Answered step by step

Verified Expert Solution

Question

1 Approved Answer

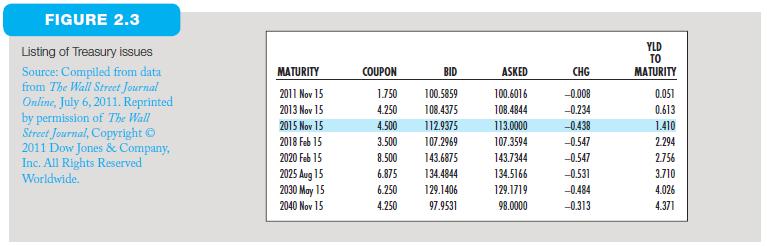

Turn back to Figure 2.3 and look at the Treasury bond maturing in November 2040. a. How much would you have to pay to purchase

Turn back to Figure 2.3 and look at the Treasury bond maturing in November 2040.

a. How much would you have to pay to purchase one of these bonds?

b. What is its coupon rate?

c. What is the current yield (i.e., coupon income as a fraction of bond price) of the bond?

FIGURE 2.3 Listing of Treasury issues Source: Compiled from data from The Wall Street Journal YLD 22 TO MATURITY COUPON BID ASKED CHG MATURITY 2011 Nov 15 1.750 100.5859 100.6016 -0.008 0.051 Online, July 6, 2011. Reprinted by permission of The Wall 2013 Nov 15 4.250 108.4375 108.4844 -0.234 0.613 2015 Nov 15 4.500 112.9375 113.0000 -0.438 1.410 Street Journal, Copyright 2018 Feb 15 3.500 107.2969 2011 Dow Jones & Company, Inc. All Rights Reserved Worldwide. 107.3594 -0.547 2.294 2020 Feb 15 8.500 143.6875 143.7344 -0.547 2.756 2025 Aug 15 6.875 134.4844 134.5166 -0.531 3.710 2030 May 15 6.250 129.1406 129.1719 -0.484 4.026 2040 Nov 15 4.250 97.9531 98.0000 -0.313 4.371

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started