Question

17! i need help asap with the CORRECT answers! After graduating from college with a bachelor of business administration, you begin an ambitious plan to

17! i need help asap with the CORRECT answers!

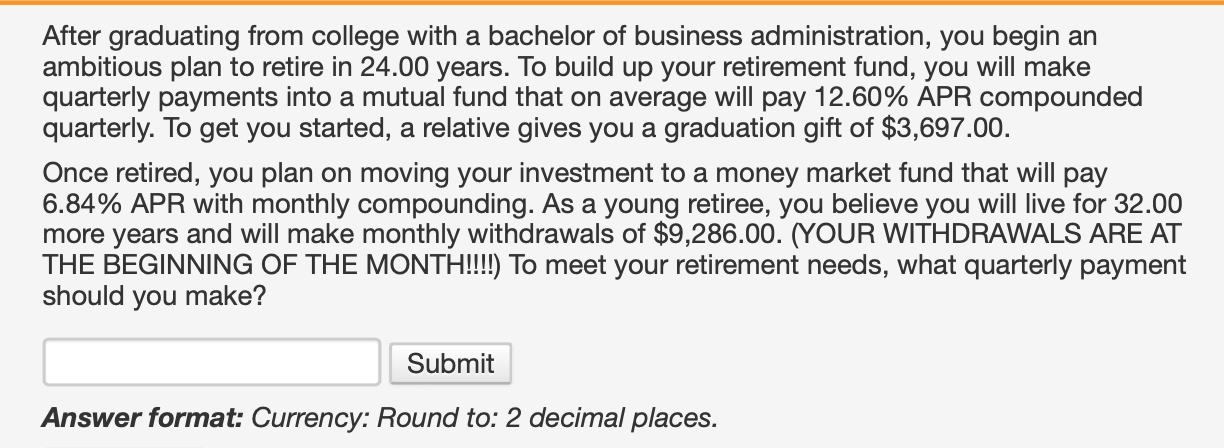

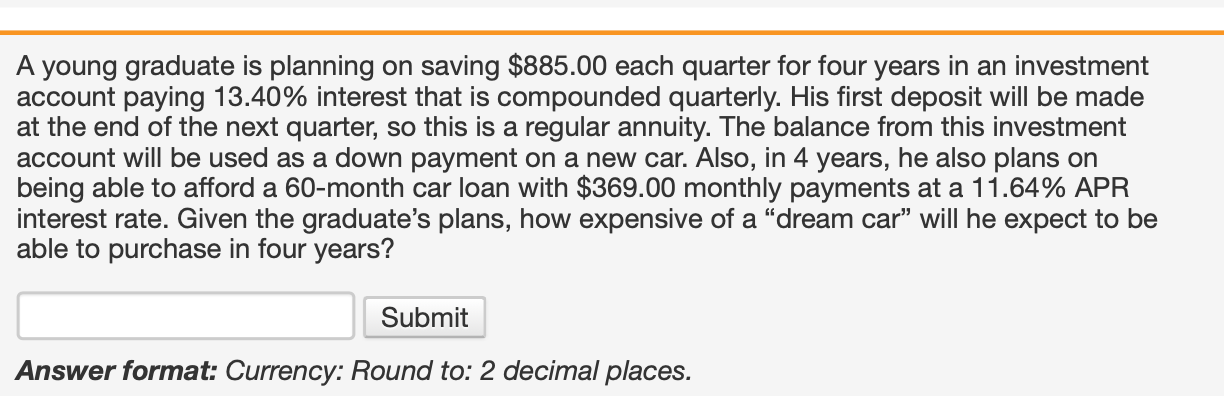

After graduating from college with a bachelor of business administration, you begin an ambitious plan to retire in 24.00 years. To build up your retirement fund, you will make quarterly payments into a mutual fund that on average will pay 12.60% APR compounded quarterly. To get you started, a relative gives you a graduation gift of $3,697.00. Once retired, you plan on moving your investment to a money market fund that will pay 6.84% APR with monthly compounding. As a young retiree, you believe you will live for 32.00 more years and will make monthly withdrawals of $9,286.00. (YOUR WITHDRAWALS ARE AT THE BEGINNING OF THE MONTH!!!!) To meet your retirement needs, what quarterly payment should you make? Answer format: Currency: Round to: 2 decimal places. A young graduate is planning on saving $885.00 each quarter for four years in an investment account paying 13.40% interest that is compounded quarterly. His first deposit will be made at the end of the next quarter, so this is a regular annuity. The balance from this investment account will be used as a down payment on a new car. Also, in 4 years, he also plans on being able to afford a 60-month car loan with $369.00 monthly payments at a 11.64% APR interest rate. Given the graduate's plans, how expensive of a "dream car" will he expect to be able to purchase in four years? Answer format: Currency: Round to: 2 decimal places

After graduating from college with a bachelor of business administration, you begin an ambitious plan to retire in 24.00 years. To build up your retirement fund, you will make quarterly payments into a mutual fund that on average will pay 12.60% APR compounded quarterly. To get you started, a relative gives you a graduation gift of $3,697.00. Once retired, you plan on moving your investment to a money market fund that will pay 6.84% APR with monthly compounding. As a young retiree, you believe you will live for 32.00 more years and will make monthly withdrawals of $9,286.00. (YOUR WITHDRAWALS ARE AT THE BEGINNING OF THE MONTH!!!!) To meet your retirement needs, what quarterly payment should you make? Answer format: Currency: Round to: 2 decimal places. A young graduate is planning on saving $885.00 each quarter for four years in an investment account paying 13.40% interest that is compounded quarterly. His first deposit will be made at the end of the next quarter, so this is a regular annuity. The balance from this investment account will be used as a down payment on a new car. Also, in 4 years, he also plans on being able to afford a 60-month car loan with $369.00 monthly payments at a 11.64% APR interest rate. Given the graduate's plans, how expensive of a "dream car" will he expect to be able to purchase in four years? Answer format: Currency: Round to: 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started