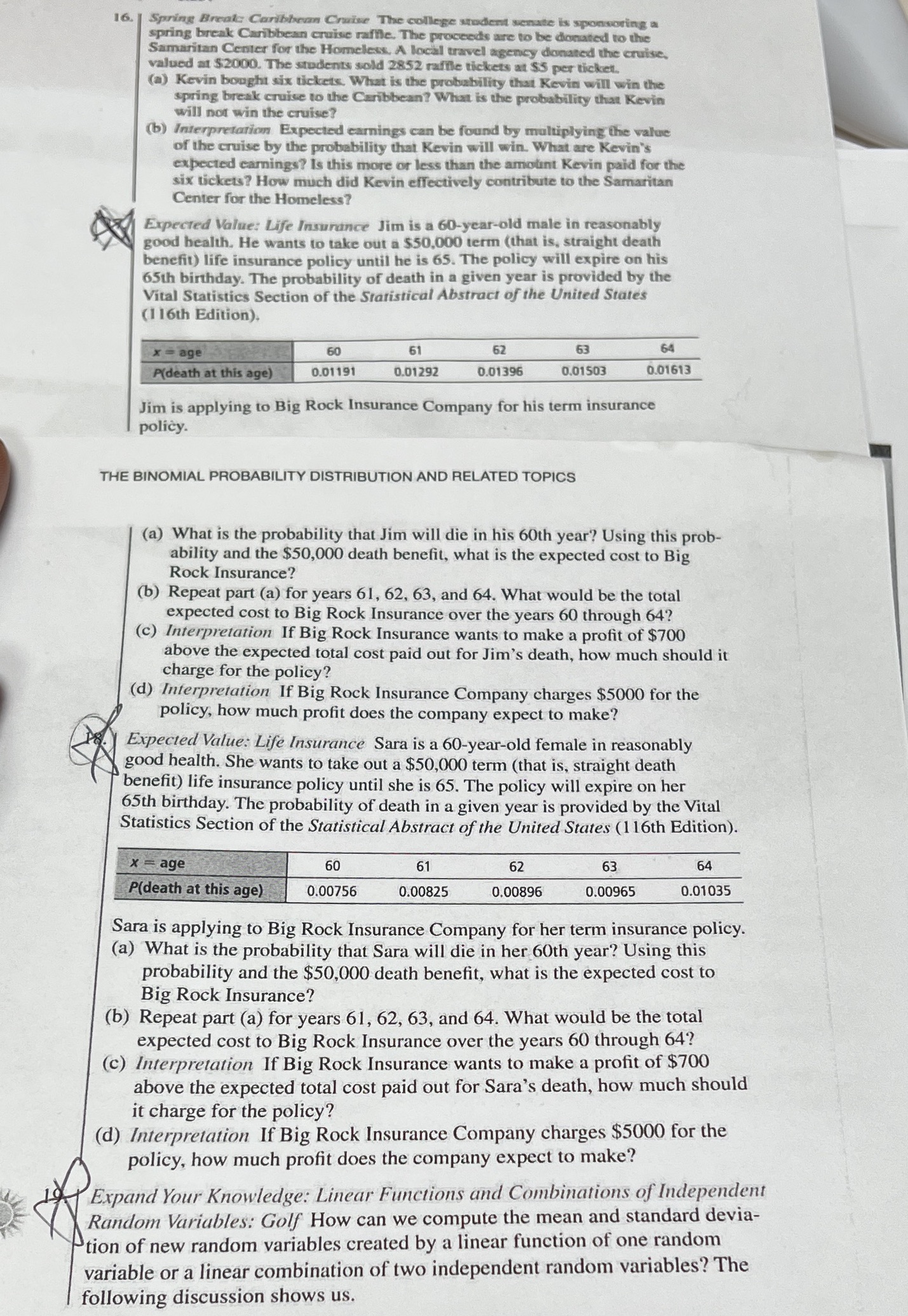

16. Spring Break Caribbean Cruise The college students nate is sponsoring a spring break Caribbean cruise raffle. The proceeds are to be donated to the Samaritan Center for the Homeless, A local travel agency donated the cruise. valued at $2000. The students sold 2852 raffle tickets at $5 per ticket. (a) Kevin bought six tickets. What is the probability that Kevin will win the spring break cruise to the Caribbean? What is the probability that Kevin will not win the cruise? (b) Interpretation Expected earnings can be found by multiplying the value of the cruise by the probability that Kevin will win. What are Kevin's expected earnings? Is this more or less than the amount Kevin paid for the six tickets? How much did Kevin effectively contribute to the Samaritan Center for the Homeless? Expected Value: Life Insurance Jim is a 60-year-old male in reasonably good health. He wants to take out a $50,000 term (that is. straight death benefit) life insurance policy until he is 65. The policy will expire on his 65th birthday. The probability of death in a given year is provided by the Vital Statistics Section of the Statistical Abstract of the United States (1 16th Edition). x = age 60 61 62 63 64 P(death at this age) 0.01191 0.01292 0.01396 0.01503 0.01613 Jim is applying to Big Rock Insurance Company for his term insurance policy. THE BINOMIAL PROBABILITY DISTRIBUTION AND RELATED TOPICS (a) What is the probability that Jim will die in his 60th year? Using this prob- ability and the $50,000 death benefit, what is the expected cost to Big Rock Insurance? (b) Repeat part (a) for years 61, 62, 63, and 64. What would be the total expected cost to Big Rock Insurance over the years 60 through 64? (c) Interpretation If Big Rock Insurance wants to make a profit of $700 above the expected total cost paid out for Jim's death, how much should it charge for the policy? d) Interpretation If Big Rock Insurance Company charges $5000 for the policy, how much profit does the company expect to make? Expected Value: Life Insurance Sara is a 60-year-old female in reasonably good health. She wants to take out a $50,000 term (that is, straight death benefit) life insurance policy until she is 65. The policy will expire on her 65th birthday. The probability of death in a given year is provided by the Vital Statistics Section of the Statistical Abstract of the United States (1 16th Edition). x = age 60 61 62 63 64 P(death at this age) 0.00756 0.00825 0.00896 0.00965 0.01035 Sara is applying to Big Rock Insurance Company for her term insurance policy. (a) What is the probability that Sara will die in her 60th year? Using this probability and the $50,000 death benefit, what is the expected cost to Big Rock Insurance? (b) Repeat part (a) for years 61, 62, 63, and 64. What would be the total expected cost to Big Rock Insurance over the years 60 through 64? (c) Interpretation If Big Rock Insurance wants to make a profit of $700 above the expected total cost paid out for Sara's death, how much should it charge for the policy? (d) Interpretation If Big Rock Insurance Company charges $5000 for the policy, how much profit does the company expect to make? Expand Your Knowledge: Linear Functions and Combinations of Independent Random Variables: Golf How can we compute the mean and standard devia- tion of new random variables created by a linear function of one random variable or a linear combination of two independent random variables? The following discussion shows us