17,18,19 AND 23 (ASAP)

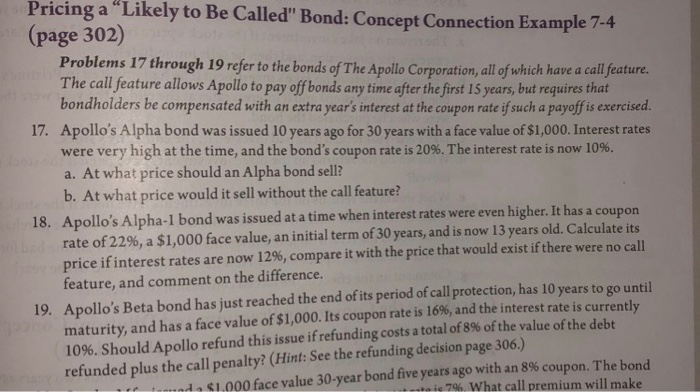

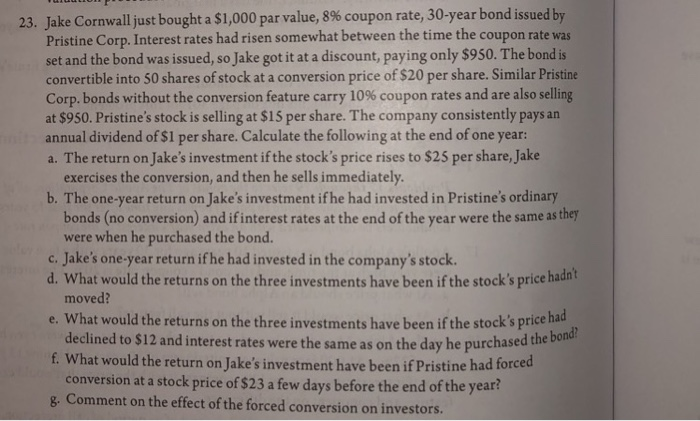

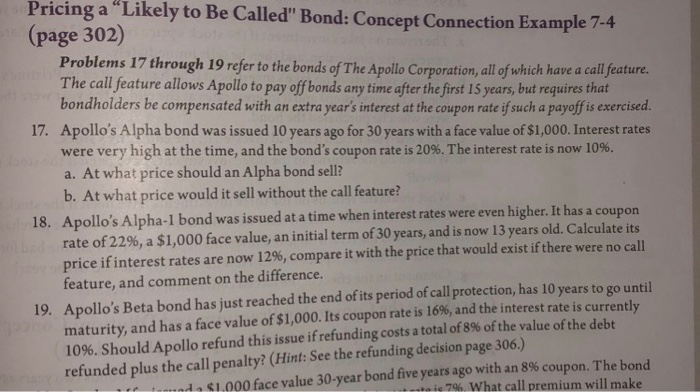

Pricing a "Likely to Be Called" Bond: Concept Connection Example 7-41 (page 302) Problems 17 through 19 refer to the bonds of The Apollo Corporation, all of which have a call feature. The call feature allows Apollo to pay off bonds any time after the first 15 years, but requires that bondholders be compensated with an extra year's interest at the coupon rate if such a payoff is exercised. 17. Apollo's Alpha bond was issued 10 years ago for 30 years with a face value of $1,000. Interest rates were very high at the time, and the bond's coupon rate is 20%. The interest rate is now 10%. a. At what price should an Alpha bond sell? b. At what price would it sell without the call feature? 18. Apollo's Alpha-1 bond was issued at a time when interest rates were even higher. It has a coupon rate of 2296, a $1,000 face value, an initial term of 30 years, and is now 13 years old. Calculate its price if interest rates are now 12%, compare it with the price that would exist if there were no call feature, and comment on the difference. 19. Apollo's Beta bond has just reached the end of its period of call protection, has 10 years to go until maturity, and has a face value of $1,000. Its coupon rate is 16%, and the interest rate is currently 10%. Should Apollo refund this issue if refunding costs a total of 8% of the value of the debt refunded plus the call penalty? (Hint: See the refunding decision page 306.) 1111 fue $1.000 face value 30-year bond five years ago with an 8% coupon. The bond nie 7% What call premium will make Tuulon 23. Jake Cornwall just bought a $1,000 par value, 8% coupon rate, 30-year bond issued by Pristine Corp. Interest rates had risen somewhat between the time the coupon rate was set and the bond was issued, so Jake got it at a discount, paying only $950. The bond is convertible into 50 shares of stock at a conversion price of $20 per share. Similar Pristine Corp. bonds without the conversion feature carry 10% coupon rates and are also selling at $950. Pristine's stock is selling at $15 per share. The company consistently pays an annual dividend of $1 per share. Calculate the following at the end of one year: a. The return on Jake's investment if the stock's price rises to $25 per share, Jake exercises the conversion, and then he sells immediately. b. The one-year return on Jake's investment if he had invested in Pristine's ordinary bonds (no conversion) and if interest rates at the end of the year were the same as they were when he purchased the bond. c. Jake's one-year return if he had invested in the company's stock. d. What would the returns on the three investments have been if the stock's price hadh moved? e. What would the returns on the three investments have been if the stock's price declined to $12 and interest rates were the same as on the day he purchased in f. What would the return on Jake's investment have been if Pristine had forced conversion at a stock price of $23 a few days before the end of the year? g. Comment on the effect of the forced conversion on investors. he purchased the bond