Answered step by step

Verified Expert Solution

Question

1 Approved Answer

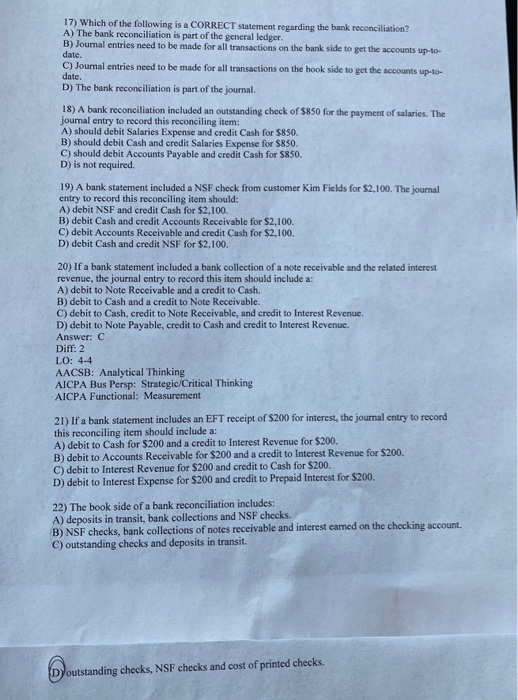

17) Which of the following is a CORRECT statement regarding the bank reconciliation? A) The bank reconciliation is part of the general ledger. B)

17) Which of the following is a CORRECT statement regarding the bank reconciliation? A) The bank reconciliation is part of the general ledger. B) Journal entries need to be made for all transactions on the bank side to get the accounts up-to- date. C) Journal entries need to be made for all transactions on the book side to get the accounts up-to- date. D) The bank reconciliation is part of the journal. 18) A bank reconciliation included an outstanding check of $850 for the payment of salaries. The journal entry to record this reconciling item: A) should debit Salaries Expense and credit Cash for $850. B) should debit Cash and credit Salaries Expense for $850. C) should debit Accounts Payable and credit Cash for $850. D) is not required. 19) A bank statement included a NSF check from customer Kim Fields for $2,100. The journal entry to record this reconciling item should: A) debit NSF and credit Cash for $2,100. B) debit Cash and credit Accounts Receivable for $2,100. C) debit Accounts Receivable and credit Cash for $2,100. D) debit Cash and credit NSF for $2,100. 20) If a bank statement included a bank collection of a note receivable and the related interest revenue, the journal entry to record this item should include a: A) debit to Note Receivable and a credit to Cash. B) debit to Cash and a credit to Note Receivable. C) debit to Cash, credit to Note Receivable, and credit to Interest Revenue. D) debit to Note Payable, credit to Cash and credit to Interest Revenue. Answer: C Diff: 2 LO: 4-4 AACSB: Analytical Thinking AICPA Bus Persp: Strategic/Critical Thinking AICPA Functional: Measurement 21) If a bank statement includes an EFT receipt of $200 for interest, the journal entry to record this reconciling item should include a: A) debit to Cash for $200 and a credit to Interest Revenue for $200. B) debit to Accounts Receivable for $200 and a credit to Interest Revenue for $200. C) debit to Interest Revenue for $200 and credit to Cash for $200. D) debit to Interest Expense for $200 and credit to Prepaid Interest for $200. 22) The book side of a bank reconciliation includes: A) deposits in transit, bank collections and NSF checks. B) NSF checks, bank collections of notes receivable and interest earned on the checking account. C) outstanding checks and deposits in transit. Doutstanding checks, NSF checks and cost of printed checks.

Step by Step Solution

★★★★★

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below 17 Answer C Journal entry that need to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started