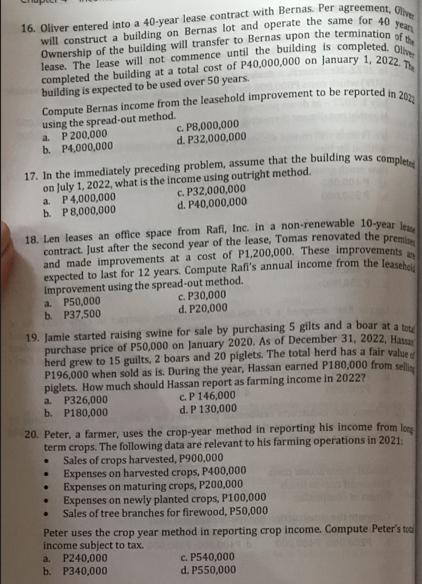

16. Oliver entered into a 40-year lease contract with Bernas. Per agreement, Olive will construct a building on Bernas lot and operate the same for 40 year Ownership of the building will transfer to Bernas upon the termination of the lease. The lease will not commence until the building is completed. Olive completed the building at a total cost of P40,000,000 on January 1, 2022. The building is expected to be used over 50 years. Compute Bernas income from the leasehold improvement to be reported in 2022 using the spread-out method. a. P 200,000 b. P4,000,000 17. In the immediately preceding problem, assume that the building was on July 1, 2022, what is the income using outright method. a. P 4,000,000 b. P 8,000,000 c. P32,000,000 d. P40,000,000 18. Len leases an office space from Rafi, Inc. in a non-renewable 10-year lea contract. Just after the second year of the lease, Tomas renovated the premi and made improvements at a cost of P1,200,000. These improvements expected to last for 12 years. Compute Rafi's annual income from the leasehoi Improvement using the spread-out method. a. P50,000 b. P37,500 a. P326,000. b. P180,000 19. Jamle started raising swine for sale by purchasing 5 gilts and a boar at a tote purchase price of P50,000 on January 2020. As of December 31, 2022, Ha herd grew to 15 guilts, 2 boars and 20 piglets. The total herd has a fair value P196,000 when sold as is. During the year, Hassan earned P180,000 from selling piglets. How much should Hassan report as farming income in 20227 . c. P8,000,000 d. P32,000,000 . 20. Peter, a farmer, uses the crop-year method in reporting his income from long term crops. The following data are relevant to his farming operations in 2021: . . c. P30,000 d. P20,000 s completed c. P 146,000. d. P 130,000 a. P240,000 b. P340,000 Sales of crops harvested, P900,000 Expenses on harvested crops, P400,000 Expenses on maturing crops, P200,000 Expenses on newly planted crops, P100,000 Sales of tree branches for firewood, P50,000 Peter uses the crop year method in reporting crop income. Compute Peter's too income subject to tax. c. P540,000 d. P550,000

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

16 To compute Bernass income from the leasehold improvement using the spreadout method we need to determine the annual depreciation expense The total ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started