17. This question has three parts (parts a c). Answer all three parts of the question. a. You run the three factor model regression for SDF stock using monthly return series and obtain the following regression outputs. Evaluate the following statement if true or false and justify your answer. SDF acts like a large-cap value stock. (4 points) Fama-French Intercept Rm-Rf SMB HML Adjusted R2 Estimates 0.002% 0.53 -0.58 0.66 0.65 p-value 0.67 0.002 0.005 0.001 b. Security M has an expected return of 17% and standard deviation of 32%. Security S has an expected return of 13% and standard deviation of 19%. If the two securities have a correlation coefficient of 0.78, what is their covariance? (3 Points) c. Assume unlimited lending and borrowing at risk-free rate is possible. Suppose there are two hedge funds X and Y. Both funds have arrived at the same optimal risky portfolio D and global minimum variance portfolio C. The risk free rate is 5%. Fund X clients are very risk averse and do not allow borrowing money to buy risky assets, while Fund Y clients do not place such restrictions. A junior analyst in your firm suggest that portfolio E is ideal for Fund X and portfolio B is ideal for fund Y. Explain in 2-3 sentences if you agree with the analysts suggestions. (4 points)

17. This question has three parts (parts a c). Answer all three parts of the question. a. You run the three factor model regression for SDF stock using monthly return series and obtain the following regression outputs. Evaluate the following statement if true or false and justify your answer. SDF acts like a large-cap value stock. (4 points) Fama-French Intercept Rm-Rf SMB HML Adjusted R2 Estimates 0.002% 0.53 -0.58 0.66 0.65 p-value 0.67 0.002 0.005 0.001 b. Security M has an expected return of 17% and standard deviation of 32%. Security S has an expected return of 13% and standard deviation of 19%. If the two securities have a correlation coefficient of 0.78, what is their covariance? (3 Points) c. Assume unlimited lending and borrowing at risk-free rate is possible. Suppose there are two hedge funds X and Y. Both funds have arrived at the same optimal risky portfolio D and global minimum variance portfolio C. The risk free rate is 5%. Fund X clients are very risk averse and do not allow borrowing money to buy risky assets, while Fund Y clients do not place such restrictions. A junior analyst in your firm suggest that portfolio E is ideal for Fund X and portfolio B is ideal for fund Y. Explain in 2-3 sentences if you agree with the analysts suggestions. (4 points)

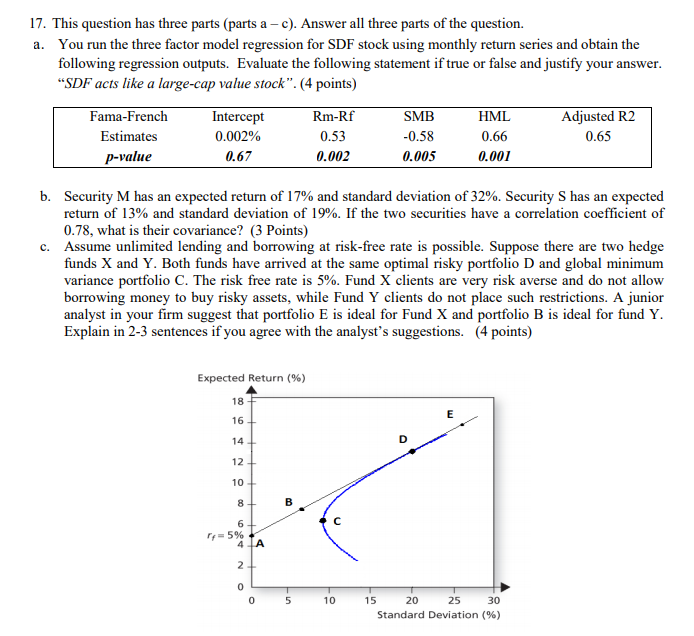

17. This question has three parts (parts a -c). Answer all three parts of the question. a. You run the three factor model regression for SDF stock using monthly return series and obtain the following regression outputs. Evaluate the following statement if true or false and justify your answer. "SDF acts like a large-cap value stock". (4 points) Fama-French Intercept Rm-Rf SMB HML Adjusted R2 Estimates 0.002% 0.53 -0.58 0.66 0.65 p-value 0.67 0.002 0.005 0.001 b. Security M has an expected return of 17% and standard deviation of 32%. Security S has an expected return of 13% and standard deviation of 19%. If the two securities have a correlation coefficient of 0.78, what is their covariance? (3 Points) C. Assume unlimited lending and borrowing at risk-free rate is possible. Suppose there are two hedge funds X and Y. Both funds have arrived at the same optimal risky portfolio D and global minimum variance portfolio C. The risk free rate is 5%. Fund X clients are very risk averse and do not allow borrowing money to buy risky assets, while Fund Y clients do not place such restrictions. A junior analyst in your firm suggest that portfolio E is ideal for Fund X and portfolio B is ideal for fund Y. Explain in 2-3 sentences if you agree with the analyst's suggestions. (4 points) Expected Return (%) 18 E 16 14+ 12+ 10+ 8 B 6 ry=5% 4 LA 21 0 0 5 10 30 15 20 25 Standard Deviation (%) 17. This question has three parts (parts a -c). Answer all three parts of the question. a. You run the three factor model regression for SDF stock using monthly return series and obtain the following regression outputs. Evaluate the following statement if true or false and justify your answer. "SDF acts like a large-cap value stock". (4 points) Fama-French Intercept Rm-Rf SMB HML Adjusted R2 Estimates 0.002% 0.53 -0.58 0.66 0.65 p-value 0.67 0.002 0.005 0.001 b. Security M has an expected return of 17% and standard deviation of 32%. Security S has an expected return of 13% and standard deviation of 19%. If the two securities have a correlation coefficient of 0.78, what is their covariance? (3 Points) C. Assume unlimited lending and borrowing at risk-free rate is possible. Suppose there are two hedge funds X and Y. Both funds have arrived at the same optimal risky portfolio D and global minimum variance portfolio C. The risk free rate is 5%. Fund X clients are very risk averse and do not allow borrowing money to buy risky assets, while Fund Y clients do not place such restrictions. A junior analyst in your firm suggest that portfolio E is ideal for Fund X and portfolio B is ideal for fund Y. Explain in 2-3 sentences if you agree with the analyst's suggestions. (4 points) Expected Return (%) 18 E 16 14+ 12+ 10+ 8 B 6 ry=5% 4 LA 21 0 0 5 10 30 15 20 25 Standard Deviation (%)

17. This question has three parts (parts a c). Answer all three parts of the question. a. You run the three factor model regression for SDF stock using monthly return series and obtain the following regression outputs. Evaluate the following statement if true or false and justify your answer. SDF acts like a large-cap value stock. (4 points) Fama-French Intercept Rm-Rf SMB HML Adjusted R2 Estimates 0.002% 0.53 -0.58 0.66 0.65 p-value 0.67 0.002 0.005 0.001 b. Security M has an expected return of 17% and standard deviation of 32%. Security S has an expected return of 13% and standard deviation of 19%. If the two securities have a correlation coefficient of 0.78, what is their covariance? (3 Points) c. Assume unlimited lending and borrowing at risk-free rate is possible. Suppose there are two hedge funds X and Y. Both funds have arrived at the same optimal risky portfolio D and global minimum variance portfolio C. The risk free rate is 5%. Fund X clients are very risk averse and do not allow borrowing money to buy risky assets, while Fund Y clients do not place such restrictions. A junior analyst in your firm suggest that portfolio E is ideal for Fund X and portfolio B is ideal for fund Y. Explain in 2-3 sentences if you agree with the analysts suggestions. (4 points)

17. This question has three parts (parts a c). Answer all three parts of the question. a. You run the three factor model regression for SDF stock using monthly return series and obtain the following regression outputs. Evaluate the following statement if true or false and justify your answer. SDF acts like a large-cap value stock. (4 points) Fama-French Intercept Rm-Rf SMB HML Adjusted R2 Estimates 0.002% 0.53 -0.58 0.66 0.65 p-value 0.67 0.002 0.005 0.001 b. Security M has an expected return of 17% and standard deviation of 32%. Security S has an expected return of 13% and standard deviation of 19%. If the two securities have a correlation coefficient of 0.78, what is their covariance? (3 Points) c. Assume unlimited lending and borrowing at risk-free rate is possible. Suppose there are two hedge funds X and Y. Both funds have arrived at the same optimal risky portfolio D and global minimum variance portfolio C. The risk free rate is 5%. Fund X clients are very risk averse and do not allow borrowing money to buy risky assets, while Fund Y clients do not place such restrictions. A junior analyst in your firm suggest that portfolio E is ideal for Fund X and portfolio B is ideal for fund Y. Explain in 2-3 sentences if you agree with the analysts suggestions. (4 points)