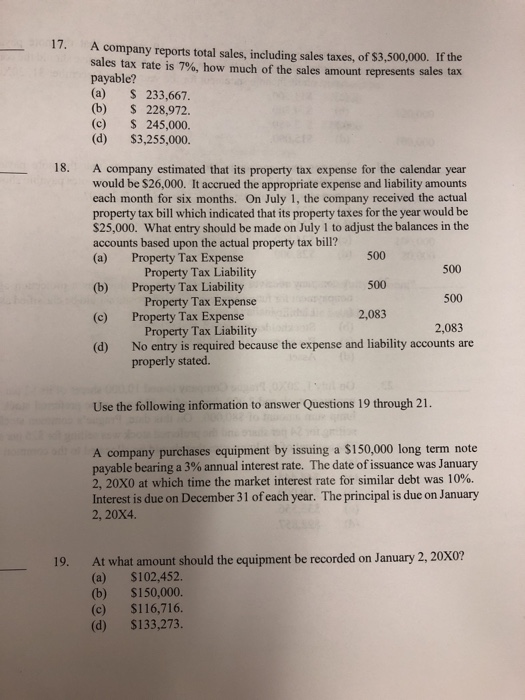

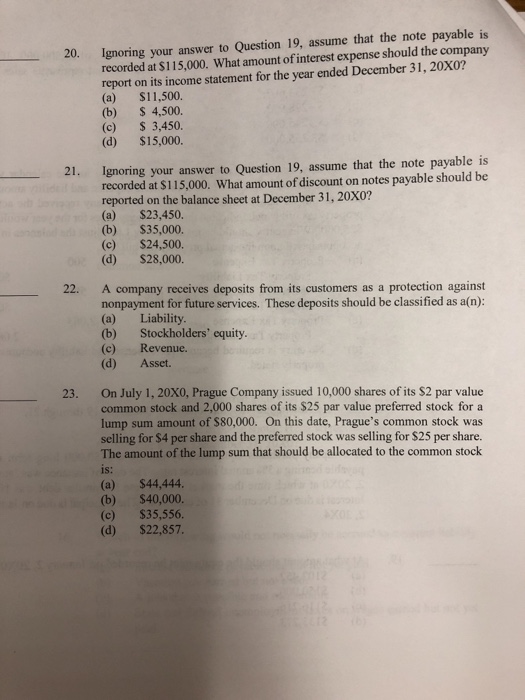

17. A company reports total sales, including sales taxes, of $3,500,000. If the sales tax rate is 7%, how much of the sales amount represents sales tax payable? (a) 233,667. (b) 228,972. (c) 245,000. (d) $3,255,000. 18. A company estimated that its property tax expense for the calendar year would be $26,000. It accrued the appropriate expense and liability amounts each month for six months. On July 1, the company received the actual property tax bill which indicated that its property taxes for the year would be $25,000. What entry should be made on July 1 to adjust the balances in the accounts based upon the actual property tax bill? (a) Property Tax Expense 500 500 2,083 500 Property Tax Liability Property Tax Liability (b) (c) (d) Property Tax Expense Property Tax Expense Property Tax Liability No entry is required because the expense and liability accounts are properly stated Use the following information to answer Questions 19 through 21. A company purchases equipment by issuing a $150,000 long term note payable bearing a 3% annual interest rate. The date of issuance was January 2, 20X0 at which time the market interest rate for similar debt was 10%. Interest is due on December 31 of each year. The principal is due on January 2, 20X4. At what amount should the equipment be recorded on January 2, 20x0? (a) $102,452. (b) $150,000. (c) $116,716. (d) $133,273. 19. 17. A company reports total sales, including sales taxes, of $3,500,000. If the sales tax rate is 7%, how much of the sales amount represents sales tax payable? (a) 233,667. (b) 228,972. (c) 245,000. (d) $3,255,000. 18. A company estimated that its property tax expense for the calendar year would be $26,000. It accrued the appropriate expense and liability amounts each month for six months. On July 1, the company received the actual property tax bill which indicated that its property taxes for the year would be $25,000. What entry should be made on July 1 to adjust the balances in the accounts based upon the actual property tax bill? (a) Property Tax Expense 500 500 2,083 500 Property Tax Liability Property Tax Liability (b) (c) (d) Property Tax Expense Property Tax Expense Property Tax Liability No entry is required because the expense and liability accounts are properly stated Use the following information to answer Questions 19 through 21. A company purchases equipment by issuing a $150,000 long term note payable bearing a 3% annual interest rate. The date of issuance was January 2, 20X0 at which time the market interest rate for similar debt was 10%. Interest is due on December 31 of each year. The principal is due on January 2, 20X4. At what amount should the equipment be recorded on January 2, 20x0? (a) $102,452. (b) $150,000. (c) $116,716. (d) $133,273. 19