17.

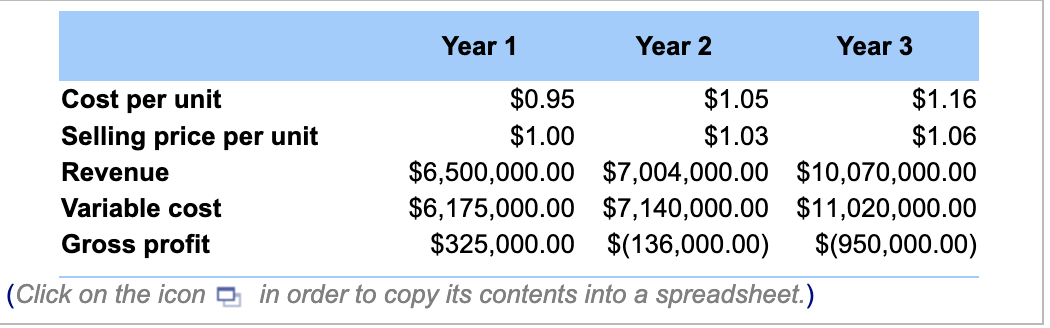

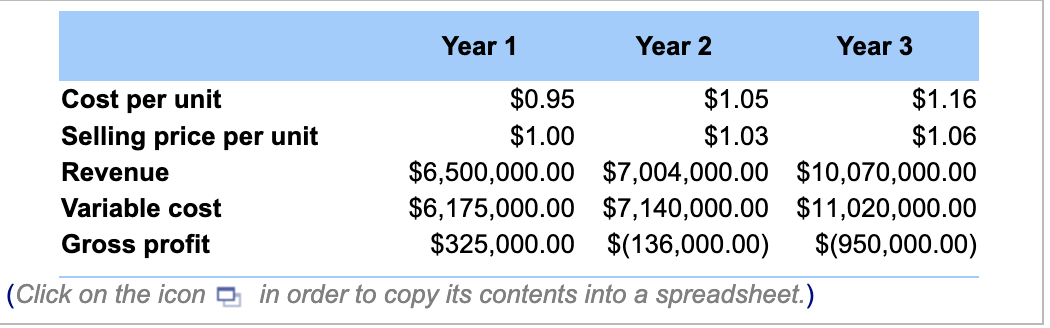

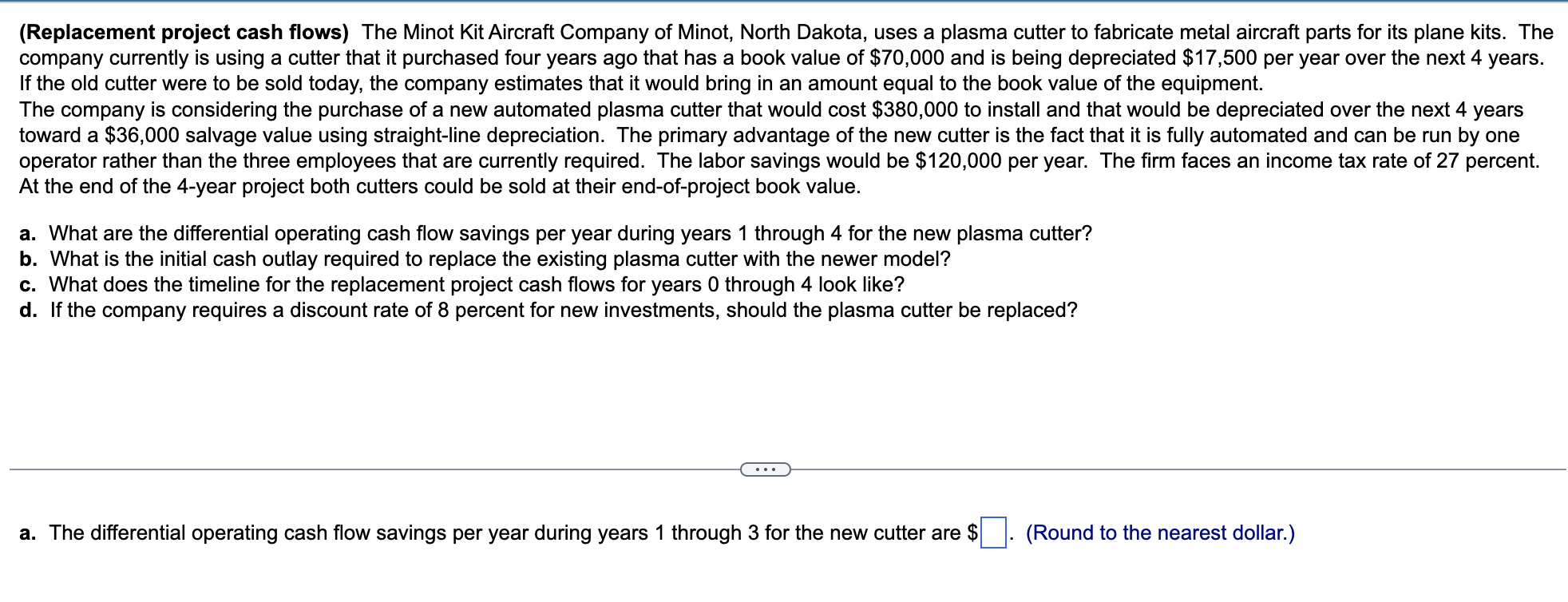

(Inflation and project cash flows) Carlyle Chemicals is evaluating a new chemical compound used in the manufacture of a wide range of consumer products. The firm is concerned that inflation in the cost of raw materials will have an adverse effect on the project's cash flows. Specifically, the firm expects the cost per unit (which is currently $0.86) will rise at a rate of 10 percent annually over the next three years. The per-unit selling price is currently $0.97 and this price is expected to rise at a meager 3 percent annual rate over the next three years. Carlyle expects to sell 6.5, 6.8, and 9.5 million units for the next three years, respectively. Based on this, 3 Carlyle estimated the gross profits in the table below: B The company CFO suggested that they could purchase raw materials in advance for future delivery. This would involve paying for the raw materials today and taking delivery as the materials are needed. Through the advance purchase plan the cost of raw materials would cost $0.97 per unit. How does this new plan affect your cash flow estimates? How should the advance payment for the raw materials enter into your analysis of project cash flows? The gross profit or (loss) for year 1 is $ (Round to the nearest dollar.) Year 1 Year 2 Year 3 Cost per unit $0.95 $1.05 $1.16 Selling price per unit $1.00 $1.03 $1.06 Revenue $6,500,000.00 $7,004,000.00 $10,070,000.00 Variable cost $6,175,000.00 $7,140,000.00 $11,020,000.00 Gross profit $325,000.00 $(136,000.00) $(950,000.00) (Click on the icon in order to copy its contents into a spreadsheet.) (Replacement project cash flows) The Minot Kit Aircraft Company of Minot, North Dakota, uses a plasma cutter to fabricate metal aircraft parts for its plane kits. The company currently is using a cutter that it purchased four years ago that has a book value of $70,000 and is being depreciated $17,500 per year over the next 4 years. If the old cutter were to be sold today, the company estimates that it would bring in an amount equal to the book value of the equipment. The company is considering the purchase of a new automated plasma cutter that would cost $380,000 to install and that would be depreciated over the next 4 years toward a $36,000 salvage value using straight-line depreciation. The primary advantage of the new cutter is the fact that it is fully automated and can be run by one operator rather than the three employees that are currently required. The labor savings would be $120,000 per year. The firm faces an income tax rate of 27 percent. At the end of the 4-year project both cutters could be sold at their end-of-project book value. a. What are the differential operating cash flow savings per year during years 1 through 4 for the new plasma cutter? b. What is the initial cash outlay required to replace the existing plasma cutter with the newer model? c. What does the timeline for the replacement project cash flows for years 0 through 4 look like? d. If the company requires a discount rate of 8 percent for new investments, should the plasma cutter be replaced? a. The differential operating cash flow savings per year during years 1 through 3 for the new cutter are $ (Round to the nearest dollar.) (Inflation and project cash flows) Carlyle Chemicals is evaluating a new chemical compound used in the manufacture of a wide range of consumer products. The firm is concerned that inflation in the cost of raw materials will have an adverse effect on the project's cash flows. Specifically, the firm expects the cost per unit (which is currently $0.86) will rise at a rate of 10 percent annually over the next three years. The per-unit selling price is currently $0.97 and this price is expected to rise at a meager 3 percent annual rate over the next three years. Carlyle expects to sell 6.5, 6.8, and 9.5 million units for the next three years, respectively. Based on this, 3 Carlyle estimated the gross profits in the table below: B The company CFO suggested that they could purchase raw materials in advance for future delivery. This would involve paying for the raw materials today and taking delivery as the materials are needed. Through the advance purchase plan the cost of raw materials would cost $0.97 per unit. How does this new plan affect your cash flow estimates? How should the advance payment for the raw materials enter into your analysis of project cash flows? The gross profit or (loss) for year 1 is $ (Round to the nearest dollar.) Year 1 Year 2 Year 3 Cost per unit $0.95 $1.05 $1.16 Selling price per unit $1.00 $1.03 $1.06 Revenue $6,500,000.00 $7,004,000.00 $10,070,000.00 Variable cost $6,175,000.00 $7,140,000.00 $11,020,000.00 Gross profit $325,000.00 $(136,000.00) $(950,000.00) (Click on the icon in order to copy its contents into a spreadsheet.) (Replacement project cash flows) The Minot Kit Aircraft Company of Minot, North Dakota, uses a plasma cutter to fabricate metal aircraft parts for its plane kits. The company currently is using a cutter that it purchased four years ago that has a book value of $70,000 and is being depreciated $17,500 per year over the next 4 years. If the old cutter were to be sold today, the company estimates that it would bring in an amount equal to the book value of the equipment. The company is considering the purchase of a new automated plasma cutter that would cost $380,000 to install and that would be depreciated over the next 4 years toward a $36,000 salvage value using straight-line depreciation. The primary advantage of the new cutter is the fact that it is fully automated and can be run by one operator rather than the three employees that are currently required. The labor savings would be $120,000 per year. The firm faces an income tax rate of 27 percent. At the end of the 4-year project both cutters could be sold at their end-of-project book value. a. What are the differential operating cash flow savings per year during years 1 through 4 for the new plasma cutter? b. What is the initial cash outlay required to replace the existing plasma cutter with the newer model? c. What does the timeline for the replacement project cash flows for years 0 through 4 look like? d. If the company requires a discount rate of 8 percent for new investments, should the plasma cutter be replaced? a. The differential operating cash flow savings per year during years 1 through 3 for the new cutter are $ (Round to the nearest dollar.)