Answered step by step

Verified Expert Solution

Question

1 Approved Answer

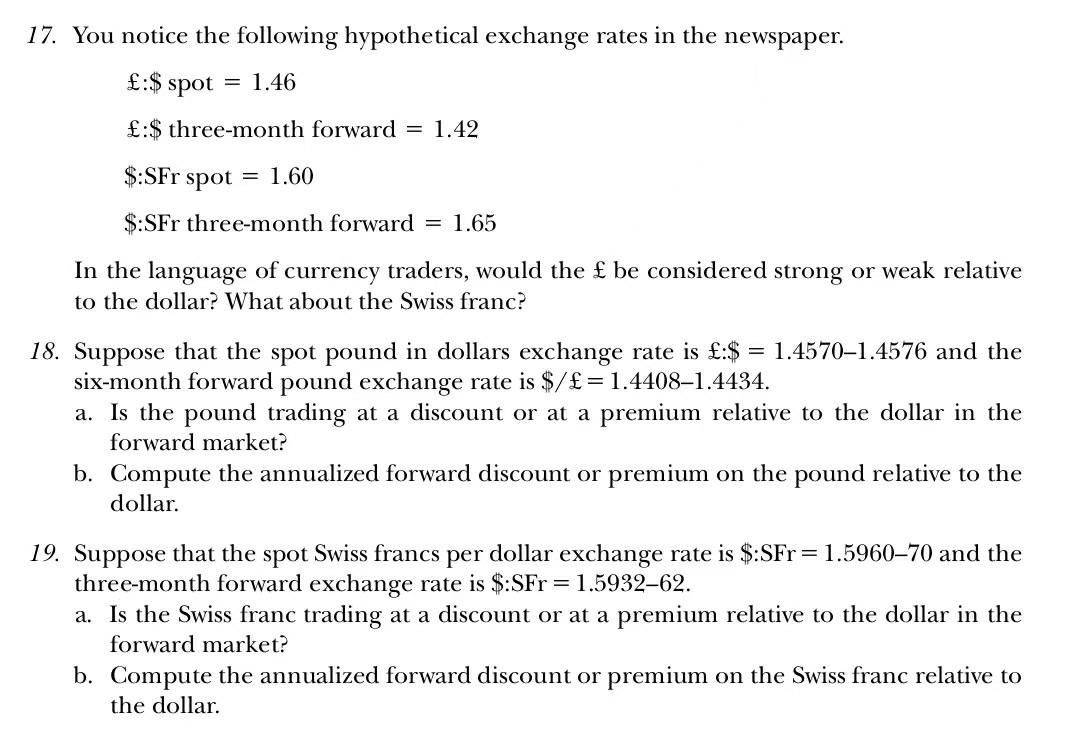

17. You notice the following hypothetical exchange rates in the newspaper. :$spot=1.46 :$ three-month forward =1.42 $:SFr spot =1.60 $: SFr three-month forward =1.65 In

17. You notice the following hypothetical exchange rates in the newspaper. :$spot=1.46 :$ three-month forward =1.42 $:SFr spot =1.60 $: SFr three-month forward =1.65 In the language of currency traders, would the be considered strong or weak relative to the dollar? What about the Swiss franc? 18. Suppose that the spot pound in dollars exchange rate is :$=1.45701.4576 and the six-month forward pound exchange rate is $/=1.44081.4434. a. Is the pound trading at a discount or at a premium relative to the dollar in the forward market? b. Compute the annualized forward discount or premium on the pound relative to the dollar. 19. Suppose that the spot Swiss francs per dollar exchange rate is $:SFr=1.596070 and the three-month forward exchange rate is $:SFr=1.593262. a. Is the Swiss franc trading at a discount or at a premium relative to the dollar in the forward market? b. Compute the annualized forward discount or premium on the Swiss franc relative to the dollar

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started