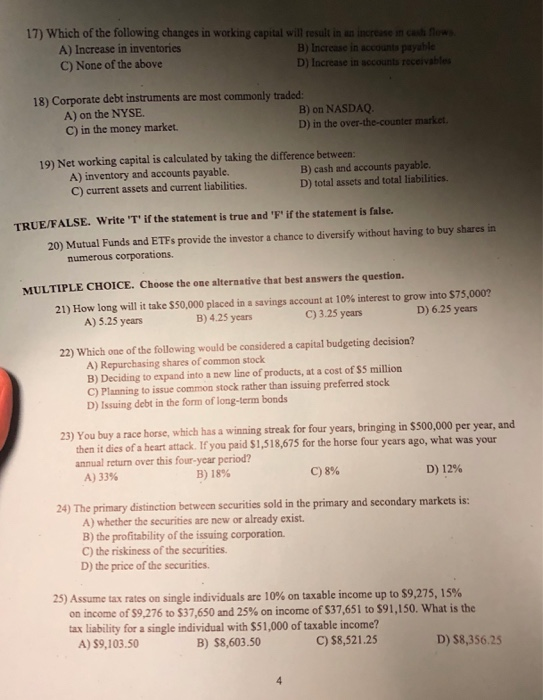

17) Which of the following changes in working capital will result in an increase in casth flows A) Increase in inventories C) None of the above B) Increase in accounts payable D) Increase in accounts receivables 18) Corporate debt instruments are most commonly traded A) on the NYSE C) in the money market B) on NASDAQ. D) in the over-the-counter market. 19) Net working capital is calculated by taking the difference between: A) inventory and accounts payable. C) current assets and current liabilities. B) cash and accounts payable. D) total assets and total liabilities. TRUE/FALSE. Write T' if the statement is true and 'F if the statement is false. 20) Mutual Funds and ETFS provide the investor a chance to diversify without having to buy shares in numerous corporations. MULTIPLE CHOICE. Choose the one alternative that best answers the question. 21) How long will it take $50,000 placed in a savings account at 10 % interest to grow into $75,000? A) 5.25 years D) 6.25 years B) 4.25 years C) 3.25 years 22) Which one of the following would be considered a capital budgeting decision? A) Repurchasing shares of common stock B) Deciding to expand into a new line of products, at a cost of $5 million C) Planning to issue common stock rather than issuing preferred stock D) Issuing debt in the form of long-term bonds 23) You buy a race horse, which has a winning streak for four years, bringing in $500,000 per year, and then it dies of a heart attack. If you paid $1,518,675 for the horse four years ago, what was your annual return over this four-year period? A) 33% B) 18% C)8% D) 12% 24) The primary distinction between securities sold in the primary and secondary markets is: A) whether the securities are new or already exist B) the profitability of the issuing corporation C) the riskiness of the securities D) the price of the securities 25) Assume tax rates on single individuals are 10% on taxable income up to $9,275, 15% on income of $9,276 to $37,650 and 25% on income of $37,651 to $91,150. What is the tax liability for a single individual with $51,000 of taxable income? A) $9,103.50 B) $8,603.50 C) $8,521.25 D) $8,356.25 4