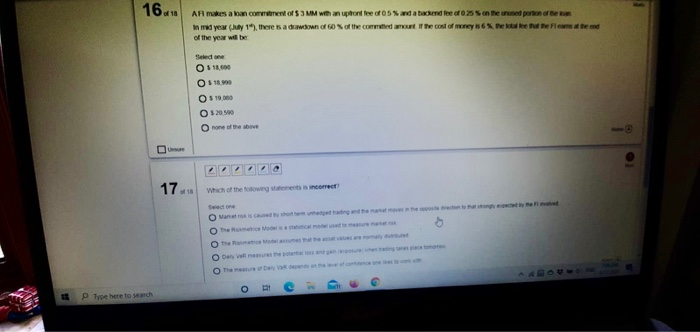

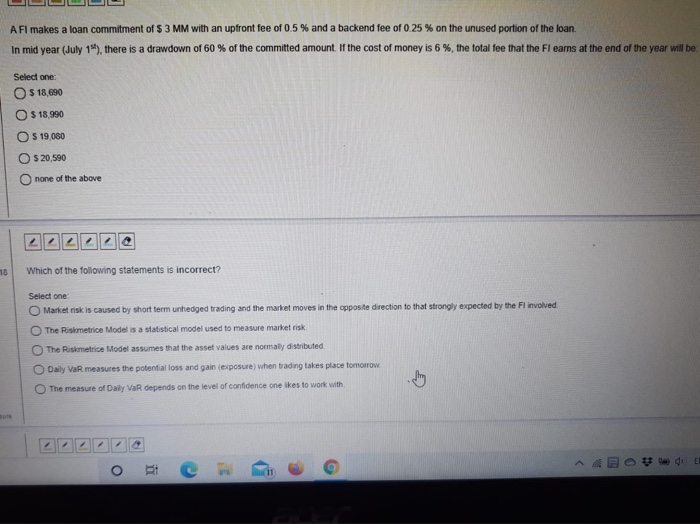

16.4 A makes a back of $3 MM with an uptont fee of 5% and a backend fee of 25 on the red person or in med year (July 19, there is a different if the cost of the eleme of the year will be Seed one O $1.000 O $18.990 O $19.000 $ 20500 one of the above 17 Which of the flowing sements is incorre Otherwise The Day O P Type here to search A FI makes a loan commitment of $ 3 MM with an upfront fee of 0.5 % and a backend fee of 0.25% on the unused portion of the loan In mid year (July 1), there is a drawdown of 60 % of the committed amount. If the cost of money is 6 %, the total fee that the Fl earns at the end of the year will be: Select one: $ 18,690 $ 18,990 $ 19,060 $ 20,590 none of the above 2 18 Which of the following statements is incorrect? Select one Market risk is caused by short term unhedged trading and the market moves in the opposite direction to that strongly expected by the Fl involved The Risometrice Model is a statistical model used to measure market risk. The Riskmetrice Model assumes that the asset values are normally distributed Daily VaR measures the potential loss and gain exposure) when trading takes place tomorrow The measure of Daily VaR depends on the level of confidence one likes to work with ED 16.4 A makes a back of $3 MM with an uptont fee of 5% and a backend fee of 25 on the red person or in med year (July 19, there is a different if the cost of the eleme of the year will be Seed one O $1.000 O $18.990 O $19.000 $ 20500 one of the above 17 Which of the flowing sements is incorre Otherwise The Day O P Type here to search A FI makes a loan commitment of $ 3 MM with an upfront fee of 0.5 % and a backend fee of 0.25% on the unused portion of the loan In mid year (July 1), there is a drawdown of 60 % of the committed amount. If the cost of money is 6 %, the total fee that the Fl earns at the end of the year will be: Select one: $ 18,690 $ 18,990 $ 19,060 $ 20,590 none of the above 2 18 Which of the following statements is incorrect? Select one Market risk is caused by short term unhedged trading and the market moves in the opposite direction to that strongly expected by the Fl involved The Risometrice Model is a statistical model used to measure market risk. The Riskmetrice Model assumes that the asset values are normally distributed Daily VaR measures the potential loss and gain exposure) when trading takes place tomorrow The measure of Daily VaR depends on the level of confidence one likes to work with ED