Answered step by step

Verified Expert Solution

Question

1 Approved Answer

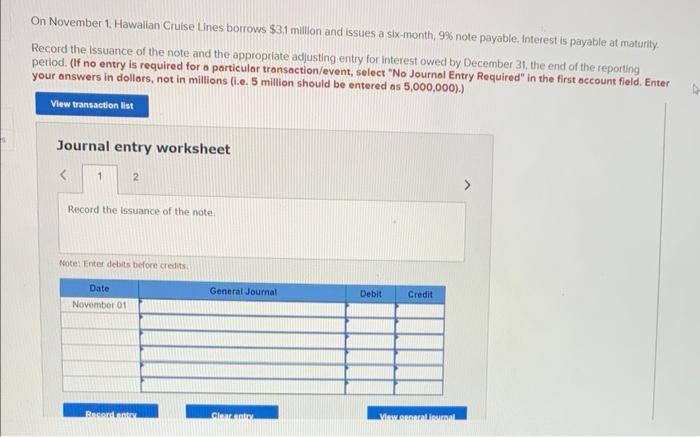

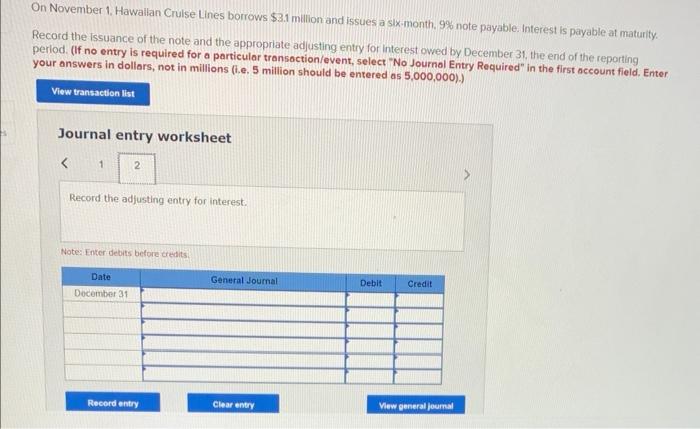

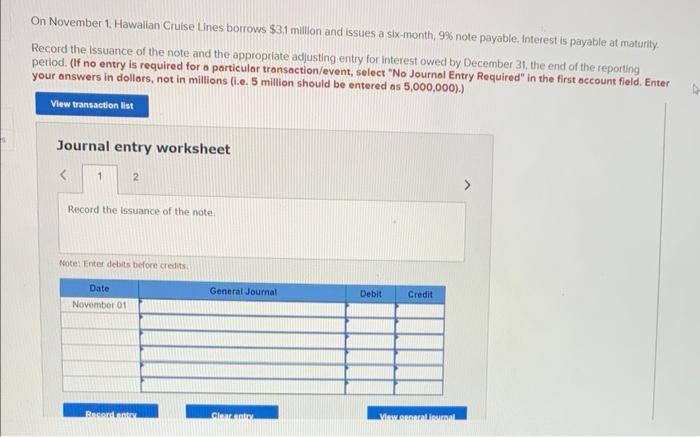

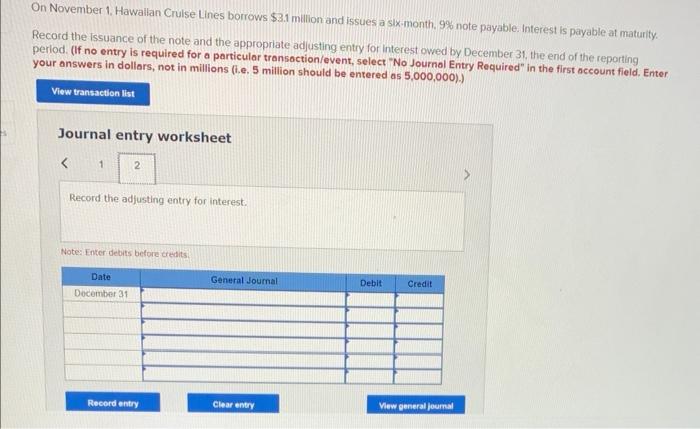

17) 18) On November 1. Hawallan Cruise Lines borrows $3.1 million and issues a six-month, 99 note payable. Interest is payable at maturity. Record the

17)

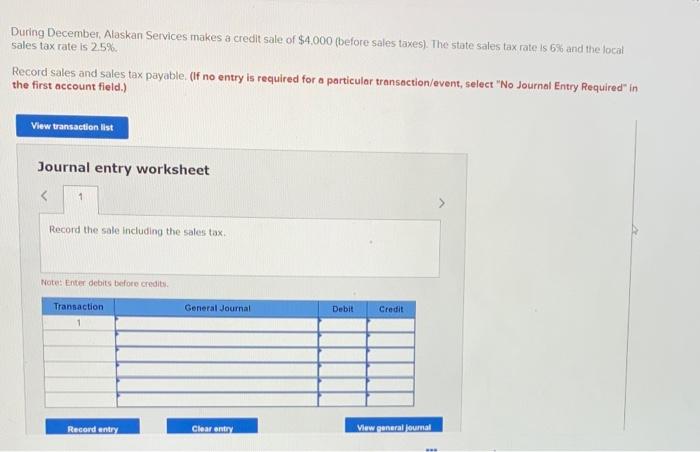

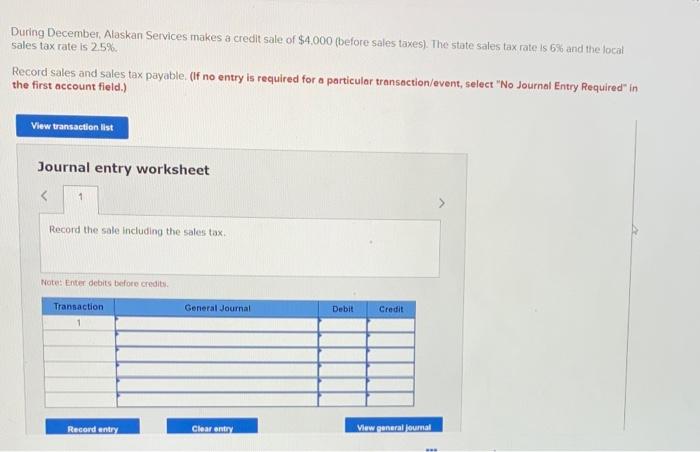

On November 1. Hawallan Cruise Lines borrows $3.1 million and issues a six-month, 99 note payable. Interest is payable at maturity. Record the Issuance of the note and the appropriate adjusting entry for interest owed by December 31, the end of the reporting period. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in dollors, not in millions (i.e. 5 million should be entered as 5,000,000) ).) Journal entry worksheet On November 1. Hawallan Crulse Lines borrows $3.1million and issues a six.month. 9% note payable. Interest is payable at maturity. Record the issuance of the note and the appropriate adjusting entry for interest oved by December 31 , the end of the reporting perlod. (If no entry is required for a particular transoction/event, select "No Journol Entry Required" in the first account field. Enter your answers in dollars, not in millions (i.e. 5 million should be entered a5 5,000,000 ).) Journal entry worksheet During December, Alaskan Services makes a credit sale of $4,000 (before sales taxes). The state sales tax rate is 6% and the local sales tax rate is 2.5%. Record sales and sales tax payable. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the sale including the sales tax. Tratet Enter debits before edity

18)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started