Answered step by step

Verified Expert Solution

Question

1 Approved Answer

17, 16 question please help me Question 17 6 pts On December 31, 20XO, Probert Corp. has 1,200,000 shares authorized to issue. On January 1,

17, 16 question please help me

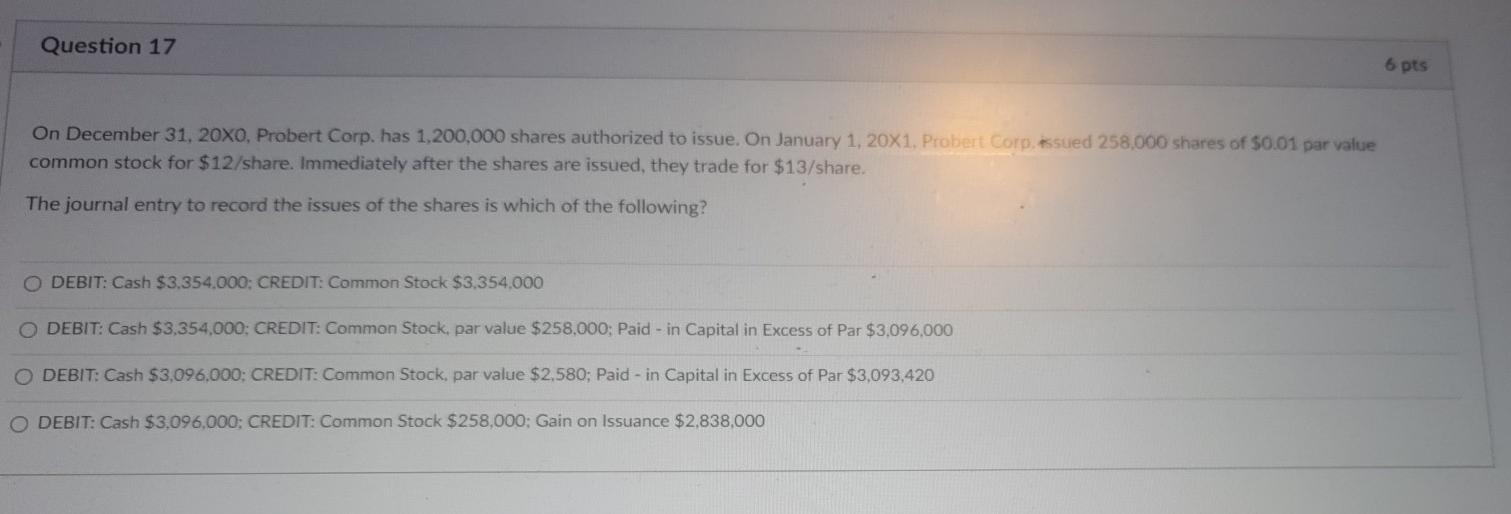

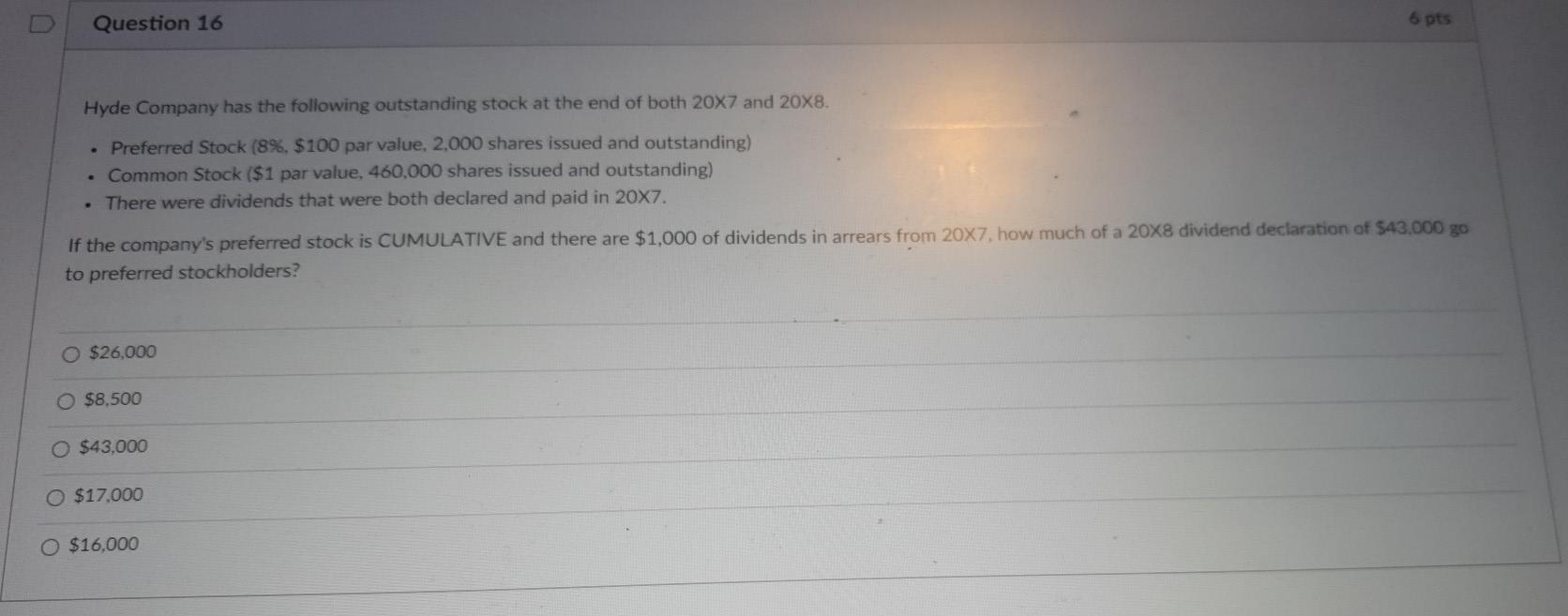

Question 17 6 pts On December 31, 20XO, Probert Corp. has 1,200,000 shares authorized to issue. On January 1, 20X1. Probert Corp. issued 258,000 shares of $0.01 par value common stock for $12/share. Immediately after the shares are issued, they trade for $13/share. The journal entry to record the issues of the shares is which of the following? O DEBIT: Cash $3.354,000: CREDIT: Common Stock $3,354.000 O DEBIT: Cash $3,354,000: CREDIT: Common Stock, par value $258.000; Paid - in Capital in Excess of Par $3,096,000 DEBIT: Cash $3,096,000: CREDIT: Common Stock, par value $2,580; Paid - in Capital in Excess of Par $3,093,420 O DEBIT: Cash $3,096,000: CREDIT: Common Stock $258,000: Gain on Issuance $2,838,000 Question 16 6 pts Hyde Company has the following outstanding stock at the end of both 20x7 and 20X8. Preferred Stock (8%. $100 par value, 2,000 shares issued and outstanding) Common Stock ($1 par value, 460,000 shares issued and outstanding) There were dividends that were both declared and paid in 20x7. If the company's preferred stock is CUMULATIVE and there are $1,000 of dividends in arrears from 20x7. how much of a 20X8 dividend declaration of $43.000 go to preferred stockholders? $26,000 $8.500 O $43,000 O $17.000 O $16,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started