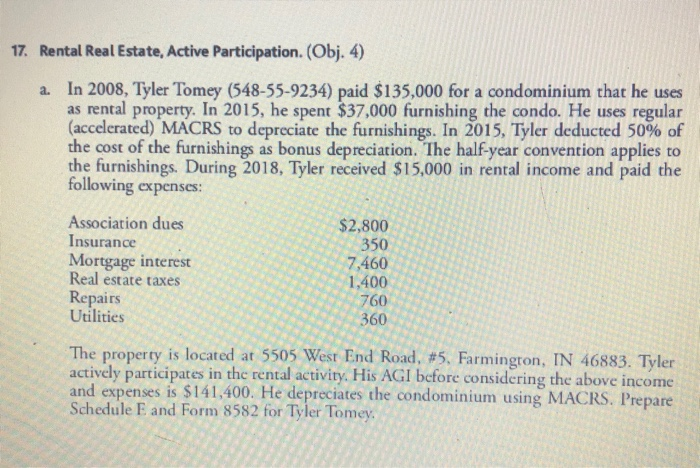

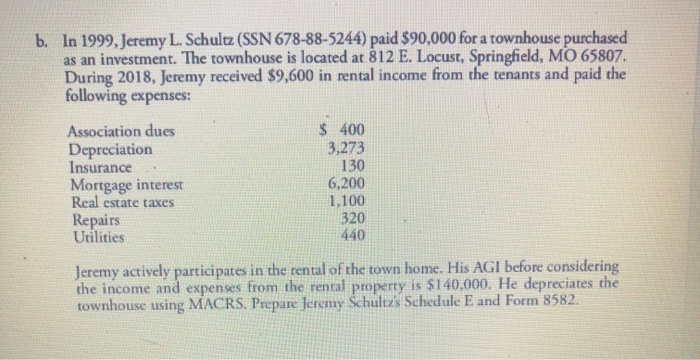

17. Rental Real Estate, Active Participation. (Obj. 4) a. In 2008, Tyler Tomey (548-55-9234) paid $135,000 for a condominium that he uses as rental property. In 2015, he spent $37,000 furnishing the condo. He uses regular (accelerated) MACRS to depreciate the furnishings. In 2015, Tyler deducted 50% of the cost of the furnishings as bonus depreciation. The half-year convention applies to the furnishings. During 2018, Tyler received $15,000 in rental income and paid the following expenses: Association dues $2,800 Insurance 350 Mortgage interest 7,460 Real estate taxes 1,400 Repairs 760 Utilities 360 The property is located at 5505 West End Road, #5. Farmington, IN 46883. Tyler actively participates in the rental activity. His AGI before considering the above income and expenses is $141,400. He depreciates the condominium using MACRS. Prepare Schedule E and Form 8582 for Tyler Tomey, b. In 1999, Jeremy L. Schultz (SSN 678-88-5244) paid $90,000 for a townhouse purchased as an investment. The townhouse is located at 812 E. Locust, Springfield, MO 65807. During 2018, Jeremy received $9,600 in rental income from the tenants and paid the following expenses: Association dues $ 400 Depreciation 3,273 Insurance 130 Mortgage interest 6,200 Real estate taxes 1,100 Repairs 320 Utilities 440 Jeremy actively participates in the rental of the town home. His AGI before considering the income and expenses from the rental property is $140,000. He depreciates the townhouse using MACRS. Prepare Jeremy Schultz's Schedule E and Form 8582. 17. Rental Real Estate, Active Participation. (Obj. 4) a. In 2008, Tyler Tomey (548-55-9234) paid $135,000 for a condominium that he uses as rental property. In 2015, he spent $37,000 furnishing the condo. He uses regular (accelerated) MACRS to depreciate the furnishings. In 2015, Tyler deducted 50% of the cost of the furnishings as bonus depreciation. The half-year convention applies to the furnishings. During 2018, Tyler received $15,000 in rental income and paid the following expenses: Association dues $2,800 Insurance 350 Mortgage interest 7,460 Real estate taxes 1,400 Repairs 760 Utilities 360 The property is located at 5505 West End Road, #5. Farmington, IN 46883. Tyler actively participates in the rental activity. His AGI before considering the above income and expenses is $141,400. He depreciates the condominium using MACRS. Prepare Schedule E and Form 8582 for Tyler Tomey, b. In 1999, Jeremy L. Schultz (SSN 678-88-5244) paid $90,000 for a townhouse purchased as an investment. The townhouse is located at 812 E. Locust, Springfield, MO 65807. During 2018, Jeremy received $9,600 in rental income from the tenants and paid the following expenses: Association dues $ 400 Depreciation 3,273 Insurance 130 Mortgage interest 6,200 Real estate taxes 1,100 Repairs 320 Utilities 440 Jeremy actively participates in the rental of the town home. His AGI before considering the income and expenses from the rental property is $140,000. He depreciates the townhouse using MACRS. Prepare Jeremy Schultz's Schedule E and Form 8582