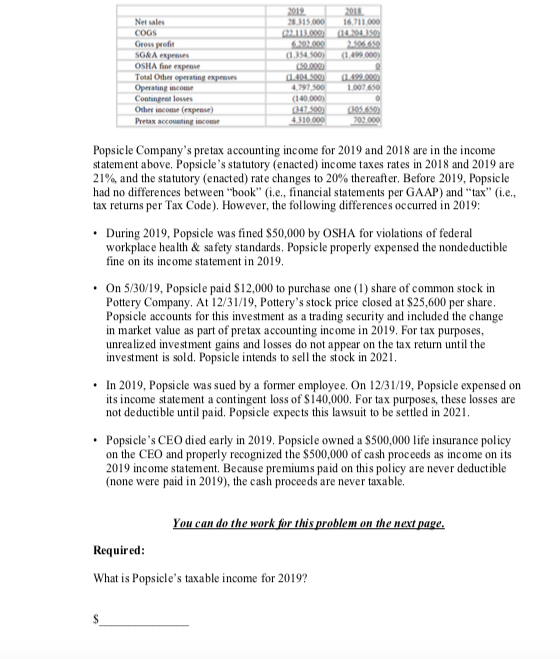

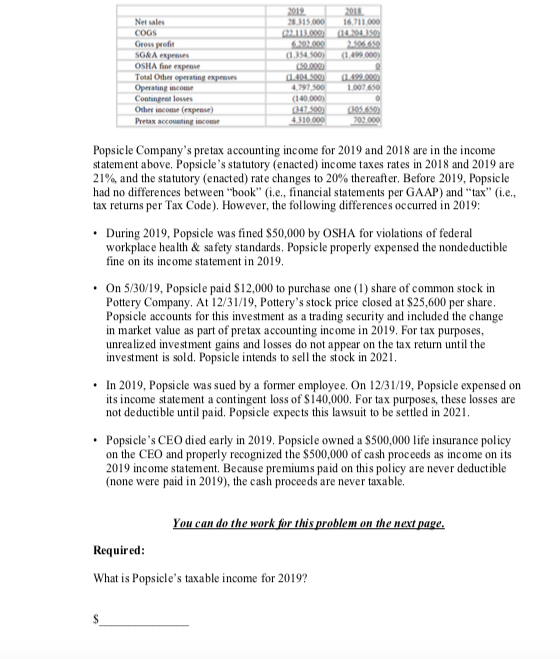

16711 01040 Net COGS Go profit SORA OSHA Toulon (1154 (1 1 007 650 4797.500 (140.000 Colow One) Pa 055 4310 000 Popsicle Company's pretax accounting income for 2019 and 2018 are in the income statement above. Popsicle's statutory (enacted) income taxes rates in 2018 and 2019 are 21% and the statutory (enacted) rate changes to 20% thereafter. Before 2019, Popsicle had no differences between "book" (i.e., financial statements per GAAP) and "tax" (i... tax returns per Tax Code). However, the following differences occurred in 2019: During 2019, Popsicle was fined $50,000 by OSHA for violations of federal workplace health & safety standards, Popsicle properly expensed the nondeductible fine on its income statement in 2019, On 5/30/19, Popsicle paid $12,000 to purchase one (1) share of common stock in Pottery Company, At 12/31/19, Pottery's stock price closed at $25,600 per share, Popsicle accounts for this investment as a trading security and included the change in market value as part of pretax accounting income in 2019. For tax purposes, unrealized investment gains and losses do not appear on the tax return until the investment is sold. Popsicle intends to sell the stock in 2021. . In 2019, Popsicle was sued by a former employee. On 12/31/19, Popsicle expensed on its income statement a contingent loss of $140,000. For tax purposes, these losses are not deductible until paid. Popsicle expects this lawsuit to be settled in 2021. Popsicle's CEO died early in 2019. Popsicle owned a $500,000 life insurance policy on the CEO and properly recognized the $500,000 of cash proceeds as income on its 2019 income statement. Because premiums paid on this policy are never deductible (none were paid in 2019), the cash proceeds are never taxable. You can do the work for this problem on the next page. Required: What is Popsicle's taxable income for 2019? 16711 01040 Net COGS Go profit SORA OSHA Toulon (1154 (1 1 007 650 4797.500 (140.000 Colow One) Pa 055 4310 000 Popsicle Company's pretax accounting income for 2019 and 2018 are in the income statement above. Popsicle's statutory (enacted) income taxes rates in 2018 and 2019 are 21% and the statutory (enacted) rate changes to 20% thereafter. Before 2019, Popsicle had no differences between "book" (i.e., financial statements per GAAP) and "tax" (i... tax returns per Tax Code). However, the following differences occurred in 2019: During 2019, Popsicle was fined $50,000 by OSHA for violations of federal workplace health & safety standards, Popsicle properly expensed the nondeductible fine on its income statement in 2019, On 5/30/19, Popsicle paid $12,000 to purchase one (1) share of common stock in Pottery Company, At 12/31/19, Pottery's stock price closed at $25,600 per share, Popsicle accounts for this investment as a trading security and included the change in market value as part of pretax accounting income in 2019. For tax purposes, unrealized investment gains and losses do not appear on the tax return until the investment is sold. Popsicle intends to sell the stock in 2021. . In 2019, Popsicle was sued by a former employee. On 12/31/19, Popsicle expensed on its income statement a contingent loss of $140,000. For tax purposes, these losses are not deductible until paid. Popsicle expects this lawsuit to be settled in 2021. Popsicle's CEO died early in 2019. Popsicle owned a $500,000 life insurance policy on the CEO and properly recognized the $500,000 of cash proceeds as income on its 2019 income statement. Because premiums paid on this policy are never deductible (none were paid in 2019), the cash proceeds are never taxable. You can do the work for this problem on the next page. Required: What is Popsicle's taxable income for 2019