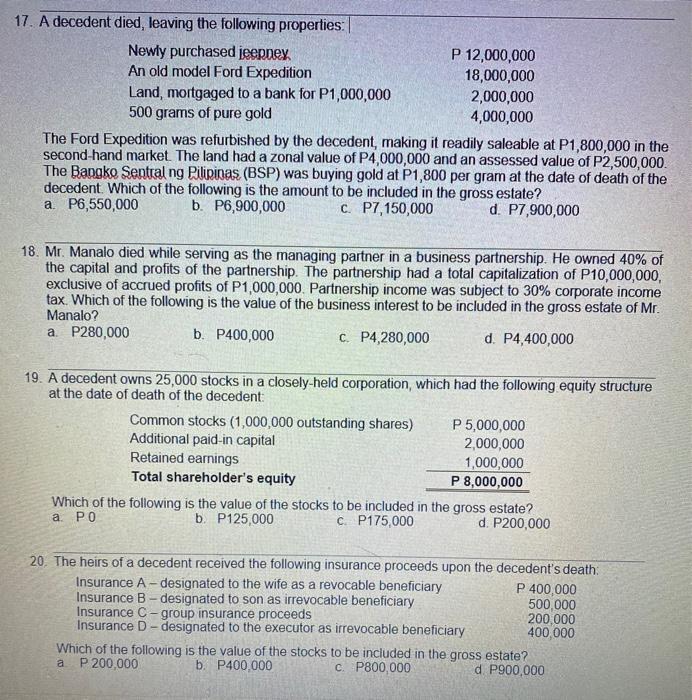

17. A decedent died, leaving the following properties: Newly purchased jeepney. P 12,000,000 An old model Ford Expedition 18,000,000 Land, mortgaged to a bank for P1,000,000 2,000,000 500 grams of pure gold 4,000,000 The Ford Expedition was refurbished by the decedent, making it readily saleable at P1,800,000 in the second-hand market. The land had a zonal value of P4,000,000 and an assessed value of P2,500,000 The Bangko Sentral ng Pilipinas (BSP) was buying gold at P1,800 per gram at the date of death of the decedent. Which of the following is the amount to be included in the gross estate? a P6,550,000 b. P6,900,000 C. P7,150,000 d. P7,900,000 18. Mr. Manalo died while serving as the managing partner in a business partnership. He owned 40% of the capital and profits of the partnership. The partnership had a total capitalization of P10,000,000, exclusive of accrued profits of P1,000,000. Partnership income was subject to 30% corporate income tax Which of the following is the value of the business interest to be included in the gross estate of Mr. Manalo? a. P280,000 b. P400,000 C. P4,280,000 d. P4,400,000 19. A decedent owns 25,000 stocks in a closely-held corporation, which had the following equity structure at the date of death of the decedent: Common stocks (1,000,000 outstanding shares) P5,000,000 Additional paid-in capital 2,000,000 Retained earnings 1,000,000 Total shareholder's equity P 8,000,000 Which of the following is the value of the stocks to be included in the gross estate? a. PO b. P125,000 C. P175,000 d. P200,000 20. The heirs of a decedent received the following insurance proceeds upon the decedent's death Insurance A-designated to the wife as a revocable beneficiary P 400,000 Insurance B - designated to son as irrevocable beneficiary 500,000 Insurance C - group insurance proceeds 200,000 Insurance D - designated to the executor as irrevocable beneficiary 400,000 Which of the following is the value of the stocks to be included in the gross estate? a P 200.000 b. P400.000 C. P800,000 d P900,000