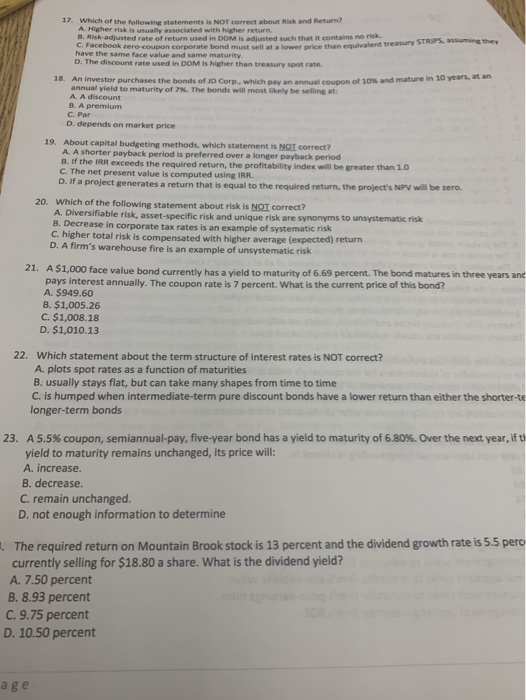

17, Which of the following statements is NOT correct about Risk and Return? A Higher risk is usualy associated with higher return. B. Risk-adjusted rate of return used in DDM is adjusted such that it contains no risk. C. Facebook zero coupon corporate bond must s ell at a lower price than equivalent treasury STRIPS, assuming they have the same face value and same maturity. D. The discount rate used in DDOM is higher than treasury spot rate. 18. years at an An investor purchases the bonds of JD Corp. which pay an annual coup on of 10% and mature i. annual yield to maturity of 7%. The bonds will most likely be selling at A. A discount B. A premium C. Par D. depends on market price 19. About capital budgeting methods, which statement is NOT correct? A. A shorter payback period is preferred over a longer payback period the IRR exceeds the required return, the profitability index will be greater than 1.0 C. The net present value is computed using IRR D. If a project generates a return that is equal to the required return, the project's NPV will be zero. 20. Which of the following statement about risk is NOI correct? A. Diversifiable risk, asset-specific risk and unique risk are synonyms to unsystematic risk B. Decrease in corporate tax rates is an example of systematic risk C. higher total risk is compensated with higher average (expected) return D. A firm's warehouse fire is an example of unsystematic risk 21. A $1,000 face value bond currently has a yield to maturity of 6.69 percent. The bond matures in three years and pays interest annually. The coupon rate is 7 percent. What is the current price of this bond? A. $949.60 B. $1,005.26 C. $1,008.18 D. $1,010.13 22. Which statement about the term structure of interest rates is NOT correct? A plots spot rates as a function of maturities B. usually stays flat, but can take many shapes from time to time C. is humped when intermediate-term pure discount bonds have a lower return than either the shorter-te longer-term bonds A 5.5% coupon, semiannual-pay, five-year bond has a yield to maturity of 6.80%. Over the next year, if t yield to maturity remains unchanged, its price will: A. increase. B. decrease. C. remain unchanged. D. not enough information to determine 23. . The required return on Mountain Brook stock is 13 percent and the dividend growth rate is 5.5 perc currently selling for $18.80 a share. What is the dividend yield? A. 7.50 percent B. 8.93 percent C. 9.75 percent D. 10.50 percent a g e