Answered step by step

Verified Expert Solution

Question

1 Approved Answer

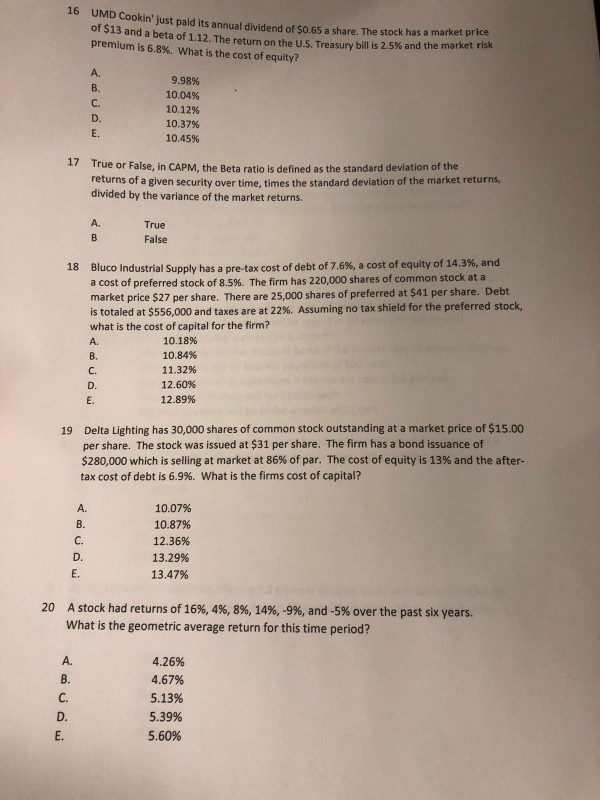

17, 18, 19 and 20 16 UMD Cookin' just paid its annual dividend of so. Just paid its annual dividend of $0.65 a share. The

17, 18, 19 and 20

16 UMD Cookin' just paid its annual dividend of so. Just paid its annual dividend of $0.65 a share. The stock has a market price 15 and a beta of 1.12. The return the US Treasury bill is 2.5% and the market premium is 6.8%. What is the cost of equity? 9.98% 10.04% 10.12% 10.37% 10.45% True or False, in CAPM, the Beta ratio is defined as the standard deviation of the returns of a given security over time, times the standard deviation of the market returns, divided by the variance of the market returns. True False 18 Bluco Industrial Supply has a pre-tax cost of debt of 7.6%, a cost of equity of 14.3%, and a cost of preferred stock of 8.5%. The firm has 220,000 shares of common stock at a market price $27 per share. There are 25.000 shares of preferred at $41 per share. Debt is totaled at $556,000 and taxes are at 22%. Assuming no tax shield for the preferred stock, what is the cost of capital for the firm? 10.18% 10.84% 11.32% 12.60% 12.89% 19 Delta Lighting has 30,000 shares of common stock outstanding at a market price of $15.00 per share. The stock was issued at $31 per share. The firm has a bond issuance of $280,000 which is selling at market at 86% of par. The cost of equity is 13% and the after- tax cost of debt is 6.9%. What is the firms cost of capital? 10.07% 10.87% 12.36% 13.29% 13.47% 20 A stock had returns of 16%, 4%, 8%, 14%, -9%, and -5% over the past six years. What is the geometric average return for this time period? 4.26% 4.67% 5.13% 5.39% 5.60%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started