Question

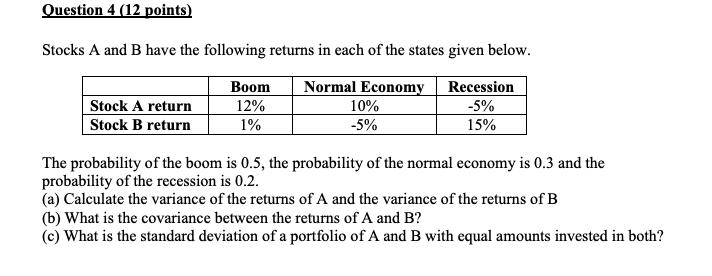

Question 4 (12 points) Stocks A and B have the following returns in each of the states given below. Boom Normal Economy Recession 12%

Question 4 (12 points) Stocks A and B have the following returns in each of the states given below. Boom Normal Economy Recession 12% -5% 1% 15% Stock A return Stock B return 10% -5% The probability of the boom is 0.5, the probability of the normal economy is 0.3 and the probability of the recession is 0.2. (a) Calculate the variance of the returns of A and the variance of the returns of B (b) What is the covariance between the returns of A and B? (c) What is the standard deviation of a portfolio of A and B with equal amounts invested in both?

Step by Step Solution

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a 1220510203520213 120552031520255 b 1205100350263 105503150267 c 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Macroeconomics

Authors: Stephen d. Williamson

5th edition

132991330, 978-0132991339

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App