16. You get a 20-year $600,000 mortgage loan at 7.5% interest. Use your financial calculator to determine your monthly payment. Then, assuming your first

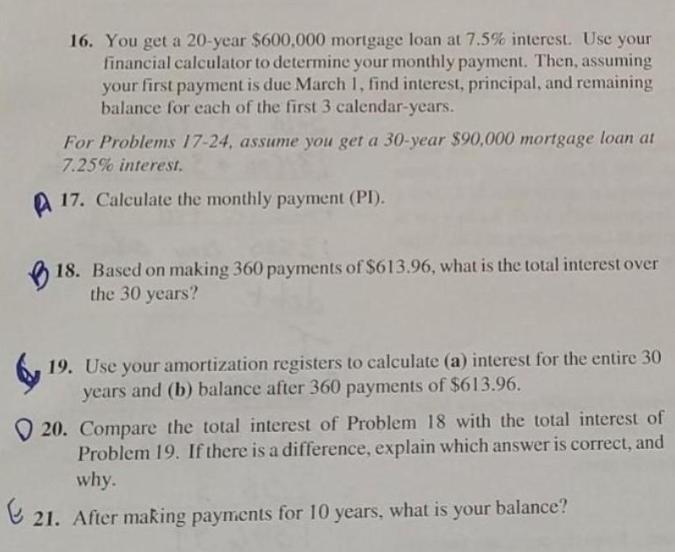

16. You get a 20-year $600,000 mortgage loan at 7.5% interest. Use your financial calculator to determine your monthly payment. Then, assuming your first payment is due March 1, find interest, principal, and remaining balance for each of the first 3 calendar-years. For Problems 17-24, assume you get a 30-year $90,000 mortgage loan at 7.25% interest. A 17. 17. Calculate the monthly payment (PI). 18. Based on making 360 payments of $613.96, what is the total interest over the 30 years? 19. Use your amortization registers to calculate (a) interest for the entire 30 years and (b) balance after 360 payments of $613.96. 20. Compare the total interest of Problem 18 with the total interest of Problem 19. If there is a difference, explain which answer is correct, and why. 21. After making payments for 10 years, what is your balance?

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Ill calculate the monthly payment interest principal and remaining balance for each of the first three calendar years for both the 20year 600000 mortg...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started