Answered step by step

Verified Expert Solution

Question

1 Approved Answer

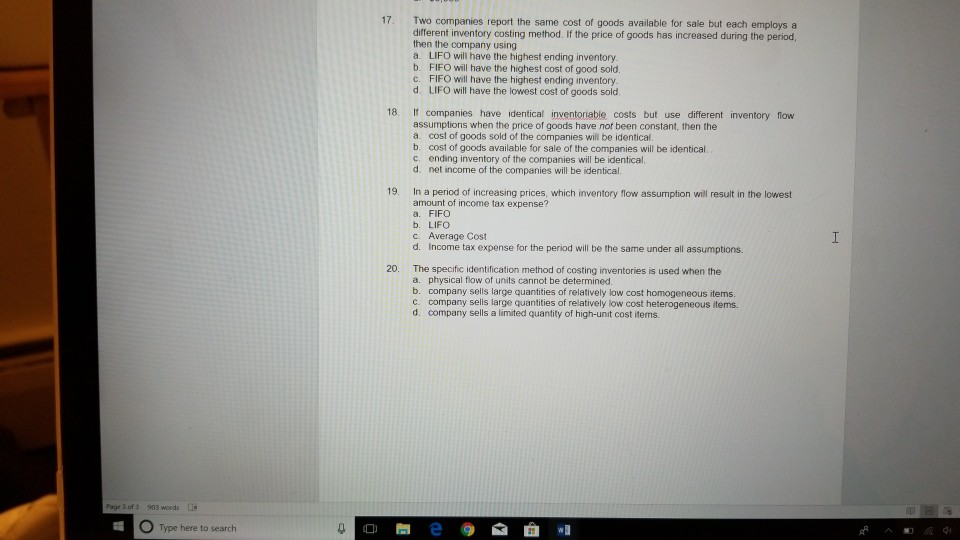

17. Two companies report the same cost of goods available for sale but each employs a different inventory costing method. If the price of goods

17. Two companies report the same cost of goods available for sale but each employs a different inventory costing method. If the price of goods has increased during the period then the company using a. LIFO will have the highest ending inventory b. FIFO will have the highest cost of good sold c. FIFO will have the highest ending inventory d. LIFO will have the lowest cost of goods sold 18. If companies have identical inventoriable costs but use different inventory flow assumptions when the price of goods have not been constant, then the a. cost of goods sold of the companies will be identical b cost of goods available for sale of the companies will be identical. c. ending inventory of the companies will be identical d. net income of the companies will be identical 19. In a period of increasing prices, which inventory flow assumption will result in the lowest amount of income tax expense? a. FIFO b. LIFO c. Average Cost d. Income tax expense for the period will be the same under all assumptions. 20. The specific identification method of costing inventories is used when the a. physical flow of units cannot be determined b. company sells large quantities of relatively low cost homogeneous items c. company sells large quantities of relatively low cost heterogeneous items. d. company sells a limited quantity of high-unit cost items Page 3 of 3 903 words L O Type here to search

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started