1-6 please

1-6 please

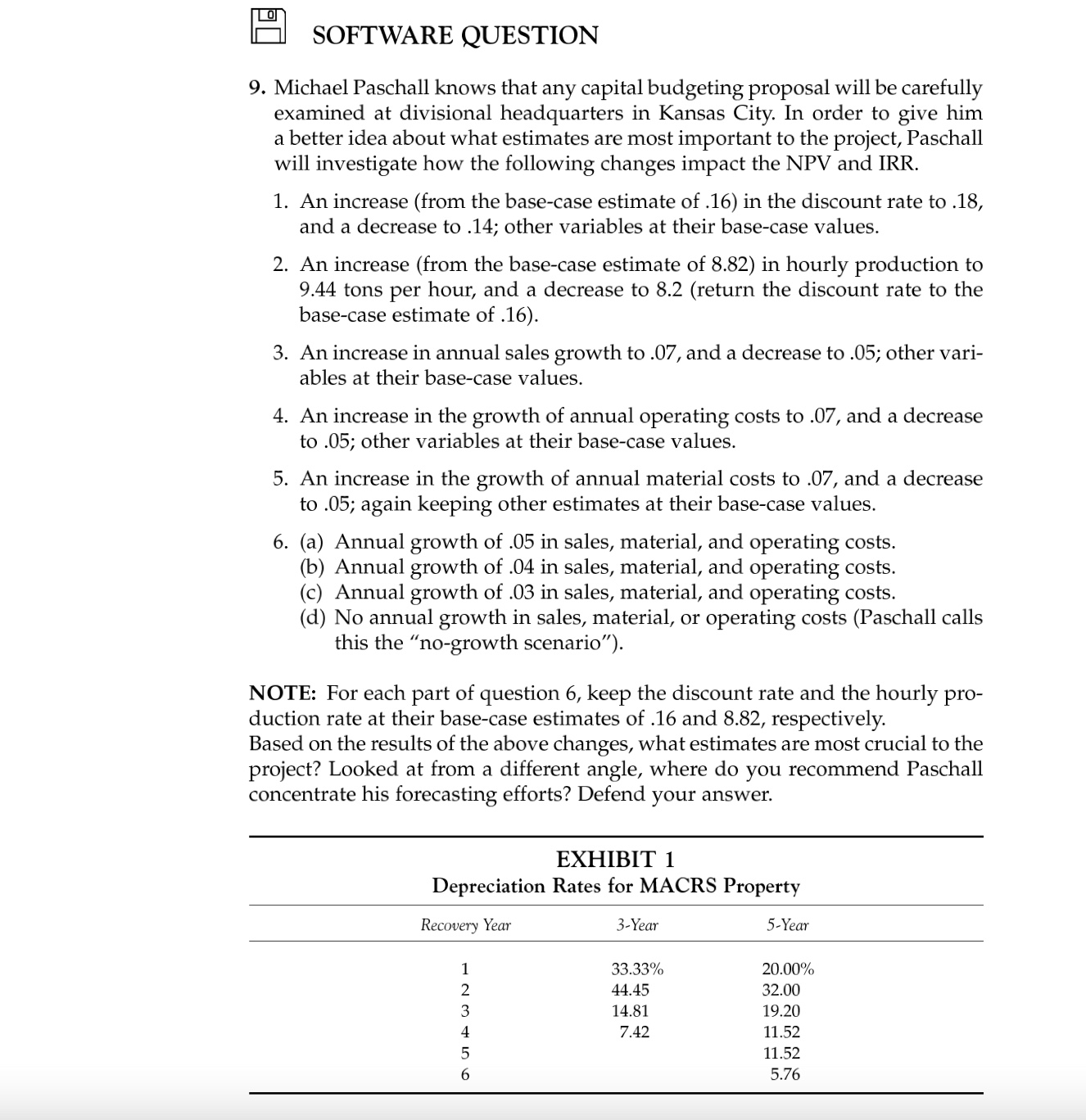

9. Michael Paschall knows that any capital budgeting proposal will be carefully examined at divisional headquarters in Kansas City. In order to give him a better idea about what estimates are most important to the project, Paschall will investigate how the following changes impact the NPV and IRR. 1. An increase (from the base-case estimate of .16) in the discount rate to .18, and a decrease to 14 ; other variables at their base-case values. 2. An increase (from the base-case estimate of 8.82) in hourly production to 9.44 tons per hour, and a decrease to 8.2 (return the discount rate to the base-case estimate of .16). 3. An increase in annual sales growth to .07, and a decrease to .05; other variables at their base-case values. 4. An increase in the growth of annual operating costs to .07, and a decrease to .05; other variables at their base-case values. 5. An increase in the growth of annual material costs to .07, and a decrease to .05; again keeping other estimates at their base-case values. 6. (a) Annual growth of .05 in sales, material, and operating costs. (b) Annual growth of .04 in sales, material, and operating costs. (c) Annual growth of .03 in sales, material, and operating costs. (d) No annual growth in sales, material, or operating costs (Paschall calls this the "no-growth scenario"). NOTE: For each part of question 6, keep the discount rate and the hourly production rate at their base-case estimates of .16 and 8.82, respectively. Based on the results of the above changes, what estimates are most crucial to the project? Looked at from a different angle, where do you recommend Paschall concentrate his forecasting efforts? Defend your answer. 9. Michael Paschall knows that any capital budgeting proposal will be carefully examined at divisional headquarters in Kansas City. In order to give him a better idea about what estimates are most important to the project, Paschall will investigate how the following changes impact the NPV and IRR. 1. An increase (from the base-case estimate of .16) in the discount rate to .18, and a decrease to 14 ; other variables at their base-case values. 2. An increase (from the base-case estimate of 8.82) in hourly production to 9.44 tons per hour, and a decrease to 8.2 (return the discount rate to the base-case estimate of .16). 3. An increase in annual sales growth to .07, and a decrease to .05; other variables at their base-case values. 4. An increase in the growth of annual operating costs to .07, and a decrease to .05; other variables at their base-case values. 5. An increase in the growth of annual material costs to .07, and a decrease to .05; again keeping other estimates at their base-case values. 6. (a) Annual growth of .05 in sales, material, and operating costs. (b) Annual growth of .04 in sales, material, and operating costs. (c) Annual growth of .03 in sales, material, and operating costs. (d) No annual growth in sales, material, or operating costs (Paschall calls this the "no-growth scenario"). NOTE: For each part of question 6, keep the discount rate and the hourly production rate at their base-case estimates of .16 and 8.82, respectively. Based on the results of the above changes, what estimates are most crucial to the project? Looked at from a different angle, where do you recommend Paschall concentrate his forecasting efforts? Defend your

1-6 please

1-6 please