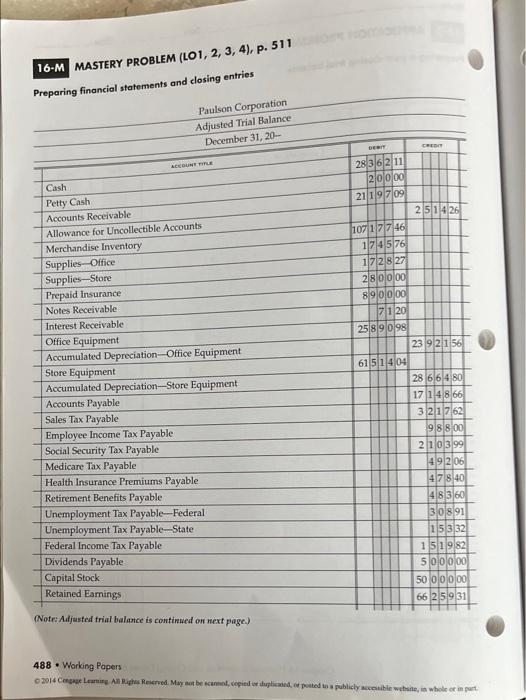

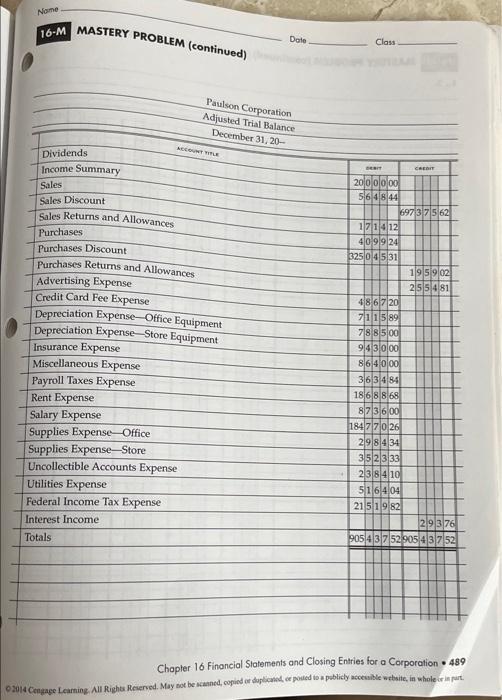

16-M Mastery Problem: Preparing financial statements and closing entries L01, 2, 3, 4 The adjusted trial balance for Paulson Corporation for the year ended December 31 of the current year and forms for completing this problem are given in the Working Papers. The beginning balance of Merchandise Inventory is $112,825.90. Instructions: 1. Prepare an income statement 2. Prepare a vertical analysis of each amount in the fourth amount column. Round percentage calculations to the nearest 0.1%. 3. Prepare a statement of stockholders' equity. The company had 4,500 shares of $10.00 par value stock outstanding on January 1. The company issued an additional 500 shares during the year. 4. Prepare a balance sheet for the current year. 5. Journalize the closing entries on page 19 of the general journal. Sage 50 Accounting 1. Journalize and post closing entries to the general journal. QR 1. Journalize and post adjusting entries to the 1. Key the account balances in the trial balance journal 2. Make the selections to print the balance sheet 2. Make the selections to print the balance sheet 2 Use the required formulas to calculate the section of the worksheet and income statement and the profit and loss statement. totals of the Trial Balance columns 3. Make the selections to print the general 3. Make the selections to print the journal and 3. Key the closing entries in the Adjustments journal and the post-closing trial balance. the post-closing trial balance. columns 4. Create the appropriate formulas to extend amounts to the income statement and balance sheet. 16-M Mastery Problem: Preparing financial statements and closing entries L01, 2, 3, 4 The adjusted trial balance for Paulson Corporation for the year ended December 31 of the current year and forms for completing this problem are given in the Working Papers. The beginning balance of Merchandise Inventory is $112,825.90. Instructions: 1. Prepare an income statement 2. Prepare a vertical analysis of each amount in the fourth amount column. Round percentage calculations to the nearest 0.1%. 3. Prepare a statement of stockholders' equity. The company had 4,500 shares of $10.00 par value stock outstanding on January 1. The company issued an additional 500 shares during the year. 4. Prepare a balance sheet for the current year. 5. Journalize the closing entries on page 19 of the general journal. Sage 50 Accounting 1. Journalize and post closing entries to the general journal. QR 1. Journalize and post adjusting entries to the 1. Key the account balances in the trial balance journal 2. Make the selections to print the balance sheet 2. Make the selections to print the balance sheet 2 Use the required formulas to calculate the section of the worksheet and income statement and the profit and loss statement. totals of the Trial Balance columns 3. Make the selections to print the general 3. Make the selections to print the journal and 3. Key the closing entries in the Adjustments journal and the post-closing trial balance. the post-closing trial balance. columns 4. Create the appropriate formulas to extend amounts to the income statement and balance sheet. 16-M MASTERY PROBLEM (LO1, 2, 3, 4), p. 511 Preparing financial statements and closing entries Paulson Corporation Adjusted Trial Balance December 31, 20- DET CHE ACCOUNT Cash Petty Cash Accounts Receivable Allowance for Uncollectible Accounts Merchandise Inventory Supplies Office Supplies-Store Prepaid Insurance Notes Receivable Interest Receivable Office Equipment Accumulated Depreciation--Office Equipment Store Equipment Accumulated Depreciation--Store Equipment Accounts Payable Sales Tax Payable Employee Income Tax Payable Social Security Tax Payable Medicare Tax Payable Health Insurance Premiums Payable Retirement Benefits Payable Unemployment Tax Payable--Federal Unemployment Tax Payable-State Federal Income Tax Payable Dividends Payable Capital Stock Retained Earnings 28 362 11 2 00 00 21/191709 2 51 426 107 177 46 1745 76 117 zis 27 28 oooo 8 9 00 00 171120 2589 098 239 2 156 6151404 28 66 4.80 171 4866 321 762 918 800 2 10399 492106 47 840 48360 30891 15332 1 519 82 slolololoo 50 OOO 00 66 25 9 31 (Note: Adjusted trial balance is continued on next page.) 488. Working Papers 2014 Cengage Long As Rags Reserved. May not be cal copied or duplicador ported to a publicly cible website is whole or in part Name 16-M MASTERY PROBLEM (continued) Date Class Paulson Corporation Adjusted Trial Balance December 31, 20- Dividends WTYLE Income Summary CREDIT Sales Sales Discount Sales Returns and Allowances Purchases Purchases Discount Purchases Returns and Allowances Advertising Expense Credit Card Fee Expense Depreciation Expense-Office Equipment Depreciation Expense-Store Equipment Insurance Expense Miscellaneous Expense Payroll Taxes Expense Rent Expense Salary Expense Supplies Expense-Office Supplies Expense-Store Uncollectible Accounts Expense Utilities Expense Federal Income Tax Expense Interest Income Totals 2010 olo oo 5648 44 697 3 7 562 1711412 409924 3250 45 31 195 902 2 554 81 486720 7 1 15.89 7 8 8 500 9/4/3 oloo 86 4 000 363484 1868 868 87 36.00 1847 710 26 29/8/4 34 3523 33 238410 5/16/404 21 5 1 9 82 29376 205 4 3 752 905 437 52 1 Chapter 16 Financial Statements and Closing Entries for a Corporation 489 2014 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated ce posted to publicly accesible website, in whole or in part 16-M Mastery Problem: Preparing financial statements and closing entries L01, 2, 3, 4 The adjusted trial balance for Paulson Corporation for the year ended December 31 of the current year and forms for completing this problem are given in the Working Papers. The beginning balance of Merchandise Inventory is $112,825.90. Instructions: 1. Prepare an income statement 2. Prepare a vertical analysis of each amount in the fourth amount column. Round percentage calculations to the nearest 0.1%. 3. Prepare a statement of stockholders' equity. The company had 4,500 shares of $10.00 par value stock outstanding on January 1. The company issued an additional 500 shares during the year. 4. Prepare a balance sheet for the current year. 5. Journalize the closing entries on page 19 of the general journal. Sage 50 Accounting 1. Journalize and post closing entries to the general journal. QR 1. Journalize and post adjusting entries to the 1. Key the account balances in the trial balance journal 2. Make the selections to print the balance sheet 2. Make the selections to print the balance sheet 2 Use the required formulas to calculate the section of the worksheet and income statement and the profit and loss statement. totals of the Trial Balance columns 3. Make the selections to print the general 3. Make the selections to print the journal and 3. Key the closing entries in the Adjustments journal and the post-closing trial balance. the post-closing trial balance. columns 4. Create the appropriate formulas to extend amounts to the income statement and balance sheet. 16-M Mastery Problem: Preparing financial statements and closing entries L01, 2, 3, 4 The adjusted trial balance for Paulson Corporation for the year ended December 31 of the current year and forms for completing this problem are given in the Working Papers. The beginning balance of Merchandise Inventory is $112,825.90. Instructions: 1. Prepare an income statement 2. Prepare a vertical analysis of each amount in the fourth amount column. Round percentage calculations to the nearest 0.1%. 3. Prepare a statement of stockholders' equity. The company had 4,500 shares of $10.00 par value stock outstanding on January 1. The company issued an additional 500 shares during the year. 4. Prepare a balance sheet for the current year. 5. Journalize the closing entries on page 19 of the general journal. Sage 50 Accounting 1. Journalize and post closing entries to the general journal. QR 1. Journalize and post adjusting entries to the 1. Key the account balances in the trial balance journal 2. Make the selections to print the balance sheet 2. Make the selections to print the balance sheet 2 Use the required formulas to calculate the section of the worksheet and income statement and the profit and loss statement. totals of the Trial Balance columns 3. Make the selections to print the general 3. Make the selections to print the journal and 3. Key the closing entries in the Adjustments journal and the post-closing trial balance. the post-closing trial balance. columns 4. Create the appropriate formulas to extend amounts to the income statement and balance sheet. 16-M MASTERY PROBLEM (LO1, 2, 3, 4), p. 511 Preparing financial statements and closing entries Paulson Corporation Adjusted Trial Balance December 31, 20- DET CHE ACCOUNT Cash Petty Cash Accounts Receivable Allowance for Uncollectible Accounts Merchandise Inventory Supplies Office Supplies-Store Prepaid Insurance Notes Receivable Interest Receivable Office Equipment Accumulated Depreciation--Office Equipment Store Equipment Accumulated Depreciation--Store Equipment Accounts Payable Sales Tax Payable Employee Income Tax Payable Social Security Tax Payable Medicare Tax Payable Health Insurance Premiums Payable Retirement Benefits Payable Unemployment Tax Payable--Federal Unemployment Tax Payable-State Federal Income Tax Payable Dividends Payable Capital Stock Retained Earnings 28 362 11 2 00 00 21/191709 2 51 426 107 177 46 1745 76 117 zis 27 28 oooo 8 9 00 00 171120 2589 098 239 2 156 6151404 28 66 4.80 171 4866 321 762 918 800 2 10399 492106 47 840 48360 30891 15332 1 519 82 slolololoo 50 OOO 00 66 25 9 31 (Note: Adjusted trial balance is continued on next page.) 488. Working Papers 2014 Cengage Long As Rags Reserved. May not be cal copied or duplicador ported to a publicly cible website is whole or in part Name 16-M MASTERY PROBLEM (continued) Date Class Paulson Corporation Adjusted Trial Balance December 31, 20- Dividends WTYLE Income Summary CREDIT Sales Sales Discount Sales Returns and Allowances Purchases Purchases Discount Purchases Returns and Allowances Advertising Expense Credit Card Fee Expense Depreciation Expense-Office Equipment Depreciation Expense-Store Equipment Insurance Expense Miscellaneous Expense Payroll Taxes Expense Rent Expense Salary Expense Supplies Expense-Office Supplies Expense-Store Uncollectible Accounts Expense Utilities Expense Federal Income Tax Expense Interest Income Totals 2010 olo oo 5648 44 697 3 7 562 1711412 409924 3250 45 31 195 902 2 554 81 486720 7 1 15.89 7 8 8 500 9/4/3 oloo 86 4 000 363484 1868 868 87 36.00 1847 710 26 29/8/4 34 3523 33 238410 5/16/404 21 5 1 9 82 29376 205 4 3 752 905 437 52 1 Chapter 16 Financial Statements and Closing Entries for a Corporation 489 2014 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated ce posted to publicly accesible website, in whole or in part