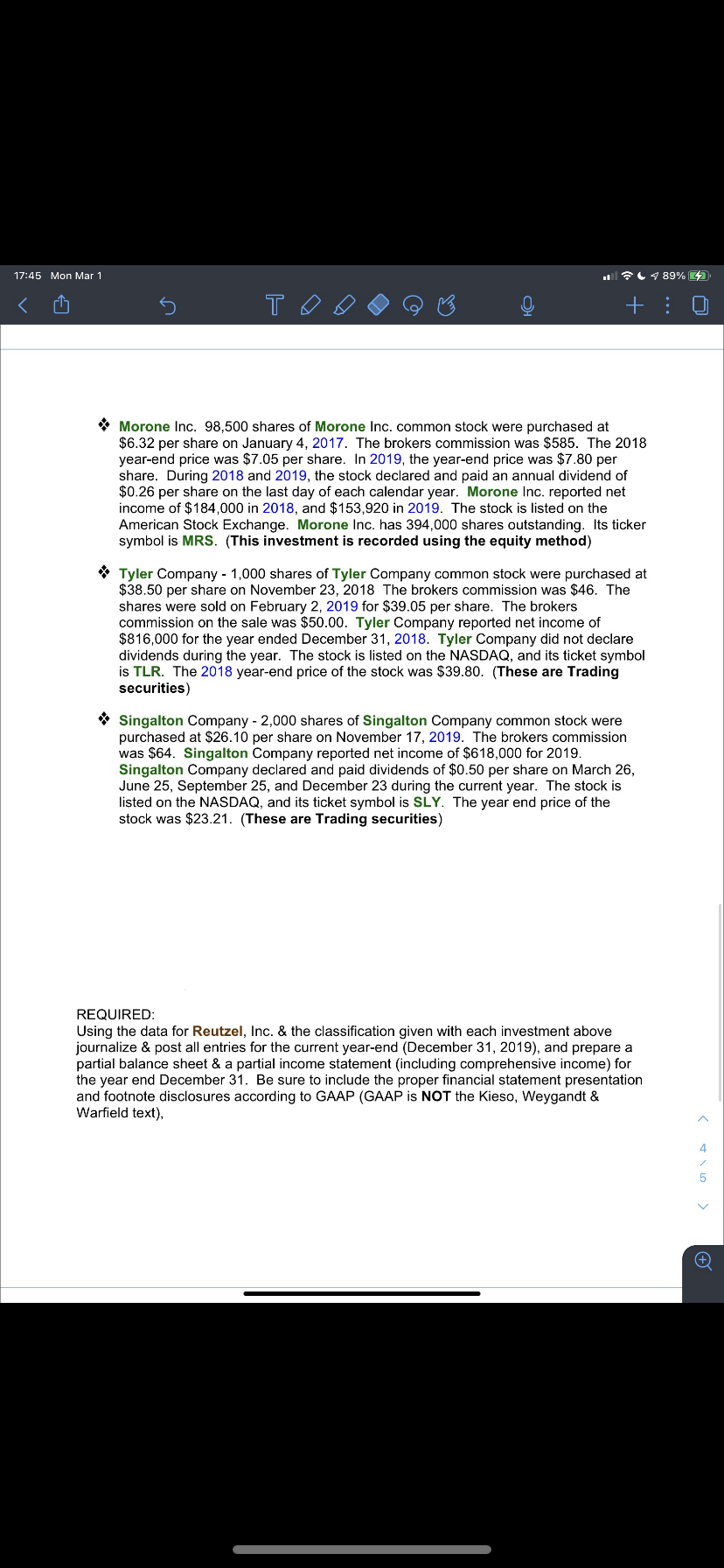

17:45 Mon Mar 1 04 89% 2 T + : 0 George, Inc. is in the process of preparing its 2019 year-end financial statements for the current year. During the year, Reutzel, Inc. had the following securities: Bishop Inc. - 342 Bishop Inc. $1,000 bonds were purchased on January 1, 2013 to yield 6.0045%. The price includes a brokers commission. The stated rate of interest of the bonds is 5.45% and it is paid annually on December 31st. The bonds mature in 20 years from the date of purchase. The market value of these bonds at 2018 year end was 91.2316 and at 2019 year end was 93.1316. (These are Available-for-sale securities). Bratkowitz Inc. - 1,000 shares of Bratkowitz Inc. common stock, series B were purchased at $7.61 per share on October 11, 2019. The brokers commission was $29.50. Bratkowitz Inc. reported net income of $314,000 in 2019. Bratkowitz Inc. declared its semi-annual dividend dividend of $0.25 per share on September 7th The dividend was paid on October 8th to stockholders of record on September 18th. The stock is listed on the New York Stock Exchange. Its ticker symbol is BTK. The year-end price of the stock was $10.12. (These are Trading securities) Conner Inc. bonds 1,200 Conner Company $500 bonds were purchased on April 1, 2014 to yield 5.85%. The bonds mature on March 31, 2034. The price includes a brokers commission. The stated rate of interest on the bonds is 6.102% and it is paid annually on March 31st. The market value of these bonds at the prior year-end was 101.3279, and at the current year-end it was 102.4829. (These are Hold-to- maturity bonds) Durst- 1,500 shares of Durst Inc. common stock were purchased at $26 per share on November 28, 2019. The brokers commission was $39.50. The shares were sold on January 15, 2020 for $27.50. The brokers commission was $40.25. Durst Inc. reported net income of $339,000 in 2019. * Hecht Inc. 2,800 shares of Hecht Inc. common stock were purchased at $107 per share on August 18, 2018. The brokers commission was $78. Hecht Inc. reported net income of $817,000 for the year ended December 31, 2018, and net income of $916,000 for the year-end December 31, 2019. Hecht Inc. declared and paid dividends of $2.75 per share on the last day November each year. The stock is listed on the NASDAQ, and its ticket symbol is HHT. The 2019 year-end price of the stock was $111, and the 2018 year-end price was $109. (These are Available- for-sale securities) Marconi Company bonds 80 Marconi Company $750 bonds were purchased on November 1, 2019 at 99.092613 to yield 4.1125%. The bonds mature in 10 years from the date of purchase. The price includes a brokers commission. The stated rate of interest on the bonds is 4.0% and it is paid annually on October 30th. The market value of these bonds at December 31, 2019 was 100.328. (These are trading security bonds) 07 > 17:45 Mon Mar 1 04 89% 42 HT + : 0 Morone Inc. 98,500 shares of Morone Inc. common stock were purchased at $6.32 per share on January 4, 2017. The brokers commission was $585. The 2018 year-end price was $7.05 per share. In 2019, the year-end price was $7.80 per share. During 2018 and 2019, the stock declared and paid an annual dividend of $0.26 per share on the last day of each calendar year. Morone Inc. reported net income of $184,000 in 2018, and $153,920 in 2019. The stock is listed on the American Stock Exchange. Morone Inc. has 394,000 shares outstanding. Its ticker symbol is MRS. (This investment is recorded using the equity method) Tyler Company - 1,000 shares of Tyler Company common stock were purchased at $38.50 per share on November 23, 2018 The brokers commission was $46. The shares were sold on February 2, 2019 for $39.05 per share. The brokers commission on the sale was $50.00. Tyler Company reported net income of $816,000 for the year ended December 31, 2018. Tyler Company did not declare dividends during the year. The stock is listed on the NASDAQ, and its ticket symbol is TLR. The 2018 year-end price of the stock was $39.80. (These are Trading securities) Singalton Company - 2,000 shares of Singalton Company common stock were purchased at $26.10 per share on November 17, 2019. The brokers commission was $64. Singalton Company reported net income of $618,000 for 2019. Singalton Company declared and paid dividends of $0.50 per share on March 26, June 25, September 25, and December 23 during the current year. The stock is listed on the NASDAQ, and its ticket symbol is SLY. The year end price of the stock was $23.21. (These are Trading securities) REQUIRED: Using the data for Reutzel, Inc. & the classification given with each investment above journalize & post all entries for the current year-end (December 31, 2019), and prepare a partial balance sheet & a partial income statement (including comprehensive income) for the year end December 31. Be sure to include the proper financial statement presentation and footnote disclosures according to GAAP (GAAP is NOT the Kieso, Weygandt & Warfield text), 17:45 Mon Mar 1 04 89% 2 T + : 0 George, Inc. is in the process of preparing its 2019 year-end financial statements for the current year. During the year, Reutzel, Inc. had the following securities: Bishop Inc. - 342 Bishop Inc. $1,000 bonds were purchased on January 1, 2013 to yield 6.0045%. The price includes a brokers commission. The stated rate of interest of the bonds is 5.45% and it is paid annually on December 31st. The bonds mature in 20 years from the date of purchase. The market value of these bonds at 2018 year end was 91.2316 and at 2019 year end was 93.1316. (These are Available-for-sale securities). Bratkowitz Inc. - 1,000 shares of Bratkowitz Inc. common stock, series B were purchased at $7.61 per share on October 11, 2019. The brokers commission was $29.50. Bratkowitz Inc. reported net income of $314,000 in 2019. Bratkowitz Inc. declared its semi-annual dividend dividend of $0.25 per share on September 7th The dividend was paid on October 8th to stockholders of record on September 18th. The stock is listed on the New York Stock Exchange. Its ticker symbol is BTK. The year-end price of the stock was $10.12. (These are Trading securities) Conner Inc. bonds 1,200 Conner Company $500 bonds were purchased on April 1, 2014 to yield 5.85%. The bonds mature on March 31, 2034. The price includes a brokers commission. The stated rate of interest on the bonds is 6.102% and it is paid annually on March 31st. The market value of these bonds at the prior year-end was 101.3279, and at the current year-end it was 102.4829. (These are Hold-to- maturity bonds) Durst- 1,500 shares of Durst Inc. common stock were purchased at $26 per share on November 28, 2019. The brokers commission was $39.50. The shares were sold on January 15, 2020 for $27.50. The brokers commission was $40.25. Durst Inc. reported net income of $339,000 in 2019. * Hecht Inc. 2,800 shares of Hecht Inc. common stock were purchased at $107 per share on August 18, 2018. The brokers commission was $78. Hecht Inc. reported net income of $817,000 for the year ended December 31, 2018, and net income of $916,000 for the year-end December 31, 2019. Hecht Inc. declared and paid dividends of $2.75 per share on the last day November each year. The stock is listed on the NASDAQ, and its ticket symbol is HHT. The 2019 year-end price of the stock was $111, and the 2018 year-end price was $109. (These are Available- for-sale securities) Marconi Company bonds 80 Marconi Company $750 bonds were purchased on November 1, 2019 at 99.092613 to yield 4.1125%. The bonds mature in 10 years from the date of purchase. The price includes a brokers commission. The stated rate of interest on the bonds is 4.0% and it is paid annually on October 30th. The market value of these bonds at December 31, 2019 was 100.328. (These are trading security bonds) 07 > 17:45 Mon Mar 1 04 89% 42 HT + : 0 Morone Inc. 98,500 shares of Morone Inc. common stock were purchased at $6.32 per share on January 4, 2017. The brokers commission was $585. The 2018 year-end price was $7.05 per share. In 2019, the year-end price was $7.80 per share. During 2018 and 2019, the stock declared and paid an annual dividend of $0.26 per share on the last day of each calendar year. Morone Inc. reported net income of $184,000 in 2018, and $153,920 in 2019. The stock is listed on the American Stock Exchange. Morone Inc. has 394,000 shares outstanding. Its ticker symbol is MRS. (This investment is recorded using the equity method) Tyler Company - 1,000 shares of Tyler Company common stock were purchased at $38.50 per share on November 23, 2018 The brokers commission was $46. The shares were sold on February 2, 2019 for $39.05 per share. The brokers commission on the sale was $50.00. Tyler Company reported net income of $816,000 for the year ended December 31, 2018. Tyler Company did not declare dividends during the year. The stock is listed on the NASDAQ, and its ticket symbol is TLR. The 2018 year-end price of the stock was $39.80. (These are Trading securities) Singalton Company - 2,000 shares of Singalton Company common stock were purchased at $26.10 per share on November 17, 2019. The brokers commission was $64. Singalton Company reported net income of $618,000 for 2019. Singalton Company declared and paid dividends of $0.50 per share on March 26, June 25, September 25, and December 23 during the current year. The stock is listed on the NASDAQ, and its ticket symbol is SLY. The year end price of the stock was $23.21. (These are Trading securities) REQUIRED: Using the data for Reutzel, Inc. & the classification given with each investment above journalize & post all entries for the current year-end (December 31, 2019), and prepare a partial balance sheet & a partial income statement (including comprehensive income) for the year end December 31. Be sure to include the proper financial statement presentation and footnote disclosures according to GAAP (GAAP is NOT the Kieso, Weygandt & Warfield text)