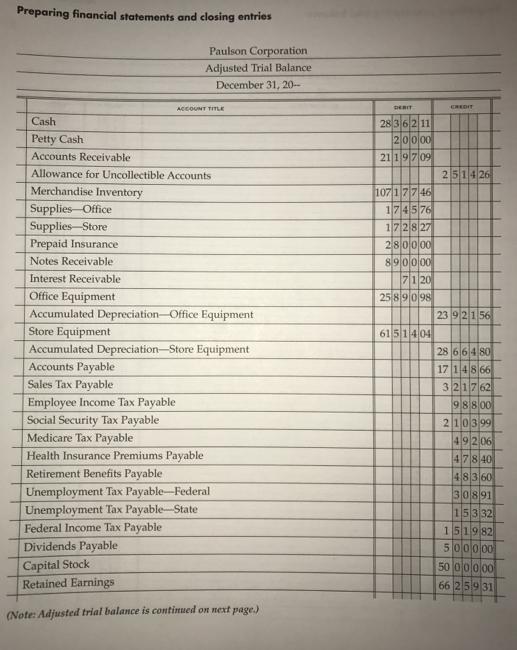

Question: ? ? Preparing financial statements and closing entries Paulson Corporation Adjusted Trial Balance December 31, 20- DERIT CREDIT ACCOUNT TTLE Cash 28 3 6 211

?

?

?

?

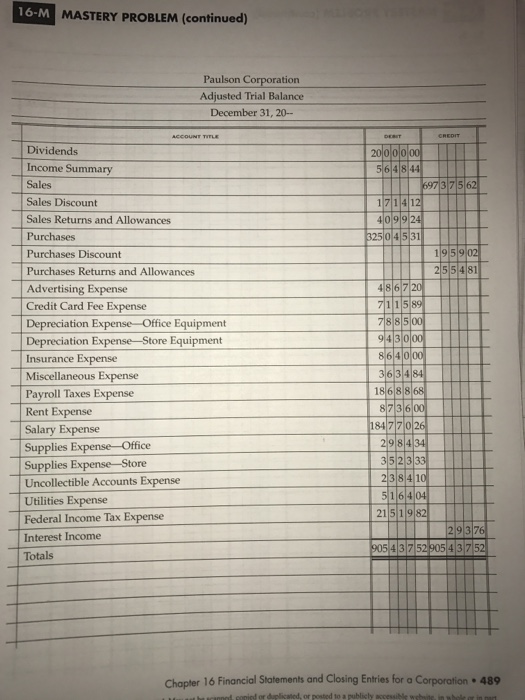

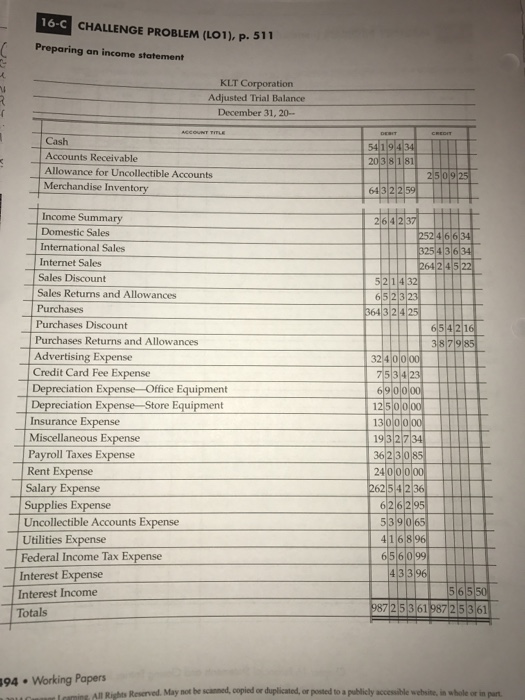

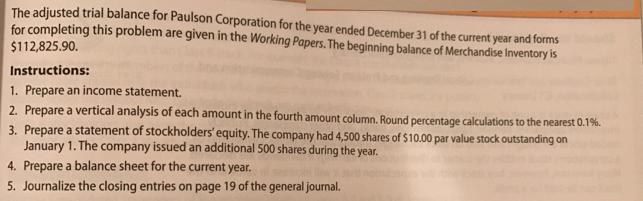

Preparing financial statements and closing entries Paulson Corporation Adjusted Trial Balance December 31, 20- DERIT CREDIT ACCOUNT TTLE Cash 28 3 6 211 Petty Cash 1200 Accounts Receivable 2119709 Allowance for Uncollectible Accounts 251426 Merchandise Inventory 107 17746 Supplies-Office Supplies-Store 1745 76 172827 Prepaid Insurance 280000 Notes Receivable 890000 Interest Receivable 7120 Office Equipment Accumulated Depreciation-Office Equipment 25 8 9 098 23 9 2156 Store Equipment Accumulated Depreciation-Store Equipment Accounts Payable 6151404 28 664 80 17 148 66 Sales Tax Payable 321762 Employee Income Tax Payable Social Security Tax Payable Medicare Tax Payable 988 00 2103 99 49 206 Health Insurance Premiums Payable 47840 48360 Retirement Benefits Payable Unemployment Tax Payable-Federal Unemployment Tax Payable-State Federal Income Tax Payable Dividends Payable 30891 15332 151982 5000 00 Capital Stock 50 oolol00 Retained Earnings 66 259 31 (Note: Adjusted trial balance is continued on next page.) 16-M MASTERY PROBLEM (continued) Paulson Corporation Adjusted Trial Balance December 31, 20- ACCOUNT TITLE DEBIT CREDIT Dividends 20000 00 Income Summary 564844 Sales 697 3 7562 Sales Discount 171412 Sales Returns and Allowances 4099 24 Purchases 325 0 4531 1959 02 255481 Purchases Discount Purchases Returns and Allowances Advertising Expense 4867 20 711589 788500 Credit Card Fee Expense Depreciation Expense Office Equipment Depreciation Expense-Store Equipment Insurance Expense 943000 864000 Miscellaneous Expense 363484 Payroll Taxes Expense 18 688 68 Rent Expense 873600 Salary Expense 184 7 70 26 Supplies Expense- Office Supplies Expense-Store Uncollectible Accounts Expense Utilities Expense Federal Income Tax Expense 298434 352333 238 4 10 5164 04 2151982 29376 Interest Income 905 43752 905 43752 Totals Chapter 16 Financial Statements and Closing Entries for a Corporation 489 anned conied or duplicated, or posted to a publicly accessible 16-C CHALLENGE PROBLEM (LO1), p. 511 Preparing an income statement KLT Corporation Adjusted Trial Balance December 31, 20- ACCOUNT TITLE DEBIT CREDIT Cash 5419434 2038181 Accounts Receivable Allowance for Uncollectible Accounts 2509 25 Merchandise Inventory 64 32259 Income Summary 264237 Domestic Sales 252 4 66 34 International Sales 325 4 3634 Internet Sales 264 2 45 22 Sales Discount 521432 652323 364 3 24 25 Sales Returns and Allowances Purchases Purchases Discount 65 4216 3879 85 Purchases Returns and Allowances Advertising Expense Credit Card Fee Expense 32 4 0000 7534 23 Depreciation Expense-Office Equipment Depreciation Expense-Store Equipment Insurance Expense 69 0000 1250000 13000 00 Miscellaneous Expense Payroll Taxes Expense 193 2734 36 23085 Rent Expense 2400000 Salary Expense Supplies Expense 2625 4236 626295 Uncollectible Accounts Expense 539065 4168 96 Utilities Expense Federal Income Tax Expense Interest Expense 6560 99 43396 Interest Income 56550 Totals 987 61 987 25361 194 Working Papers lemine, All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. The adjusted trial balance for Paulson Corporation for the year ended December 31 of the current year and forms for completing this problem are given in the Working Papers. The beginning balance of Merchandise Inventory is $112,825.90. Instructions: 1. Prepare an income statement. 2. Prepare a vertical analysis of each amount in the fourth amount column. Round percentage calculations to the nearest 0.1%. 3. Prepare a statement of stockholders' equity. The company had 4,500 shares of $10.00 par value stock outstanding on January 1. The company issued an additional 500 shares during the year. 4. Prepare a balance sheet for the current year. 5. Journalize the closing entries on page 19 of the general journal.

Step by Step Solution

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Solution to the Given Instructions Based on the Adjusted Trial Balance of Paulson Corporation 1 Prepare an Income Statement The income statement reports revenues and expenses for the year leading to t... View full answer

Get step-by-step solutions from verified subject matter experts