#16 Please: In problem 14, suppose JCpenny slls for $8 per share immediately before your options expiration. What is the rate of return on your investment? What is the rate of return if the stock sells for $10 per share. Assume your holding period for this investment is exacly three months.

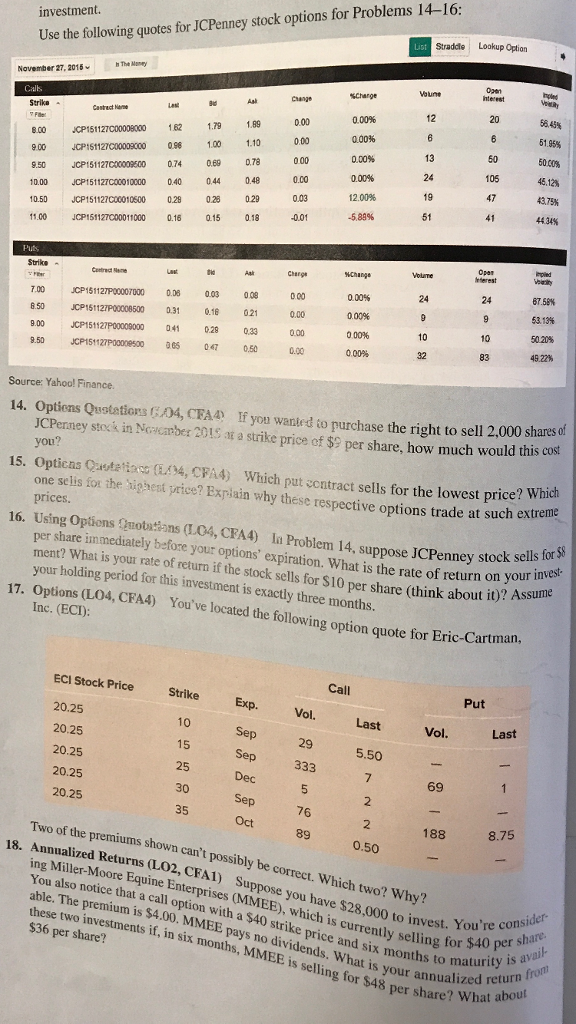

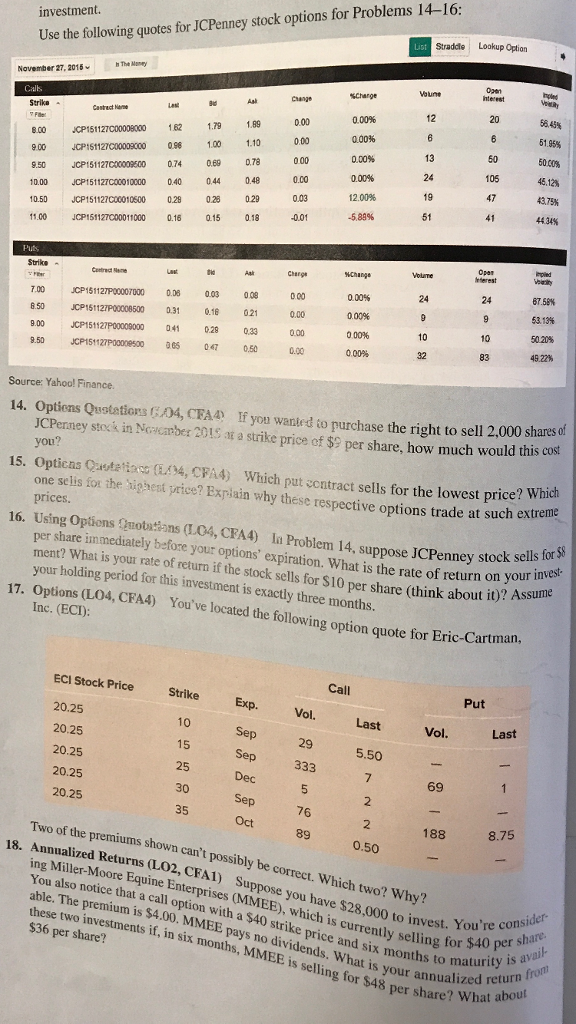

investment. Use the following quotes for JCPenney stock options for Problems 14-16: List Stradcle Lookup Option November 27, 2015. The Money Cals Open Voune Scharge strike Change Interest Castract Name 1.62 0.00% 1.89 1.89 1.79 1.79 1.00 56,45% 0.00% o 51.95% o 8 0.00% 079 8.00 9.00 9.50 10.00 10.50 11.00 JCP151127C00008000 06000 JCP151127C00009000 JCP151127C00009500 JCP151127C00010000 JCP151127C00010500 JCP151127C00011000 162 0.98 0.74 0.40 0.28 0.16 0.69 0.44 0.00 0.00 0.00 0.00 0.00 0.00 0.03 -0.01 50 C05 46.125 X 0.48 0.49 0.00% 8 0.44 0.28 12.00% o 43.79% 0.15 018 -5.899% 9 # 44 34% Puts, Strike - Certina Here * Fiber Aalt Charge Change Oper terest 7.00 6.50 Volume 24 24 JCP161127P00007000 JCP151127PQc000500 JCP151127P00000000 JCP151127P00000500 0.08 0.00 021 0.00 0.08 0.31 041 24 0.00 0.00 0.00 0.00% 0.00% 0.00% 0.00 0.03 0.18 0.28 047 67.58 53.13% 9.00 0.00 9.50 065 0.50 0.00% 0.00% 0.00 8 = 50 20% 45.22% Source: Yahoo! Finance. 14. Options Qustations C/04, CFA4) If you wanted to purchase the right to sell 2,000 shares o JCPenney stock in Newcarber 2015 at a strike price of $9 per share, how much would this cost you? 15. Opticas Cavtation A/34, CFA4) one sclis for the highest price? Explain why these respective options trade at such extrem Which put contract sells for the lowest price? W ?ri???. 16. Using Options Cuotations (L04, CFA4) Ia Problem 14, suppose JCPenney stock sell per share immediately before your options' expiration. What is the rate of return on your ment? What is your rate of return if the stock sells for $10 per share (think about it)! A your holding period for this investment is exactly three months. 17. Options (L04, CFA4) You've located the following option quote for Eric-Cartina JCPenney stock sells for $8 Share (think about it)? Assume Inc. (ECT): ECI Stock Price Strike Call 20.25 Put Vol. 10 Last Vol. 3 20.25 20.25 Exp. Sep Sep Dec Last 15 5.50 333 20.25 20.25 T 8 Sep 76 Oct 89 188 8.75 0.50 Two of the premiums shown can't possibly be correct. Which two? Why? valized Returns (L02, CFA1) Suppose you have $28,000 to invest. Yo ing Miller-Moore Equine Enterprises (MMEE), which is currently selling for 5 You also notice that a call option with a $40 strike price ble. The premium IS $4.00. MMEE pays no dividends. What a un these two investments if, in six months, MMEE is selling for $48 per share? W $36 per share? - price and six months to maturity vidends. What is your annualize annualized to invest. You're consider ng for $40 per share- ulurity is avail- Zed return front Fshare? What about