Answered step by step

Verified Expert Solution

Question

1 Approved Answer

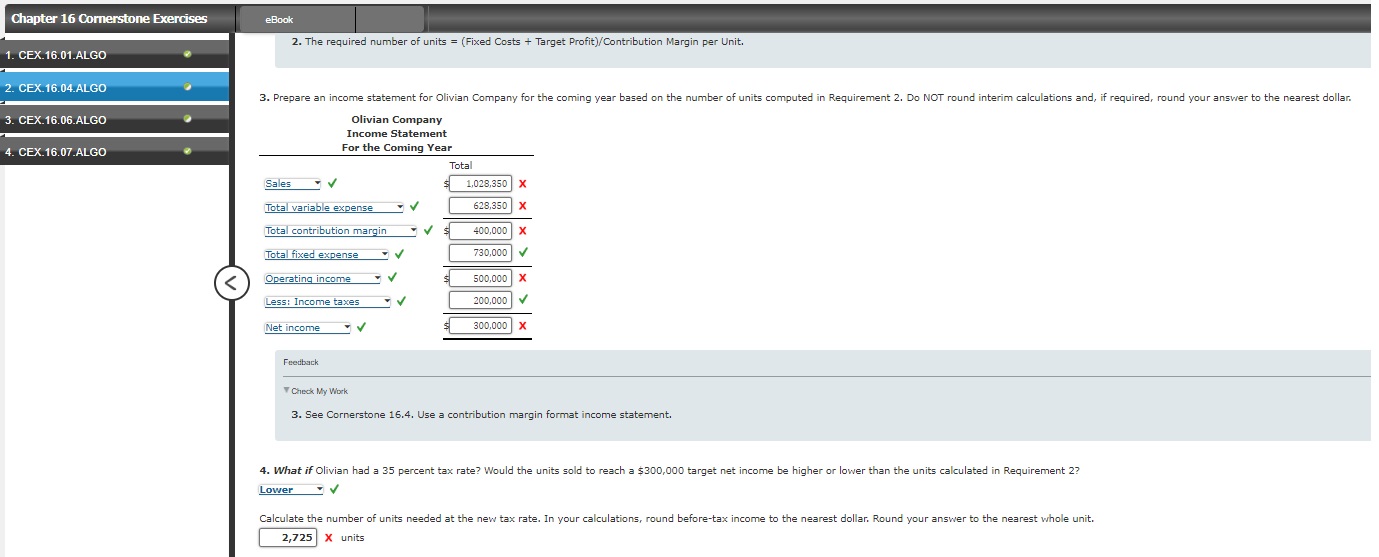

16-2-pt 2 V Check My Work 3. See Cornerstone 16.4 . Use a contribution margin format income statement. X units Variable selling expense is $14

16-2-pt 2

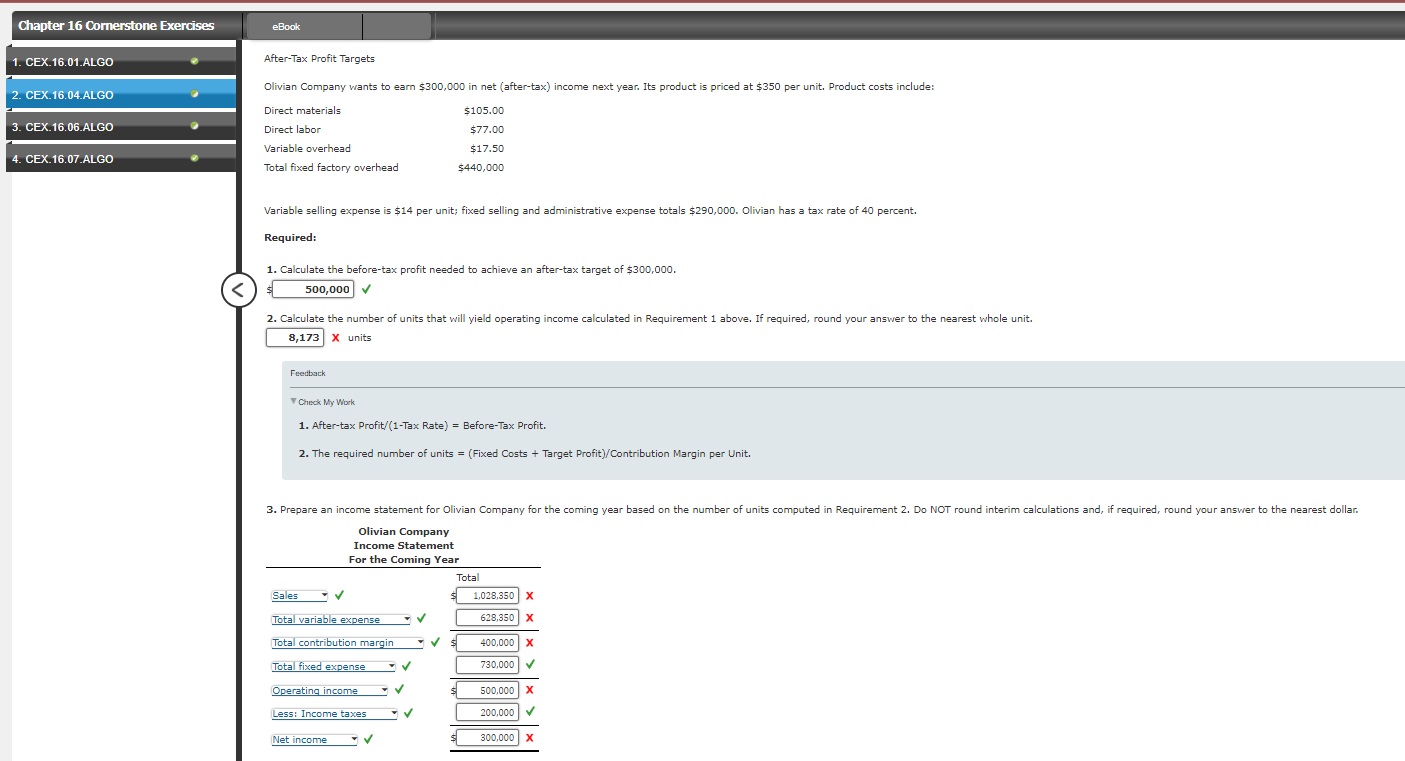

V Check My Work 3. See Cornerstone 16.4 . Use a contribution margin format income statement. X units Variable selling expense is $14 per unit; fixed selling and administrative expense totals $290,000. Olivian has a tax rate of 40 percent. Required: 1. Calculate the before-tax profit needed to achieve an after-tax target of $300,000. 2. Calculate the number of units that will yield operating income calculated in Requirement 1 above. If required, round your answer to the nearest whole unit. x units Feedback Check My Work 1. After-tax Profit/(1-Tax Rate) = Before-Tax Profit. 2. The required number of units = (Fixed Costs + Target Profit )/ Contribution Margin per UnitStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started