Answered step by step

Verified Expert Solution

Question

1 Approved Answer

17. Kerri James is considering the purchase of a car, which will cost her $26,400. She will borrow the entire purchase price and make monthly

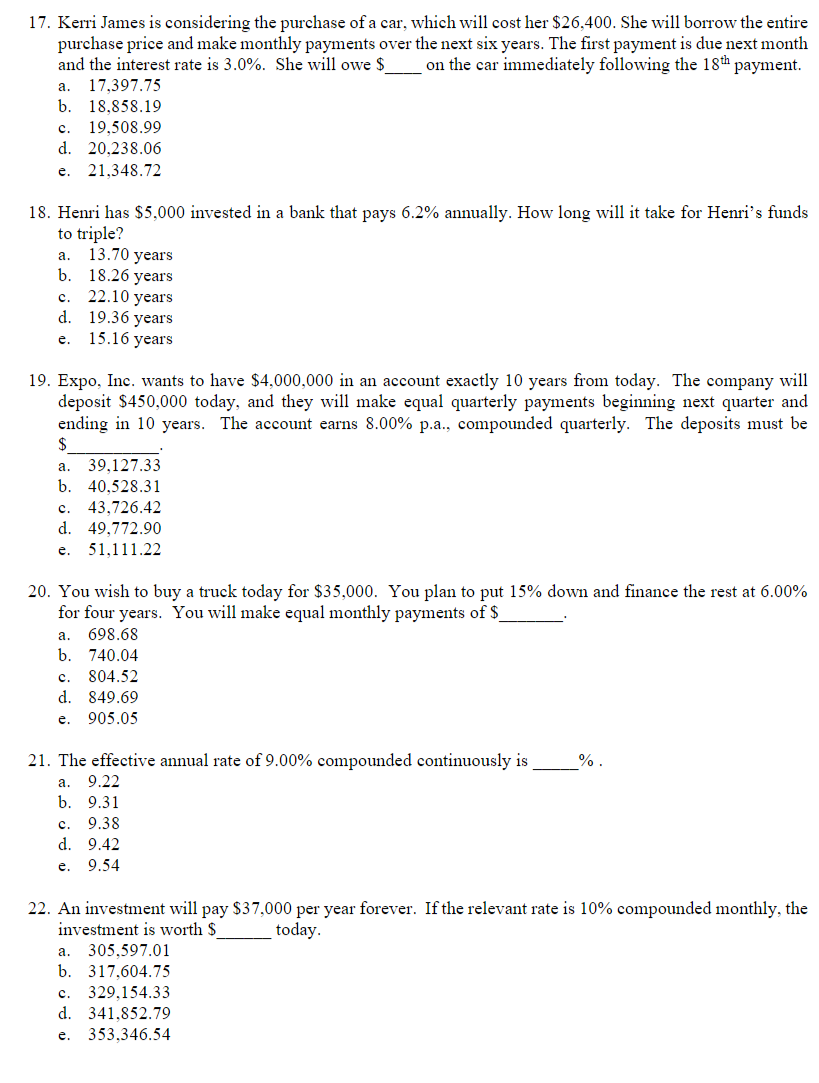

17. Kerri James is considering the purchase of a car, which will cost her $26,400. She will borrow the entire purchase price and make monthly payments over the next six years. The first payment is due next month and the interest rate is 3.0%. She will owe $ on the car immediately following the 18th payment. a. 17,397.75 b. 18,858.19 c. 19,508.99 d. 20,238.06 e. 21,348.72 18. Henri has $5,000 invested in a bank that pays 6.2% annually. How long will it take for Henri's funds to triple? a. 13.70 years b. 18.26 years c. 22.10 years d. 19.36 years e. 15.16 years 19. Expo, Inc. wants to have $4,000,000 in an account exactly 10 years from today. The company will deposit $450,000 today, and they will make equal quarterly payments beginning next quarter and ending in 10 years. The account earns 8.00% p.a., compounded quarterly. The deposits must be $ a. 39,127.33 b. 40,528.31 c. 43,726.42 d. 49,772.90 e. 51,111.22 20. You wish to buy a truck today for $35,000. You plan to put 15% down and finance the rest at 6.00% for four years. You will make equal monthly payments of $ a. 698.68 b. 740.04 c. 804.52 d. 849.69 e. 905.05 21. The effective annual rate of 9.00% compounded continuously is %. a. 9.22 b. 9.31 c. 9.38 d. 9.42 e. 9.54 22. An investment will pay $37,000 per year forever. If the relevant rate is 10% compounded monthly, the investment is worth $ today. a. 305,597.01 b. 317,604.75 c. 329,154.33 d. 341,852.79 e. 353,346.54

17. Kerri James is considering the purchase of a car, which will cost her $26,400. She will borrow the entire purchase price and make monthly payments over the next six years. The first payment is due next month and the interest rate is 3.0%. She will owe $ on the car immediately following the 18th payment. a. 17,397.75 b. 18,858.19 c. 19,508.99 d. 20,238.06 e. 21,348.72 18. Henri has $5,000 invested in a bank that pays 6.2% annually. How long will it take for Henri's funds to triple? a. 13.70 years b. 18.26 years c. 22.10 years d. 19.36 years e. 15.16 years 19. Expo, Inc. wants to have $4,000,000 in an account exactly 10 years from today. The company will deposit $450,000 today, and they will make equal quarterly payments beginning next quarter and ending in 10 years. The account earns 8.00% p.a., compounded quarterly. The deposits must be $ a. 39,127.33 b. 40,528.31 c. 43,726.42 d. 49,772.90 e. 51,111.22 20. You wish to buy a truck today for $35,000. You plan to put 15% down and finance the rest at 6.00% for four years. You will make equal monthly payments of $ a. 698.68 b. 740.04 c. 804.52 d. 849.69 e. 905.05 21. The effective annual rate of 9.00% compounded continuously is %. a. 9.22 b. 9.31 c. 9.38 d. 9.42 e. 9.54 22. An investment will pay $37,000 per year forever. If the relevant rate is 10% compounded monthly, the investment is worth $ today. a. 305,597.01 b. 317,604.75 c. 329,154.33 d. 341,852.79 e. 353,346.54 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started