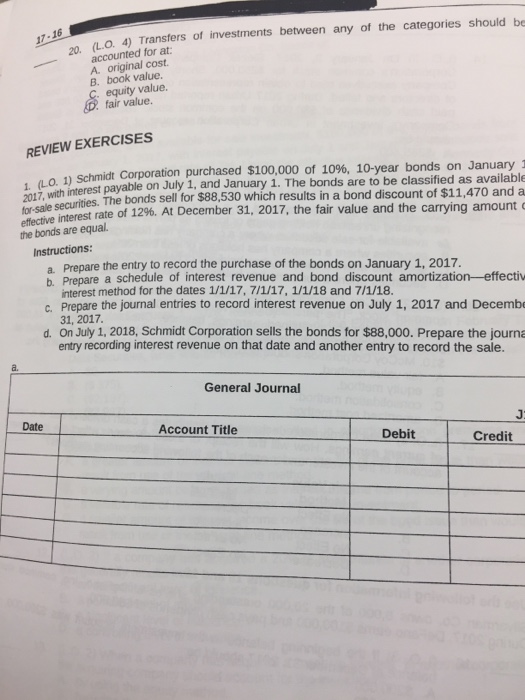

17-16 o. 4) Transfers of investments between any of the categories should be 20. (L.O accounted for at A. original cost. B. book value. equity value. fair value. REVIEW EXERCISES , LO 1) Schmidt Corporation purchased $100,000 of 10%, 10-year bonds on January 1 st payable on July 1, and January 1. The bonds are to be classified as available bonds sell for $88,530 which results in a bond discount of $11,470 and a rate of 12%. At December 31, 2017, the fair value and the carrying amount 20 17, with intere securities. The effective the bonds are equal. Instructions: a. Prepare the entry to record the purchase of the bonds on January 1, 2017. b. Preparea c. Prepare the journal entries to record interest revenue on July 1, 2017 and Decembe d. On July 1, 2018, Schmidt Corporation sells the bonds for $88,000. Prepare the journa interest method for the dates 1/1/17, 7/1/17, 1/1/18 and 7/1/18. 31, 2017. entry recording interest revenue on that date and another entry to record the sale. a. General Journal Date Account Title Debit Credit 17-16 o. 4) Transfers of investments between any of the categories should be 20. (L.O accounted for at A. original cost. B. book value. equity value. fair value. REVIEW EXERCISES , LO 1) Schmidt Corporation purchased $100,000 of 10%, 10-year bonds on January 1 st payable on July 1, and January 1. The bonds are to be classified as available bonds sell for $88,530 which results in a bond discount of $11,470 and a rate of 12%. At December 31, 2017, the fair value and the carrying amount 20 17, with intere securities. The effective the bonds are equal. Instructions: a. Prepare the entry to record the purchase of the bonds on January 1, 2017. b. Preparea c. Prepare the journal entries to record interest revenue on July 1, 2017 and Decembe d. On July 1, 2018, Schmidt Corporation sells the bonds for $88,000. Prepare the journa interest method for the dates 1/1/17, 7/1/17, 1/1/18 and 7/1/18. 31, 2017. entry recording interest revenue on that date and another entry to record the sale. a. General Journal Date Account Title Debit Credit