Answered step by step

Verified Expert Solution

Question

1 Approved Answer

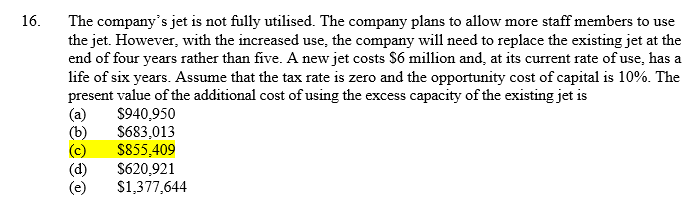

16. The companys jet is not fully utilised. The company plans to allow more staff members to use the jet. However, with the increased use,

16. The companys jet is not fully utilised. The company plans to allow more staff members to use the jet. However, with the increased use, the company will need to replace the existing jet at the end of four years rather than five. A new jet costs $6 million and, at its current rate of use, has a life of six years. Assume that the tax rate is zero and the opportunity cost of capital is 10%. The present value of the additional cost of using the excess capacity of the existing jet is:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started