Answered step by step

Verified Expert Solution

Question

1 Approved Answer

16 O'Neill Mining NL spent $2,000,000 on Exploration and Evaluation in an Area of Interest, discovered a mineral deposit there and spent $200,000 developing

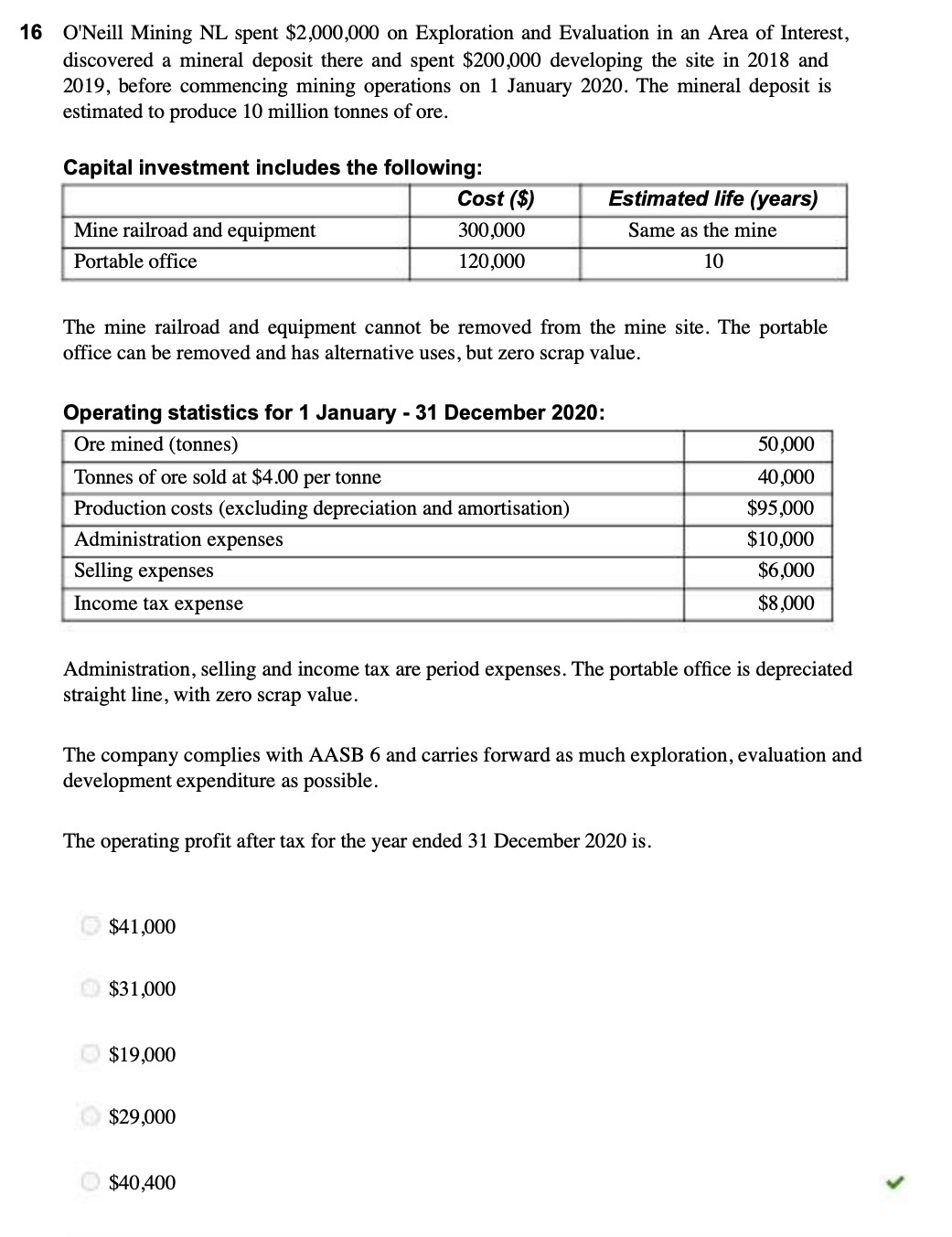

16 O'Neill Mining NL spent $2,000,000 on Exploration and Evaluation in an Area of Interest, discovered a mineral deposit there and spent $200,000 developing the site in 2018 and 2019, before commencing mining operations on 1 January 2020. The mineral deposit is estimated to produce 10 million tonnes of ore. Capital investment includes the following: Mine railroad and equipment Portable office The mine railroad and equipment cannot be removed from the mine site. The portable office can be removed and has alternative uses, but zero scrap value. Operating statistics for 1 January - 31 December 2020: Ore mined (tonnes) Tonnes of ore sold at $4.00 per tonne Production costs (excluding depreciation and amortisation) Administration expenses Selling expenses Income tax expense Cost ($) 300,000 120,000 $41,000 Administration, selling and income tax are period expenses. The portable office is depreciated straight line, with zero scrap value. $31,000 The company complies with AASB 6 and carries forward as much exploration, evaluation and development expenditure as possible. The operating profit after tax for the year ended 31 December 2020 is. $19,000 Estimated life (years) Same as the mine 10 $29,000 $40,400 50,000 40,000 $95,000 $10,000 $6,000 $8,000

Step by Step Solution

★★★★★

3.41 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the operating profit after tax we need to determine the total expen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started